NVIDIA 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

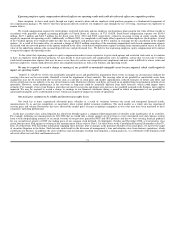

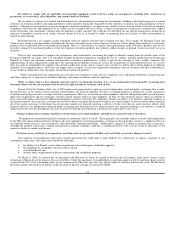

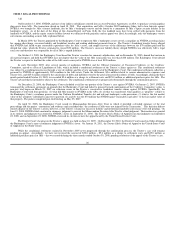

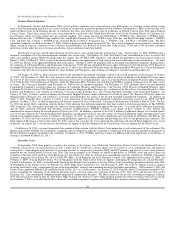

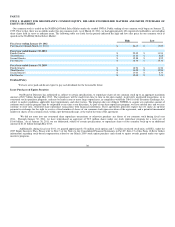

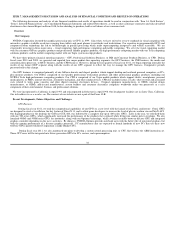

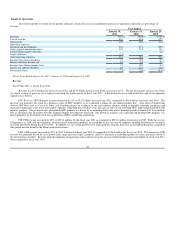

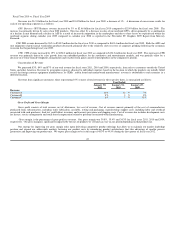

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with our financial statements and the notes thereto, and with Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The consolidated statements of operations data for the years

ended January 30, 2011, January 31, 2010 and January 25, 2009, and the consolidated balance sheet data as of January 30, 2011 and January 31, 2010 have

been derived from and should be read in conjunction with our audited consolidated financial statements and the notes thereto included elsewhere in this

Annual Report on Form 10-K. We operate on a 52 or 53-week year, ending on the last Sunday in January. Fiscal years 2011, 2009, 2008 and 2007 were 52-

week years, while fiscal year 2010 was a 53-week year.

Year Ended

January 30, January 31, January 25, January 27, January 28,

2011

(B,C)

2010

(B,D)

2009

(B,E)

2008

(F)

2007

(F,G)

(In thousands, except per share data)

Consolidated Statement of Operations Data:

Revenue $ 3,543,309 $ 3,326,445 $ 3,424,859 $ 4,097,860 $ 3,068,771

Income (loss) from operations $ 255,747 $ (98,945) $ (70,700) $ 836,346 $ 453,452

Net income (loss) $ 253,146 $ (67,987) $ (30,041) $ 797,645 $ 448,834

Basic net income (loss) per share $ 0.44 $ (0.12) $ (0.05) $ 1.45 $ 0.85

Diluted net income (loss) per share $ 0.43 $ (0.12) $ (0.05) $ 1.31 $ 0.76

Shares used in basic per share computation (A) 575,177 549,574 548,126 550,108 528,606

Shares used in diluted per share computation (A) 588,684 549,574 548,126 606,732 587,256

January 30, January 31, January 25, January 27, January 28,

2011 2010 2009 2008 2007

Consolidated Balance Sheet Data:

Cash, cash equivalents and marketable securities $ 2,490,563 $ 1,728,227 $ 1,255,390 $ 1,809,478 $ 1,117,850

Total assets $ 4,495,246 $ 3,585,918 $ 3,350,727 $ 3,747,671 $ 2,675,263

Capital lease obligations, less current portion $ 23,389 $ 24,450 $ 25,634 $ - $ -

Total stockholders’ equity $ 3,181,462 $ 2,665,140 $ 2,394,652 $ 2,617,912 $ 2,006,919

Cash dividends declared per common share $ - $ - $ - $ - $ -

(A) Reflects a three-for-two stock-split effective September 10, 2007 and a two-for-one stock-split effective April 6, 2006.

(B) We recorded a net warranty charge of $193.9 million, $94.0 million and $188.0 million, during fiscal years 2011, 2010 and 2009, respectively, which

reduced income from operations to cover anticipated customer warranty, repair, return, replacement and other costs arising from a weak die/packaging

material set used in certain versions of our previous generation MCP and GPU products shipped after July 2008 and used in notebook configurations.

(C) On January 10, 2011, we entered into a new six-year cross licensing agreement with Intel and also mutually agreed to settle all outstanding legal

disputes. For accounting purposes, the fair valued benefit prescribed to the settlement portion was $57.0 million, which was recorded within income

from operations in fiscal year 2011.

(D) Fiscal year 2010 includes impact of charge for a tender offer to purchase an aggregate of 28.5 million outstanding stock options for a total cash payment

of $78.1 million. As a result of the tender offer the Company incurred a charge of $140.2 million, consisting of the remaining unamortized stock-based

compensation expenses associated with the unvested portion of the options tendered in the offer, stock-based compensation expense resulting from

amounts paid in excess of the fair value of the underlying options, plus associated payroll taxes and professional fees.

(E) Fiscal year 2009 includes a $18.9 million for a non-recurring charge resulting from the termination of a development contract related to a new campus

construction project we have put on hold and $8.0 million for restructuring charges.

(F) Fiscal years 2008 and 2007 include a charge of $4.0 million and $13.4 million towards in-process research and development expense related to our

purchase of Mental Images Inc. and PortalPlayer Inc., respectively that had not yet reached technological feasibility and have no alternative future use.

(G) Fiscal year 2007 included a charge of $17.5 million associated with a confidential patent licensing arrangement.

33