Macy's 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-42

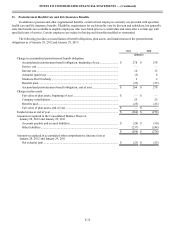

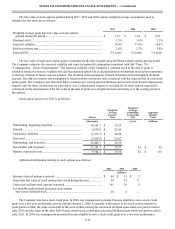

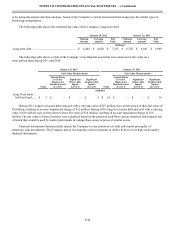

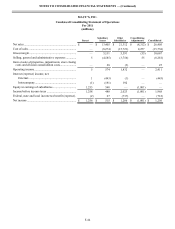

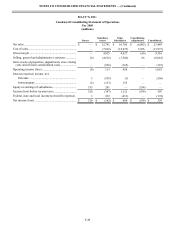

16. Quarterly Results (unaudited)

Unaudited quarterly results for the last two years were as follows:

First

Quarter Second

Quarter Third

Quarter Fourth

Quarter

(millions, except per share data)

2011:

Net sales ....................................................................... $ 5,889 $ 5,939 $ 5,853 $ 8,724

Cost of sales ................................................................. (3,586)(3,457)(3,544)(5,151)

Gross margin ................................................................ 2,303 2,482 2,309 3,573

Selling, general and administrative expenses............... (1,973)(1,976)(2,018)(2,314)

Gain on sale of properties, impairments, store closing

costs and division consolidation costs...................... ———25

Net income ................................................................... 131 241 139 745

Basic earnings per share............................................... .31 .56 .33 1.77

Diluted earnings per share............................................ .30 .55 .32 1.74

2010:

Net sales ....................................................................... $ 5,574 $ 5,537 $ 5,623 $ 8,269

Cost of sales ................................................................. (3,378)(3,214)(3,377)(4,855)

Gross margin ................................................................ 2,196 2,323 2,246 3,414

Selling, general and administrative expenses............... (1,993)(1,953)(2,069)(2,245)

Gain on sale of properties, impairments, store closing

costs and division consolidation costs...................... ———(25)

Net income ................................................................... 23 147 10 667

Basic earnings per share............................................... .05 .35 .02 1.57

Diluted earnings per share............................................ .05 .35 .02 1.55

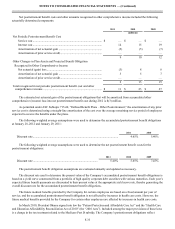

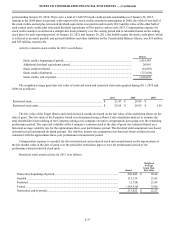

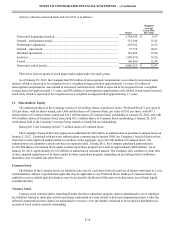

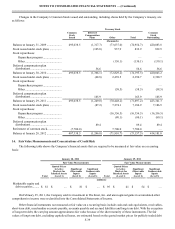

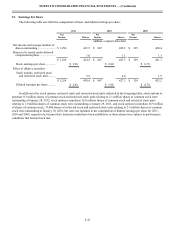

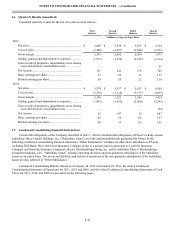

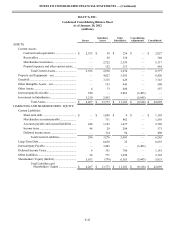

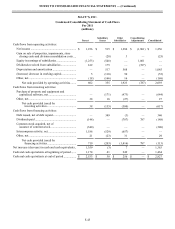

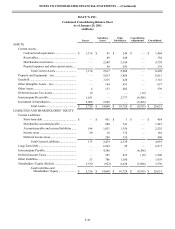

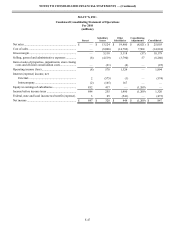

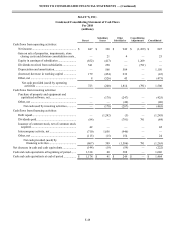

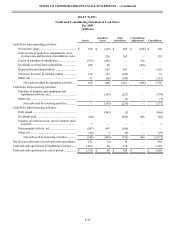

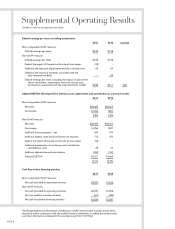

17. Condensed Consolidating Financial Information

Certain debt obligations of the Company described in Note 7, which constitute debt obligations of Parent’s wholly-owned

subsidiary, Macy’s Retail Holdings, Inc. (“Subsidiary Issuer”) are fully and unconditionally guaranteed by Parent. In the

following condensed consolidating financial statements, “Other Subsidiaries” includes all other direct subsidiaries of Parent,

including FDS Bank, West 34th Street Insurance Company (prior to a merger, known separately as Leadville Insurance

Company and Snowdin Insurance Company), Macy’s Merchandising Group, Inc. and its subsidiary Macy’s Merchandising

Group International, LLC. “Subsidiary Issuer” includes operating divisions and non-guarantor subsidiaries of the Subsidiary

Issuer on an equity basis. The assets and liabilities and results of operations of the non-guarantor subsidiaries of the Subsidiary

Issuer are also reflected in “Other Subsidiaries.”

Condensed Consolidating Balance Sheets as of January 28, 2012 and January 29, 2011, the related Condensed

Consolidating Statements of Operations for 2011, 2010 and 2009, and the related Condensed Consolidating Statements of Cash

Flows for 2011, 2010, and 2009 are presented on the following pages.