Macy's 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

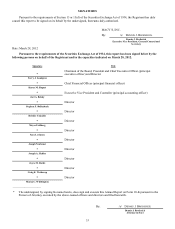

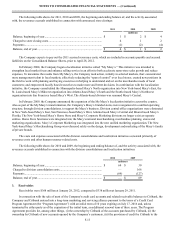

F-6

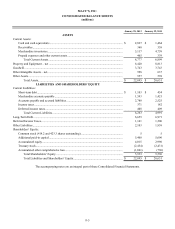

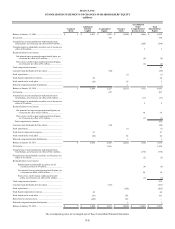

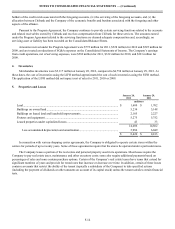

MACY’S, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(millions)

Common

Stock

Additional

Paid-In

Capital Accumulated

Equity Treasury

Stock

Accumulated

Other

Comprehensive

Income (Loss)

Total

Shareholders’

Equity

Balance at January 31, 2009 .................................................. $ 5 $ 5,663 $ 1,982 $ (2,544) $ (486) $ 4,620

Net income............................................................................. 329 329

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $166 million.... (266)(266)

Unrealized gain on marketable securities, net of income tax

effect of $3 million ........................................................... 5 5

Reclassifications to net income:

Net actuarial gain on postretirement benefit plans, net

of income tax effect of $3 million.............................. (4)(4)

Prior service credit on post employment benefit plans,

net of income tax effect of $1 million........................ (2)(2)

Total comprehensive income................................................. 62

Common stock dividends ($.20 per share) ............................ (84)(84)

Stock repurchases................................................................... (1)(1)

Stock-based compensation expense....................................... 50 50

Stock issued under stock plans .............................................. (24) 29 5

Deferred compensation plan distributions ............................. 1 1

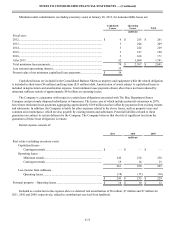

Balance at January 30, 2010 .................................................. 5 5,689 2,227 (2,515)(753) 4,653

Net income............................................................................. 847 847

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $4 million........ (17)(17)

Unrealized gain on marketable securities, net of income tax

effect of $3 million ........................................................... 5 5

Reclassifications to net income:

Net actuarial loss on postretirement benefit plans, net

of income tax effect of $23 million............................ 36 36

Prior service credit on post employment benefit plans,

net of income tax effect of $1 million........................ (1)(1)

Total comprehensive income.............................................. 870

Common stock dividends ($.20 per share) ............................ (84)(84)

Stock repurchases................................................................... (1)(1)

Stock-based compensation expense....................................... 47 47

Stock issued under stock plans .............................................. (40) 82 42

Deferred compensation plan distributions ............................. 3 3

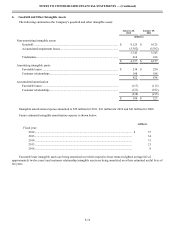

Balance at January 29, 2011 .................................................. 5 5,696 2,990 (2,431)(730) 5,530

Net income............................................................................. 1,256 1,256

Actuarial loss on post employment and postretirement

benefit plans, net of income tax effect of $241 million.... (376)(376)

Unrealized loss on marketable securities, net of income tax

effect of $1 million ........................................................... (2)(2)

Reclassifications to net income:

Realized gain on marketable securities, net of

income tax effect of $4 million .............................. (8)(8)

Net actuarial loss on postretirement benefit plans, net

of income tax effect of $35 million........................ 56 56

Prior service credit on post employment benefit

plans, net of income tax effect of $1 million.......... (1)(1)

Total comprehensive income................................................. 925

Common stock dividends ($.55 per share) ............................ (231)(231)

Stock repurchases................................................................... (502)(502)

Stock-based compensation expense....................................... 48 48

Stock issued under stock plans .............................................. (81) 242 161

Retirement of common stock................................................. (255) 255 —

Deferred compensation plan distributions ............................. 2 2

Balance at January 28, 2012 .................................................. $ 5 $ 5,408 $ 4,015 $ (2,434) $ (1,061) $ 5,933

The accompanying notes are an integral part of these Consolidated Financial Statements.