NVIDIA 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

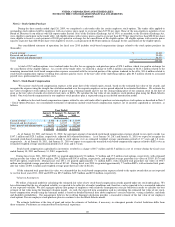

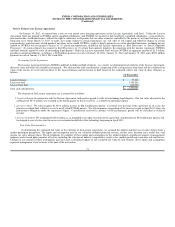

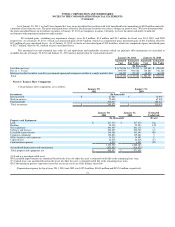

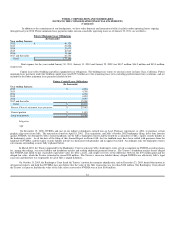

Note 5 – Net Income (Loss) Per Share

The following is a reconciliation of the numerators and denominators of the basic and diluted net income (loss) per share computations for the periods

presented:

Year Ended

January 30,

2011 January 31,

2010 January 25,

2009

(In thousands, except per share data)

Numerator:

Net income (loss) $ 253,146 $ (67,987) $ (30,041)

Denominator:

Denominator for basic net income (loss) per share, weighted average shares 575,177 549,574 548,126

Effect of dilutive securities:

Equity Awards outstanding 13,507 - -

Denominator for diluted net income (loss) per share, weighted average shares 588,684 549,574 548,126

Net income (loss) per share:

Basic net income (loss) per share $ 0.44 $ (0.12) $ (0.05)

Diluted net income (loss) per share $ 0.43 $ (0.12) $ (0.05)

Diluted net income per share for 2011 did not include the effect of anti-dilutive common equivalent shares from 24.6 million outstanding stock

options and RSUs, respectively. All of our outstanding stock options were anti-dilutive during fiscal year 2010 and 2009 and excluded from the computation

of diluted earnings per share due to the net loss for fiscal years 2010 and 2009.

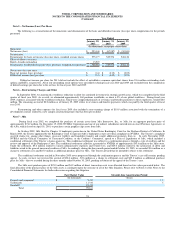

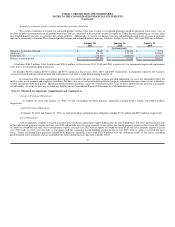

Note 6 – Restructuring Charges and Other

In September 2008, we announced a workforce reduction to allow for continued investment in strategic growth areas, which was completed in the third

quarter of fiscal year 2009. As a result, we eliminated approximately 360 positions worldwide, or about 6.5% of our global workforce. During fiscal year

2009, expenses associated with the workforce reduction, which were comprised primarily of severance and benefits payments to these employees, totaled $8.0

million. The remaining accrual of $0.2 million as of January 25, 2009 relates to severance and benefits payments, which was paid by the third quarter of fiscal

year 2010.

Restructuring and other expenses for fiscal year 2009 also included a non-recurring charge of $18.9 million associated with the termination of a

development contract related to a new campus construction project that has been put on hold.

Note 7 - 3dfx

During fiscal year 2002, we completed the purchase of certain assets from 3dfx Interactive, Inc., or 3dfx, for an aggregate purchase price of

approximately $74.2 million. On December 15, 2000, NVIDIA Corporation and one of our indirect subsidiaries entered into an Asset Purchase Agreement, or

the APA, which closed on April 18, 2001, to purchase certain graphics chip assets from 3dfx.

In October 2002, 3dfx filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the Northern District of California. In

March 2003, the Trustee appointed by the Bankruptcy Court to represent 3dfx’s bankruptcy estate served his complaint on NVIDIA. The Trustee’s complaint

asserted claims for, among other things, successor liability and fraudulent transfer and sought additional payments from us. In early November 2005,

NVIDIA and the Official Committee of Unsecured Creditors, or the Creditors’ Committee, agreed to a Plan of Liquidation of 3dfx, which included a

conditional settlement of the Trustee’s claims against us. This conditional settlement was subject to a confirmation process through a vote of creditors and the

review and approval of the Bankruptcy Court. The conditional settlement called for a payment by NVIDIA of approximately $30.6 million to the 3dfx estate.

Under the settlement, $5.6 million related to various administrative expenses and Trustee fees, and $25.0 million related to the satisfaction of debts and

liabilities owed to the general unsecured creditors of 3dfx. Accordingly, during the three month period ended October 30, 2005, we recorded $5.6 million as a

charge to settlement costs and $25.0 million as additional purchase price for 3dfx. The Trustee advised that he intended to object to the settlement.

The conditional settlement reached in November 2005 never progressed through the confirmation process and the Trustee’s case still remains pending

appeal. As such, we have not reversed the accrual of $30.6 million - $5.6 million as a charge to settlement costs and $25.0 million as additional purchase

price for 3dfx – that we recorded during the three months ended October 30, 2005, pending resolution of the appeal of the Trustee’s case.

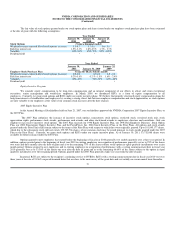

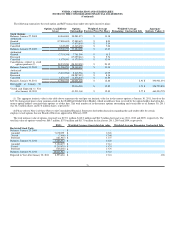

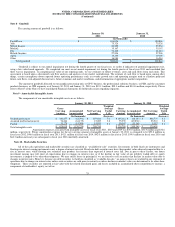

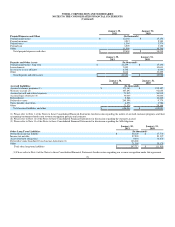

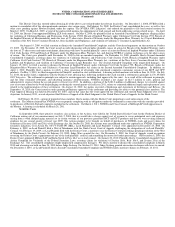

The 3dfx asset purchase price of $95.0 million and $4.2 million of direct transaction costs were allocated based on fair values presented below. The

final allocation of the purchase price of the 3dfx assets is contingent upon the outcome of all of the 3dfx litigation. Please refer to Note12 of the Notes to the

Consolidated Financial Statements for further discussion regarding this litigation.

Fair Market Value Straight-Line Amortization Period

(In thousands) (Years)

Property and equipment $ 2,433 1-2

Trademarks 11,310 5

Goodwill 85,418 -

Total $ 99,161

74