NVIDIA 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

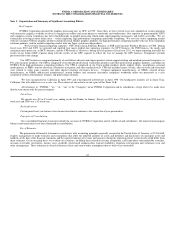

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

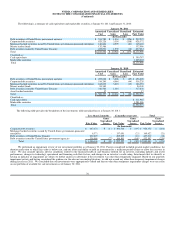

Intangible Assets

Intangible assets primarily represent rights acquired under technology licenses, patents, acquired intellectual property, trademarks and customer

relationships. We currently amortize our intangible assets with definitive lives over periods ranging from one to ten years using a method that reflects the

pattern in which the economic benefits of the intangible asset are consumed or otherwise used up or, if that pattern cannot be reliably determined, using a

straight-line amortization method.

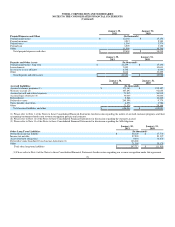

Impairment of Long-Lived Assets

Long-lived assets, such as property and equipment and intangible assets subject to amortization, are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset, or asset group may not be recoverable. Recoverability of assets to be held and used is

measured by a comparison of the carrying amount of an asset, or asset group to estimated undiscounted future cash flows expected to be generated by the

asset, or asset group. If the carrying amount of an asset or asset group exceeds its estimated future cash flows, an impairment charge is recognized for the

amount by which the carrying amount of the asset or asset group exceeds the fair value of the asset or asset group. Fair value is determined based on the

estimated discounted future cash flows expected to be generated by the asset or asset group. Assets and liabilities to be disposed of would be separately

presented in the consolidated balance sheet and the assets would be reported at the lower of the carrying amount or fair value less costs to sell, and would no

longer be depreciated.

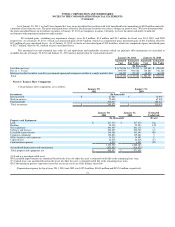

Accounting for Asset Retirement Obligations

We account for asset retirement obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. The

accounting guidance applies to legal obligations associated with the retirement of long-lived assets that result from the acquisition, construction, development

and/or normal use of the assets and requires that the fair value of a liability for an asset retirement obligation be recognized in the period in which it is

incurred if a reasonable estimate of fair value can be made. The fair value of the liability is added to the carrying amount of the associated asset and this

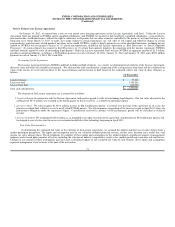

additional carrying amount is depreciated over the life of the asset. As of January 30, 2011 and January 31, 2010, our asset retirement obligations to return the

leasehold improvements to their original condition upon lease termination at our headquarters facility in Santa Clara, California and certain laboratories at our

international locations were $9.7 million and $10.6 million, respectively.

Adoption of New Accounting Pronouncements

Variable Interest Entities

During the first quarter of fiscal year 2011, we adopted new accounting guidance which amends the evaluation criteria to identify the primary

beneficiary of a variable interest entity, or VIE, and requires ongoing reassessment of whether an enterprise is the primary beneficiary of the VIE. The new

guidance changes the consolidation rules for VIEs, including the consolidation of common structures, such as joint ventures, equity method investments and

collaboration arrangements. The guidance is applicable to all new and existing VIEs. The adoption of this new accounting guidance did not have a material

impact on our consolidated financial position, results of operations or financial condition.

Improving Disclosures About Fair Value Measurements

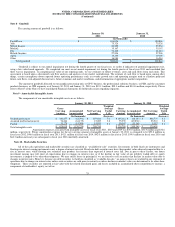

During the first quarter of fiscal year 2011, we adopted new accounting guidance which requires additional disclosures about items transferring into

and out of levels 1 and 2 in the fair value hierarchy; adding separate disclosures about purchases, sales, issuances, and settlements relative to level 3

measurements; and clarifying, among other things, the existing fair value disclosures about the level of disaggregation. This new guidance is effective for

interim and annual reporting periods beginning after December 15, 2009, except for the requirement to provide level 3 activity of purchases, sales, issuances,

and settlements on a gross basis, which is effective for fiscal years beginning after December 15, 2010. The adoption of this new accounting guidance impacts

only disclosure requirements and did not have an impact on our consolidated financial position, results of operations or financial condition.

Revenue Recognition

In September 2009, the Financial Accounting Standards Board, or FASB, issued new accounting guidance related to the revenue recognition of

multiple element arrangements. The new guidance states that if vendor specific objective evidence or third party evidence for deliverables in an arrangement

cannot be determined, companies will be required to develop a best estimate of the selling price to separate deliverables and allocate arrangement

consideration using the relative selling price method. In addition, the FASB also issued new accounting guidance related to certain revenue arrangements that

include software elements. Previously, companies that sold tangible products with “more than incidental” software were required to apply software revenue

recognition guidance. This guidance often delayed revenue recognition for the delivery of the tangible product. Under the new guidance, tangible products

that have software components that are “essential to the functionality” of the tangible product will be excluded from the software revenue recognition

guidance. The new guidance includes factors to help companies determine what is “essential to the functionality.” Software-enabled products will now be

subject to other revenue guidance and will follow the guidance for multiple deliverable arrangements issued by the FASB in September 2009 as described

above.

We elected to early adopt this accounting guidance at the beginning of the first quarter of fiscal year 2011 on a prospective basis. We did not have a

significant change in units of accounting, allocation methodology, or timing of revenue recognition. As a result, the adoption of these accounting standards

did not have a material impact on our consolidated financial position, results of operations or financial condition.

Recently Issued Accounting Pronouncements

During the fiscal year ended January 30, 2011, there was no recent issuance of accounting pronouncements as compared to those described in the

Annual Report on Form 10-K for the fiscal year ended January 31, 2010, that are of significance, or have potential material significance to us.

68