NVIDIA 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

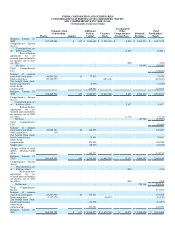

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

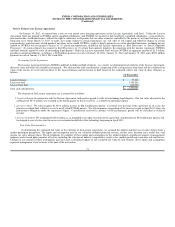

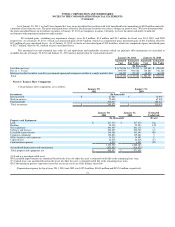

Note 2 – Stock Option Purchase

During the three months ended April 26, 2009, we completed a cash tender offer for certain employee stock options. The tender offer applied to

outstanding stock options held by employees with an exercise price equal to or greater than $17.50 per share. None of the non-employee members of our

Board of Directors or our officers who file reports under Section 16(a) of the Securities Exchange Act of 1934, as amended, or the Securities Exchange Act,

were eligible to participate in the tender offer. All eligible options with exercise prices equal to or greater than $17.50 per share but less than $28.00 per share

were eligible to receive a cash payment of $3.00 per option in exchange for the cancellation of the eligible option. All eligible options with exercise prices

equal to or greater than $28.00 per share were eligible to receive a cash payment of $2.00 per option in exchange for the cancellation of the eligible option.

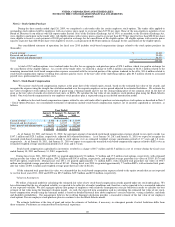

Our consolidated statement of operations for fiscal year 2010 includes stock-based compensation charges related to the stock option purchase (in

thousands):

Cost of revenue $ 11,412

Research and development 90,456

Sales, general and administrative 38,373

Total $ 140,241

A total of 28.5 million options were tendered under the offer for an aggregate cash purchase price of $78.1 million, which was paid in exchange for

the cancellation of the eligible options. As a result of the tender offer, we incurred a charge of $140.2 million consisting of $124.1 million related to the

remaining unamortized stock based compensation expense associated with the unvested portion of the options tendered in the offer, $11.6 million related to

stock-based compensation expense resulting from amounts paid in excess of the fair value of the underlying options, plus $4.5 million related to associated

payroll taxes, professional fees and other costs.

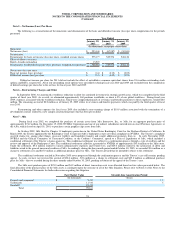

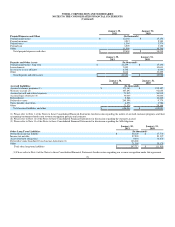

Note 3 - Stock-Based Compensation

We measure stock-based compensation expense at the grant date of the related equity awards, based on the estimated fair value of the awards, and

recognize the expense using the straight-line attribution method over the requisite employee service period adjusted for estimated forfeitures. We estimate the

fair value of employee stock options on the date of grant using a binomial model and we use the closing trading price of our common stock on the date of

grant as the fair value of awards of restricted stock units, or RSUs. We calculate the fair value of our employee stock purchase plan using the Black-Scholes

model. Our stock based compensation for our employee stock purchase plan is expensed using an accelerated amortization model.

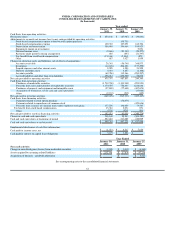

In addition to the stock-based compensation expense related to our cash tender offer to purchase certain employee stock options as described in Note 2

– Stock Option Purchase, our consolidated statements of operations include stock-based compensation expense, net of amounts capitalized as inventory, as

follows:

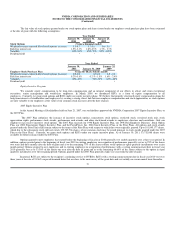

Year Ended

January 30 January 31, January 25,

2011 2010 2009

(In thousands)

Cost of revenue $ 8,308 $ 12,050 $ 11,939

Research and development 57,974 61,337 98,007

Sales, general and administrative 34,071 33,704 52,760

Total $ 100,353 $ 107,091 $ 162,706

As of January 30, 2011 and January 31, 2010, the aggregate amount of unearned stock-based compensation expense related to our equity awards was

$147.1 million and $125.3 million, respectively, adjusted for estimated forfeitures. As of January 30, 2011 and January 31, 2010, we expect to recognize the

unearned stock-based compensation expense related to stock options over an estimated weighted average amortization period of 1.7 years and 1.8 years,

respectively. As of January 30, 2011, and January 31, 2010 we expect to recognize the unearned stock-based compensation expense related to RSUs over an

estimated weighted average amortization period of 2.4 years and 2.3 years.

Stock-based compensation capitalized in inventories resulted in a charge of $0.7 million and $2.5 million in cost of revenue during the fiscal years

ended January 30, 2011 and January 31, 2010, respectively.

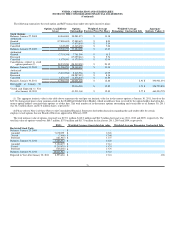

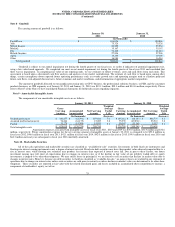

During fiscal years 2011, 2010 and 2009, we granted approximately 5.8 million, 7.7 million and 17.9 million stock options, respectively, with estimated

total grant-date fair values of $34.4 million, $44.2 million and $143.6 million, respectively, and weighted average grant-date fair values of $5.89, $5.74 and

$8.03 per option, respectively. During fiscal year 2011, we granted approximately 7.1 million RSUs, with estimated total grant-date fair values of $96.7

million and weighted average grant-date fair value of $13.61. During fiscal year 2010 we granted approximately 7.7 million RSUs, with estimated total grant-

date fair values of $94.1 million and weighted average grant-date fair value of $12.26.

Of the estimated total grant-date fair value, we estimated that the stock-based compensation expense related to the equity awards that are not expected

to vest for fiscal years 2011, 2010 and 2009 was $23.5 million, $25.7 million and $23.8 million, respectively.

Valuation Assumptions

We utilize a binomial model for calculating the estimated fair value of new stock-based compensation awards granted under our stock option plans. We

have determined that the use of implied volatility is expected to be reflective of market conditions and, therefore, can be expected to be a reasonable indicator

of our expected volatility. We also segregate options into groups of employees with relatively homogeneous exercise behavior in order to calculate the best

estimate of fair value using the binomial valuation model. As such, the expected term assumption used in calculating the estimated fair value of our stock-

based compensation awards using the binomial model is based on detailed historical data about employees' exercise behavior, vesting schedules, and death

and disability probabilities. Our management believes the resulting binomial calculation provides a reasonable estimate of the fair value of our employee

stock options. For our employee stock purchase plan we continue to use the Black-Scholes model.

We estimate forfeitures at the time of grant and revise the estimates of forfeiture, if necessary, in subsequent periods if actual forfeitures differ from

those estimates. Forfeitures are estimated based on historical experience.

69