NVIDIA 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

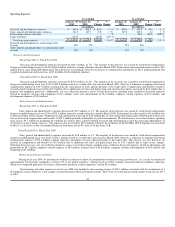

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Investment and Interest Rate Risk

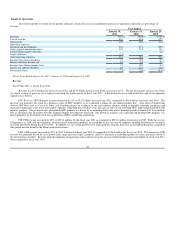

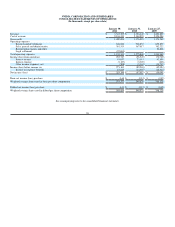

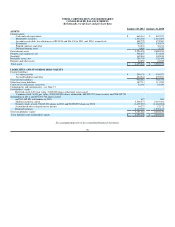

As of January 30, 2011 and January 31, 2010, we had $2.49 billion and $1.73 billion, respectively, in cash, cash equivalents and marketable

securities. We invest in a variety of financial instruments, consisting principally of cash and cash equivalents, asset-backed securities, commercial paper,

mortgage-backed securities issued by Government-sponsored enterprises, money market funds and debt securities of corporations, municipalities and the

United States government and its agencies. As of January 30, 2011, we did not have any investments in auction-rate preferred securities. Our investments are

denominated in United States dollars.

All of the cash equivalents and marketable securities are treated as “available-for-sale.” Investments in both fixed rate and floating rate interest

earning instruments carry a degree of interest rate risk. Fixed rate securities may have their market value adversely impacted due to a rise in interest rates,

while floating rate securities may produce less income than expected if interest rates fall. Due in part to these factors, our future investment income may fall

short of expectations due to changes in interest rates or if the decline in fair value of our publicly traded debt or equity investments is judged to be other-than-

temporary. We may suffer losses in principal if we are forced to sell securities that decline in securities market value due to changes in interest rates.

However, because any debt securities we hold are classified as “available-for-sale,” no gains or losses are realized in our Consolidated Statements of

Operations due to changes in interest rates unless such securities are sold prior to maturity or unless declines in value are determined to be other-than-

temporary. These securities are reported at fair value with the related unrealized gains and losses included in accumulated other comprehensive income (loss),

a component of stockholders’ equity, net of tax.

As of January 30, 2011, we performed a sensitivity analysis on our floating and fixed rate financial investments. According to our analysis, parallel

shifts in the yield curve of both plus or minus 0.5% would result in changes in fair values for these investments of approximately $11.7 million.

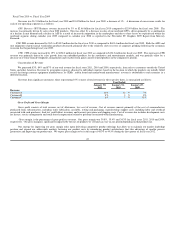

The financial turmoil that affected the banking system and financial markets and increased the possibility that financial institutions might

consolidate or go out of business resulted in a tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in

fixed income, credit, currency and equity markets. There could be a number of follow-on effects from the credit crisis on our business, including insolvency

of key suppliers resulting in product delays; inability of customers, including channel partners, to obtain credit to finance purchases of our products and/or

customer, including channel partner, insolvencies; and failure of financial institutions, which may negatively impact our treasury operations. Other income

and expense could also vary materially from expectations depending on gains or losses realized on the sale or exchange of financial instruments; impairment

charges related to debt securities as well as equity and other investments; interest rates; and cash, cash equivalent and marketable securities balances.

Volatility in the financial markets and economic uncertainty increases the risk that the actual amounts realized in the future on our financial instruments could

differ significantly from the fair values currently assigned to them. As of January 30, 2011, our investments in government agencies and government

sponsored enterprises represented approximately 51% of our total investment portfolio, while the financial sector accounted for approximately 34% of our

total investment portfolio. Of the financial sector investments, over half are guaranteed by the U.S. government. Substantially all of our investments are with

A/A2 or better rated securities. If the fair value of our investments in these sectors was to decline by 2%-5%, the fair values of these investments would

decline by approximately $37-$93 million.

Exchange Rate Risk

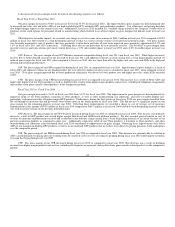

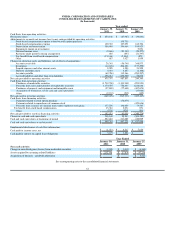

We consider our direct exposure to foreign exchange rate fluctuations to be minimal. Gains or losses from foreign currency remeasurement are

included in “Other income (expense), net” in our Consolidated Financial Statements and to date have not been significant. The impact of foreign currency

transaction loss included in determining net income (loss) for fiscal years 2011, 2010 and 2009 was $2.4 million, $0.9 million and $2.0 million,

respectively. Currently, sales and arrangements with third-party manufacturers provide for pricing and payment in United States dollars, and, therefore, are

not subject to exchange rate fluctuations. Increases in the value of the United States’ dollar relative to other currencies would make our products more

expensive, which could negatively impact our ability to compete. Conversely, decreases in the value of the United States’ dollar relative to other currencies

could result in our suppliers raising their prices in order to continue doing business with us. Fluctuations in currency exchange rates could harm our business

in the future.

We may enter into certain transactions such as forward contracts which are designed to reduce the future potential impact resulting from changes in

foreign currency exchange rates. There were no forward exchange contracts outstanding at January 30, 2011.

52