Macy's 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

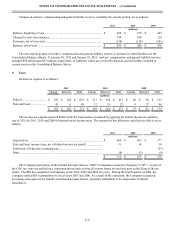

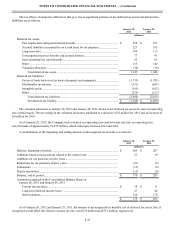

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-14

holders of the credit cards associated with the foregoing accounts, (iv) the servicing of the foregoing accounts, and (v) the

allocation between Citibank and the Company of the economic benefits and burdens associated with the foregoing and other

aspects of the alliance.

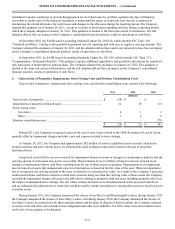

Pursuant to the Program Agreement, the Company continues to provide certain servicing functions related to the accounts

and related receivables owned by Citibank and receives compensation from Citibank for these services. The amounts earned

under the Program Agreement related to the servicing functions are deemed adequate compensation and, accordingly, no

servicing asset or liability has been recorded on the Consolidated Balance Sheets.

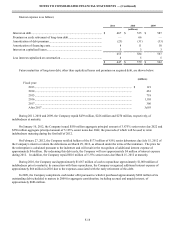

Amounts received under the Program Agreement were $772 million for 2011, $528 million for 2010 and $525 million for

2009, and are treated as reductions of SG&A expenses on the Consolidated Statements of Income. The Company’s earnings

from credit operations, net of servicing expenses, were $582 million for 2011, $332 million for 2010, and $323 million for

2009.

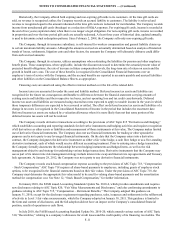

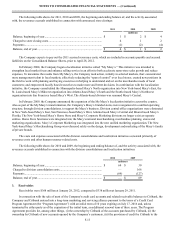

4. Inventories

Merchandise inventories were $5,117 million at January 28, 2012, compared to $4,758 million at January 29, 2011. At

these dates, the cost of inventories using the LIFO method approximated the cost of such inventories using the FIFO method.

The application of the LIFO method did not impact cost of sales for 2011, 2010 or 2009.

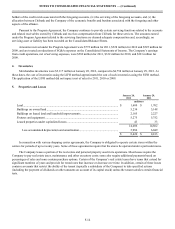

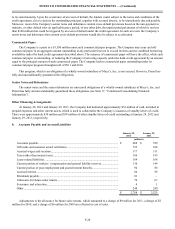

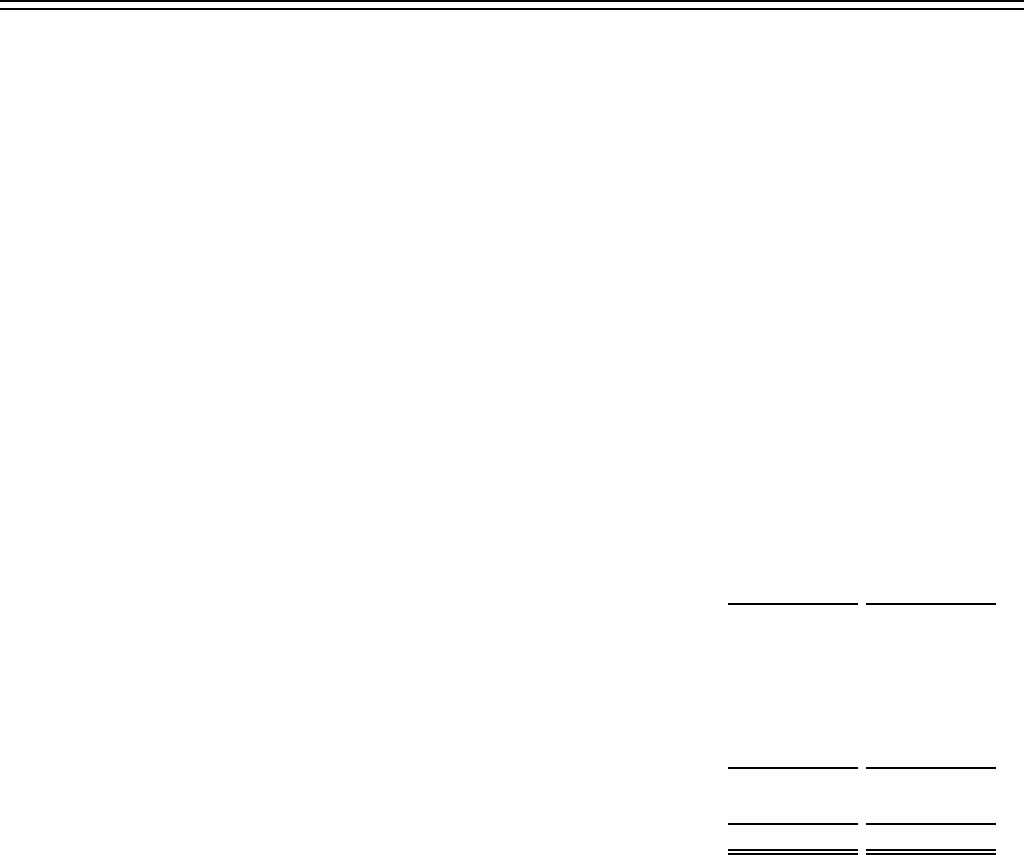

5. Properties and Leases

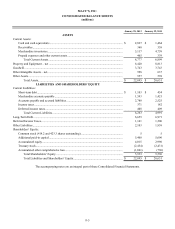

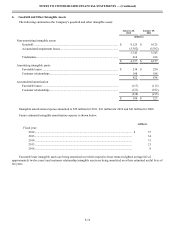

January 28,

2012 January 29,

2011

(millions)

Land................................................................................................................................. $ 1,689 $ 1,702

Buildings on owned land................................................................................................. 5,234 5,148

Buildings on leased land and leasehold improvements................................................... 2,165 2,227

Fixtures and equipment ................................................................................................... 5,275 5,752

Leased properties under capitalized leases...................................................................... 43 33

14,406 14,862

Less accumulated depreciation and amortization..................................................... 5,986 6,049

$ 8,420 $ 8,813

In connection with various shopping center agreements, the Company is obligated to operate certain stores within the

centers for periods of up to twenty years. Some of these agreements require that the stores be operated under a particular name.

The Company leases a portion of the real estate and personal property used in its operations. Most leases require the

Company to pay real estate taxes, maintenance and other executory costs; some also require additional payments based on

percentages of sales and some contain purchase options. Certain of the Company’s real estate leases have terms that extend for

significant numbers of years and provide for rental rates that increase or decrease over time. In addition, certain of these leases

contain covenants that restrict the ability of the tenant (typically a subsidiary of the Company) to take specified actions

(including the payment of dividends or other amounts on account of its capital stock) unless the tenant satisfies certain financial

tests.