Macy's 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-31

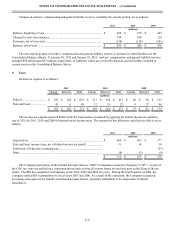

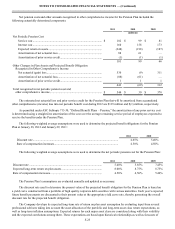

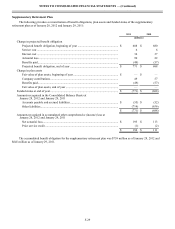

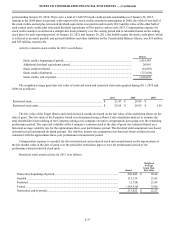

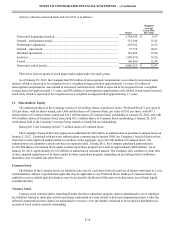

The following benefit payments are estimated to be funded by the Company and paid from the supplementary retirement

plan:

(millions)

Fiscal year:

2012.................................................................................................................................... $ 55

2013.................................................................................................................................... 57

2014.................................................................................................................................... 59

2015.................................................................................................................................... 59

2016.................................................................................................................................... 62

2017-2021........................................................................................................................... 272

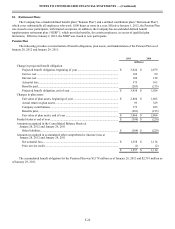

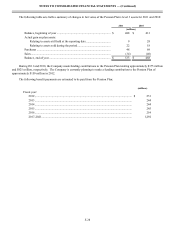

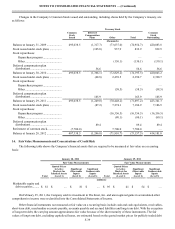

Retirement Plan

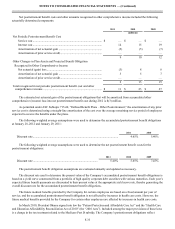

The Retirement Plan includes a voluntary savings feature for eligible employees. The Company’s contribution is based on

a stated matching contribution rate based on an employee’s eligible savings. The matching contribution rate is higher for those

employees not eligible for the Pension Plan than for employees eligible for the Pension Plan. Expense for the Retirement Plan

amounted to $10 million for 2011, $9 million for 2010 and $9 million for 2009.

Deferred Compensation Plan

The Company has a deferred compensation plan wherein eligible executives may elect to defer a portion of their

compensation each year as either stock credits or cash credits. The Company transfers shares to a trust to cover the number

management estimates will be needed for distribution on account of stock credits currently outstanding. At January 28, 2012

and January 29, 2011, the liability under the plan, which is reflected in other liabilities on the Consolidated Balance Sheets, was

$45 million and $46 million, respectively. Expense for 2011, 2010 and 2009 was immaterial.