Macy's 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-24

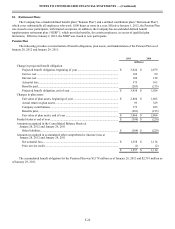

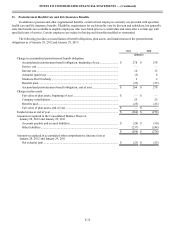

10. Retirement Plans

The Company has a funded defined benefit plan (“Pension Plan”) and a defined contribution plan (“Retirement Plan”)

which cover substantially all employees who work 1,000 hours or more in a year. Effective January 1, 2012, the Pension Plan

was closed to new participants, with limited exceptions. In addition, the Company has an unfunded defined benefit

supplementary retirement plan (“SERP”), which provides benefits, for certain employees, in excess of qualified plan

limitations. Effective January 2, 2012, the SERP was closed to new participants.

Pension Plan

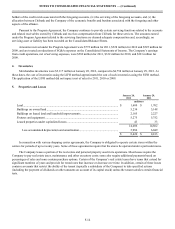

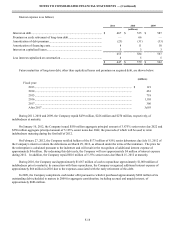

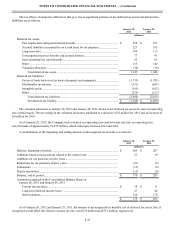

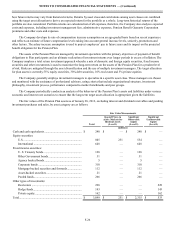

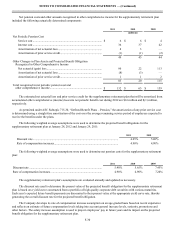

The following provides a reconciliation of benefit obligations, plan assets, and funded status of the Pension Plan as of

January 28, 2012 and January 29, 2011:

2011 2010

(millions)

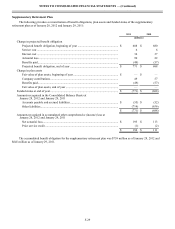

Change in projected benefit obligation

Projected benefit obligation, beginning of year ....................................................... $ 3,024 $ 2,879

Service cost .............................................................................................................. 102 99

Interest cost .............................................................................................................. 160 158

Actuarial loss............................................................................................................ 375 103

Benefits paid............................................................................................................. (203)(215)

Projected benefit obligation, end of year ................................................................. $ 3,458 $ 3,024

Changes in plan assets

Fair value of plan assets, beginning of year............................................................. $ 2,804 $ 1,865

Actual return on plan assets ..................................................................................... 93 329

Company contributions ............................................................................................ 375 825

Benefits paid............................................................................................................. (203)(215)

Fair value of plan assets, end of year ....................................................................... $ 3,069 $ 2,804

Funded status at end of year............................................................................................ $ (389) $ (220)

Amounts recognized in the Consolidated Balance Sheets at

January 28, 2012 and January 29, 2011

Other liabilities......................................................................................................... $ (389) $ (220)

Amounts recognized in accumulated other comprehensive (income) loss at

January 28, 2012 and January 29, 2011

Net actuarial loss...................................................................................................... $ 1,558 $ 1,116

Prior service credit ................................................................................................... (1)(2)

$ 1,557 $ 1,114

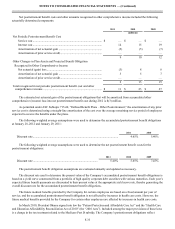

The accumulated benefit obligation for the Pension Plan was $3,178 million as of January 28, 2012 and $2,791 million as

of January 29, 2011.