NVIDIA 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

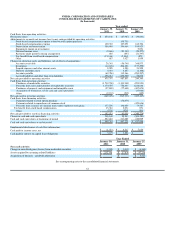

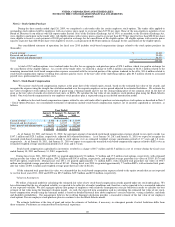

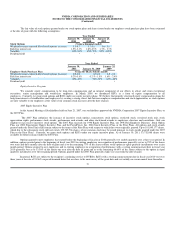

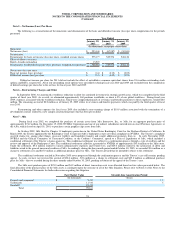

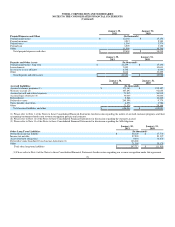

The fair value of stock options granted under our stock option plans and shares issued under our employee stock purchase plan have been estimated

at the date of grant with the following assumptions:

Year Ended

January 30,

2011 January 31,

2010 January 25,

2009

Stock Options (Using a binomial model)

Weighted average expected life of stock options (in years) 3.1-6.7 3.7-5.8 3.6 - 5.8

Risk free interest rate 1.5%-3.3% 1.8%-2.9% 1.7% - 3.7%

Volatility 42%-53% 45%-72% 52% - 105%

Dividend yield • • •

Year Ended

January 30,

2011 January 31, 2010 January 25,

2009

Employee Stock Purchase Plan (Using the Black-Scholes model)

Weighted average expected life of stock options (in years) 0.5-2.0 0.5-2.0 0.5 - 2.0

Risk free interest rate 0.2%-0.8% 0.2 %– 1.0% 1.6% - 2.4%

Volatility 45%-47% 53%-73% 62% - 68%

Dividend yield • • •

Equity Incentive Program

We consider equity compensation to be long-term compensation and an integral component of our efforts to attract and retain exceptional

executives, senior management and world-class employees. In March 2009, we introduced RSUs as a form of equity compensation to all

employees. Currently, we grant stock options and RSUs under our equity incentive plans. We believe that properly structured equity compensation aligns the

long-term interests of stockholders and employees by creating a strong, direct link between employee compensation and stock appreciation, as stock options

are only valuable to our employees if the value of our common stock increases after the date of grant.

2007 Equity Incentive Plan

At the Annual Meeting of Stockholders held on June 21, 2007, our stockholders approved the NVIDIA Corporation 2007 Equity Incentive Plan, or

the 2007 Plan.

The 2007 Plan authorizes the issuance of incentive stock options, nonstatutory stock options, restricted stock, restricted stock unit, stock

appreciation rights, performance stock awards, performance cash awards, and other stock-based awards to employees, directors and consultants. Only our

employees may receive incentive stock options. The 2007 Plan succeeds our 1998 Equity Incentive Plan, our 1998 Non-Employee Directors’ Stock Option

Plan, our 2000 Nonstatutory Equity Incentive Plan, and the PortalPlayer, Inc. 2004 Stock Incentive Plan, or the Prior Plans. All options and stock awards

granted under the Prior Plans shall remain subject to the terms of the Prior Plans with respect to which they were originally granted. Up to 101,845,177 shares,

which due to the subsequent stock split now totals 152,767,766 shares, of our common stock may be issued pursuant to stock awards granted under the 2007

Plan or the Prior Plans. Currently, we grant stock options and RSUs under our equity incentive plans. As of January 30, 2011, 33,732,068 shares were

available for future issuance under the 2007 Plan.

Options granted to new employees that started before the beginning of fiscal year 2010 generally vest ratably quarterly over a three-year period. In

addition, options granted prior to the beginning of fiscal year 2010 to existing employees in recognition of performance generally vest as to 25% of the shares

two years and three months after the date of grant and as to the remaining 75% of the shares subject to the option in equal quarterly installments over a nine

month period. Options granted to new employees and to existing employees in recognition of performance with a vesting commencement date in fiscal year

2010 generally vest as to 33.36% of the shares one year after the date of grant and as to the remaining 66.64% of the shares subject to the option in equal

quarterly installments over the remaining period. Options granted under the 2007 Plan generally expire six years from the date of grant.

In general, RSUs are subject to the recipient’s continuing service to NVIDIA. RSUs with a vesting commencement date in fiscal year 2010 vest over

three years at the rate of 33.36% on pre-determined dates that are close to the anniversary of the grant date and vest ratably on a semi-annual basis thereafter.

70