Macy's 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

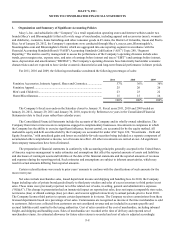

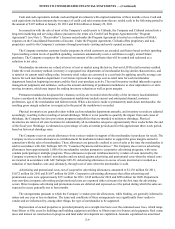

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-16

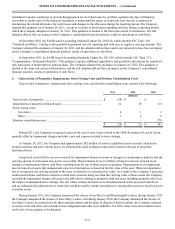

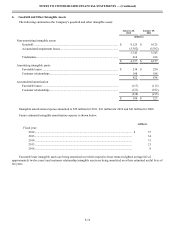

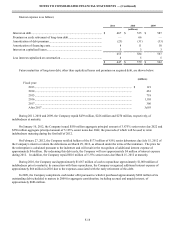

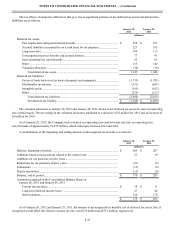

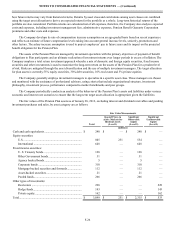

6. Goodwill and Other Intangible Assets

The following summarizes the Company’s goodwill and other intangible assets:

January 28,

2012 January 29,

2011

(millions)

Non-amortizing intangible assets

Goodwill................................................................................................................... $ 9,125 $ 9,125

Accumulated impairment losses............................................................................... (5,382)(5,382)

3,743 3,743

Tradenames .............................................................................................................. 414 414

$ 4,157 $ 4,157

Amortizing intangible assets

Favorable leases ....................................................................................................... $ 234 $ 250

Customer relationships............................................................................................. 188 188

422 438

Accumulated amortization

Favorable leases ....................................................................................................... (117)(113)

Customer relationships............................................................................................. (121)(102)

(238)(215)

$ 184 $ 223

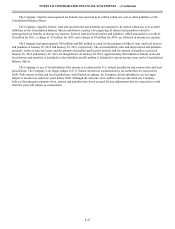

Intangible amortization expense amounted to $39 million for 2011, $41 million for 2010 and $41 million for 2009.

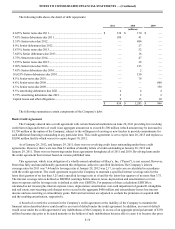

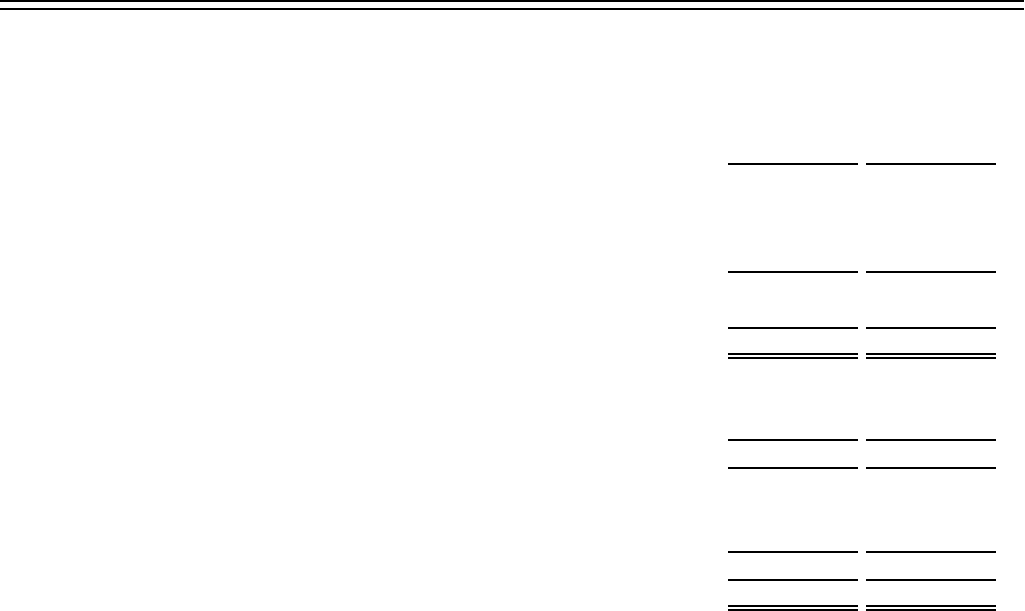

Future estimated intangible amortization expense is shown below:

(millions)

Fiscal year:

2012.................................................................................................................................... $ 37

2013.................................................................................................................................... 34

2014.................................................................................................................................... 31

2015.................................................................................................................................... 21

2016.................................................................................................................................... 8

Favorable lease intangible assets are being amortized over their respective lease terms (weighted average life of

approximately twelve years) and customer relationship intangible assets are being amortized over their estimated useful lives of

ten years.