NVIDIA 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

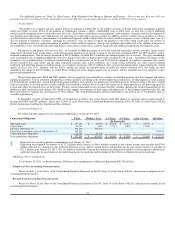

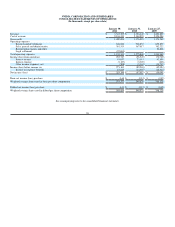

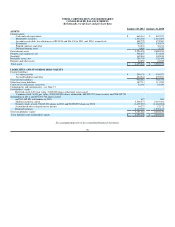

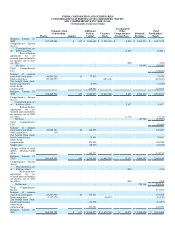

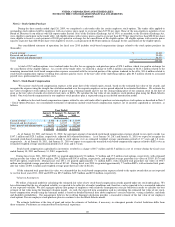

NVIDIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME (LOSS)

(In thousands, except share data)

Common Stock

Outstanding

Shares Amount

Additional

Paid-in

Capital Treasury

Stock

Accumulated

Other

Comprehensive

Income(Loss) Retained

Earnings

Total

Stockholders'

Equity

Balances, January 27,

2008 557,102,588 $ 619 $ 1,654,681

$ (1,039,632) $ 8,034 $ 1,994,210 $ 2,617,912

Comprehensive Income

(Loss):

Unrealized loss, net

of $2054 tax effect - - - - (3,920) - (3,920 )

Reclassification

adjustment for net

realized gains included in

net income, net of $135

tax effect - - - - (249) - (249)

Net Loss - - - - (30,041) (30,041)

Total Comprehensive

Loss (34,210)

Issuance of common

stock from stock plans 10,685,101 10 73,537 - - - 73,547

Stock repurchase (29,326,923) - - (423,636) - - (423,636)

Tax benefit from stock-

based compensation - - (2,946) - - - (2,946)

Stock-based

compensation - - 163,985 - - - 163,985

Balances, January 25,

2009 538,460,766 629 1,889,257 (1,463,268) 3,865 1,964,169 2,394,652

Comprehensive Income

(Loss):

Unrealized gain, net

of $484 tax effect - - - - 9,417 - 9,417

Reclassification

adjustment for net

realized gains included in

net income, net of $598

tax effect - - - - (1,110) - (1,110)

Net Loss - - - - - (67,987) (67,987)

Total Comprehensive

Loss (59,680)

Issuance of common

stock from stock plans 23,005,124 24 138,005 - - - 138,029

Stock repurchase (39) - - - - - -

Tax benefit from stock-

based compensation - - 29,891 - - - 29,891

Stock-based

compensation - - 104,588 - - - 104,588

Tender offer - - (78,075) - - - (78,075)

Charges related to stock

option purchase-tender

offer - - 135,735 - - - 135,735

Balances, January 31,

2010 561,465,851 653 2,219,401 (1,463,268) 12,172 1,896,182 2,665,140

Comprehensive Income

(Loss):

Unrealized loss, net

of $306 tax effect - - - - (918) - (918)

Reclassification

adjustment for net

realized gains included in

net income, net of $528

tax effect - - - - (982) - (982)

Net Income - - - - - 253,146 253,146

Total Comprehensive

Income - - - - - - 251,246

Issuance of common

stock from stock plans 28,207,029 24 193,381 - - - 193,405

Stock repurchase (1,117,179) - - (16,124) - - (16,124)

Tax benefit from stock-

based compensation - - (14,201) - - - (14,201)

Stock-based

compensation - - 101,996 - - - 101,996

Balances, January 30,

2011 588,555,701 $ 677 $ 2,500,577 $ (1,479,392) $ 10,272 $ 2,149,328 $ 3,181,462