Macy's 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

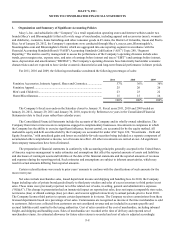

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-12

amendment requires companies to provide disaggregated levels of disclosure by portfolio segment and class of financing

receivable to enable users of the financial statements to understand the nature of credit risk, how the risk is analyzed in

determining the related allowance for credit losses and changes to the allowance during the reporting period. The Company

adopted this guidance as of January 29, 2011, except as it relates to disclosures regarding activities during a reporting period,

which the Company adopted on January 30, 2011. This guidance is limited to the form and content of disclosures. The full

adoption did not have an impact on the Company’s consolidated financial position, results of operations or cash flows.

In December 2010, the FASB issued Accounting Standard Update No. 2010-28, which amends ASC Topic 350,

“Goodwill and Other,” relating to the goodwill impairment test of a reporting unit with zero or negative carrying amounts. The

Company adopted this guidance on January 30, 2011, and the adoption did not have and is not expected to have have an impact

on the Company’s consolidated financial position, results of operations or cash flows.

In September 2011, the FASB issued Accounting Standards Update No. 2011-09, which amends ASC Topic 715,

“Compensation - Retirement Benefits.” This guidance requires additional quantitative and qualitative disclosures for employers

who participate in multiemployer pension plans. The Company adopted this guidance on January 28, 2012. This guidance is

limited to the form and content of disclosures, and the full adoption did not have an impact on the Company’s consolidated

financial position, results of operations or cash flows.

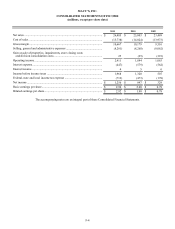

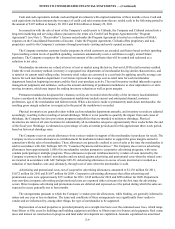

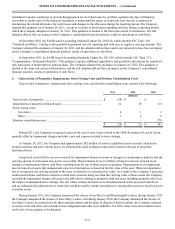

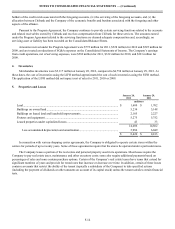

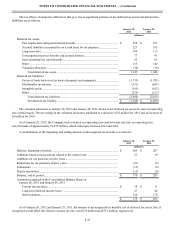

2. Gain on Sale of Properties, Impairments, Store Closing Costs and Division Consolidation Costs

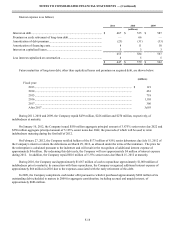

Gain on sale of properties, impairments, store closing costs, and division consolidation costs consist of the following:

2011 2010 2009

(millions)

Gain on sale of properties ............................................................................... $ (54) $ — $ —

Impairments of properties held and used........................................................ 22 18 115

Store closing costs:

Severance................................................................................................. 4 1 2

Other ........................................................................................................ 3 6 4

Division consolidation costs ........................................................................... — — 270

$(25) $ 25 $ 391

During 2011, the Company recognized a gain on the sale of store leases related to the 2006 divestiture of Lord & Taylor,

partially offset by impairment charges and other costs and expenses related to store closings.

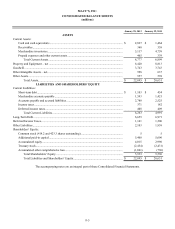

At January 28, 2012, the Company had approximately $82 million of cash in a qualified escrow account, included in

prepaid expenses and other current assets, for potential like-kind exchange transactions related to the sale of properties

mentioned above.

Long-lived assets held for use are reviewed for impairment whenever events or changes in circumstances indicate that the

carrying amount of such assets may not be recoverable. Determination of recoverability of long-lived assets is based on an

estimate of undiscounted future cash flows resulting from the use of those assets in operation. Measurement of an impairment

loss for long-lived assets that management expects to hold and use is based on the fair value of the asset. When an impairment

loss is recognized, the carrying amount of the asset is reduced to its estimated fair value. As a result of the Company’s projected

undiscounted future cash flows related to certain store locations being less than the carrying value of those assets, the Company

recorded the impairment charges reflected in the table above relating to properties held and used, including properties that were

the subject of announced store closings. The fair values of these locations were calculated based on the projected cash flows

and an estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or based on prices

of similar assets.

During January 2012, the Company announced the closure of ten Macy's and Bloomingdale's stores; during January 2011,

the Company announced the closure of three Macy’s stores; and during January 2010, the Company announced the closure of

five Macy’s stores. In connection with these announcements and the plans to dispose of these locations, the Company incurred

severance costs and other costs related to lease obligations and other store liabilities. For 2010, these costs also included a loss

on the sale of one property to be disposed.