Macy's 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

A breach of a restrictive covenant in the Company's credit agreement or the inability of the Company to maintain the

financial ratios described above could result in an event of default under the credit agreement. In addition, an event of default

would occur under the credit agreement if any indebtedness of the Company in excess of an aggregate principal amount of

$150 million becomes due prior to its stated maturity or the holders of such indebtedness become able to cause it to become

due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the terms and

conditions of the credit agreement, elect to declare the outstanding principal, together with accrued interest, to be immediately

due and payable.

Moreover, most of the Company's senior notes and debentures contain cross-default provisions based on the non-payment

at maturity, or other default after an applicable grace period, of any other debt, the unpaid principal amount of which is not less

than $100 million, that could be triggered by an event of default under the credit agreement. In such an event, the Company's

senior notes and debentures that contain cross-default provisions would also be subject to acceleration.

At January 28, 2012, no notes or debentures contain provisions requiring acceleration of payment upon a debt rating

downgrade. However, the terms of approximately $3,800 million in aggregate principal amount of the Company's senior notes

outstanding at that date require the Company to offer to purchase such notes at a price equal to 101% of their principal amount

plus accrued and unpaid interest in specified circumstances involving both a change of control (as defined in the applicable

indenture) of the Company and the rating of the notes by specified rating agencies at a level below investment grade.

As a result of upgrades of the notes by specified rating agencies, the rate of interest payable in respect of $612 million in

aggregate principal amount of the Company's senior notes outstanding at January 28, 2012 decreased by .25 percent per annum

to 8.125% effective in May 2011 and decreased by .25 percent per annum to 7.875%, its stated interest rate, effective in January

2012. The rate of interest payable in respect of these senior notes outstanding at January 28, 2012 could increase by up to 2.0

percent per annum from its current level in the event of one or more downgrades of the notes by specified rating agencies.

On January 5, 2012, the Company's board of directors approved an additional $1,000 million authorization to the

Company's existing share repurchase program. During 2011, the Company repurchased approximately 16,356,500 shares of its

common stock for a total of approximately $500 million. As of January 28, 2012, the Company had approximately $1,352

million of authorization remaining under its share repurchase program. The Company may continue or, from time to time,

suspend repurchases of shares under its share repurchase program, depending on prevailing market conditions, alternate uses of

capital and other factors.

On January 5, 2012, the Company's board of directors declared a quarterly dividend of 20 cents per share on its common

stock, payable April 2, 2012 to Macy's shareholders of record at the close of business on March 15, 2012. This dividend

reflects an increase of 100% over the previous quarterly dividend rate of 10 cents per share. The dividend had been increased

during the second quarter of 2011 to 10 cents per share from the previous quarterly dividend rate of 5 cents per share.

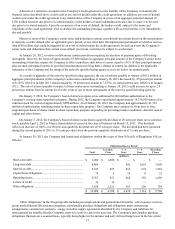

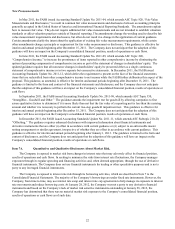

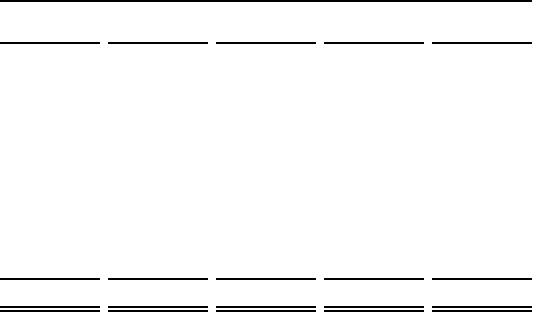

At January 28, 2012, the Company had contractual obligations (within the scope of Item 303(a)(5) of Regulation S-K) as

follows:

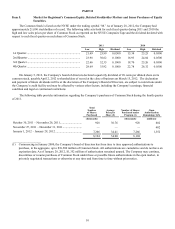

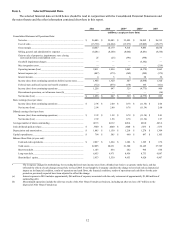

Obligations Due, by Period

Total Less than

1 Year 1 – 3

Years 3 – 5

Years More than

5 Years

(millions)

Short-term debt ...................................................................... $ 1,099 $ 1,099 $ — $ — $ —

Long-term debt....................................................................... 6,404 — 582 1,823 3,999

Interest on debt....................................................................... 5,193 455 812 674 3,252

Capital lease obligations ........................................................ 74 6 10 6 52

Operating leases..................................................................... 2,767 255 468 355 1,689

Letters of credit...................................................................... 3434———

Other obligations.................................................................... 3,838 2,251 563 256 768

$ 19,409 $ 4,100 $ 2,435 $ 3,114 $ 9,760

“Other obligations” in the foregoing table includes post employment and postretirement benefits, self-insurance reserves,

group medical/dental/life insurance programs, merchandise purchase obligations and obligations under outsourcing

arrangements, construction contracts, energy and other supply agreements identified by the Company and liabilities for

unrecognized tax benefits that the Company expects to settle in cash in the next year. The Company's merchandise purchase

obligations fluctuate on a seasonal basis, typically being higher in the summer and early fall and being lower in the late winter