Macy's 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-38

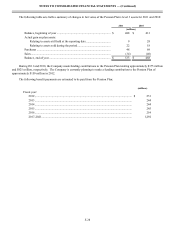

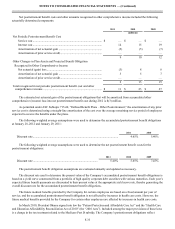

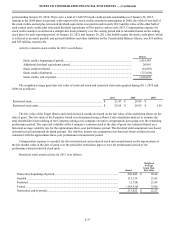

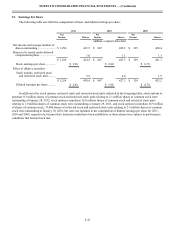

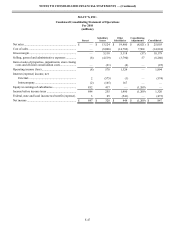

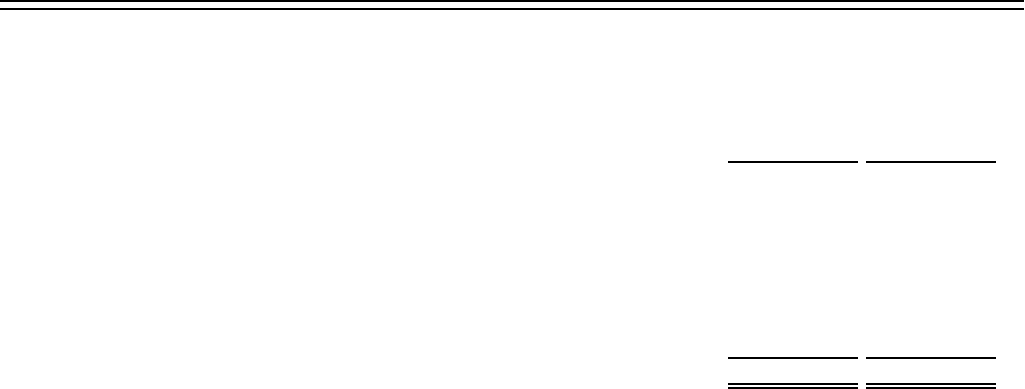

Activity related to restricted stock units for 2011 is as follows:

Shares

Weighted

Average

Grant Date

Fair Value

Nonvested, beginning of period ...................................................................................... 3,788,634 $ 8.57

Granted – performance-based.......................................................................................... 715,100 23.43

Performance adjustment.................................................................................................. 476,922 22.72

Granted – time-based....................................................................................................... 37,719 28.63

Dividend equivalents....................................................................................................... 116,422 23.04

Forfeited .......................................................................................................................... (288,071) 10.29

Vested.............................................................................................................................. (40,401) 22.54

Nonvested, end of period................................................................................................. 4,806,325 $ 12.47

There have been no grants of stock appreciation rights under the equity plans.

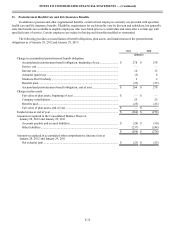

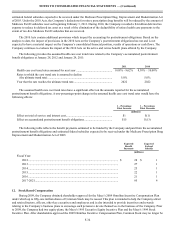

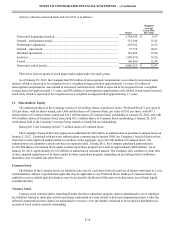

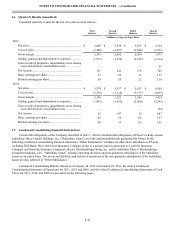

As of January 28, 2012, the Company had $39 million of unrecognized compensation costs related to nonvested stock

options, which is expected to be recognized over a weighted average period of approximately 1.8 years, $2 million of

unrecognized compensation costs related to nonvested restricted stock, which is expected to be recognized over a weighted

average period of approximately 1.6 years, and $26 million of unrecognized compensation costs related to nonvested restricted

stock units, which is expected to be recognized over a weighted average period of approximately 1.3 years.

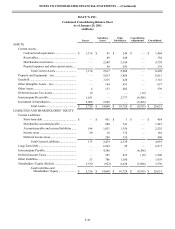

13. Shareholders’ Equity

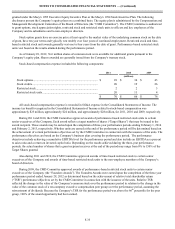

The authorized shares of the Company consist of 125 million shares of preferred stock (“Preferred Stock”), par value of

$.01 per share, with no shares issued, and 1,000 million shares of Common Stock, par value of $.01 per share, with 487.3

million shares of Common Stock issued and 414.2 million shares of Common Stock outstanding at January 28, 2012, and with

495.0 million shares of Common Stock issued and 423.3 million shares of Common Stock outstanding at January 29, 2011

(with shares held in the Company’s treasury being treated as issued, but not outstanding).

During 2011, the Company retired 7.7 million shares of Common Stock.

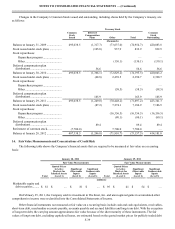

The Company's board of directors approved an additional $1,000 million in authorization to purchase Common Stock on

January 5, 2012. Combined with previous authorizations commencing in January 2000, the Company’s board of directors has

from time to time approved authorizations to purchase, in the aggregate, up to $10,500 million of Common Stock. All

authorizations are cumulative and do not have an expiration date. During 2011, the Company purchased approximately

16,356,500 shares of Common Stock under its share repurchase program for a total of approximately $500 million. As of

January 28, 2012, approximately $1,352 million of authorization remained unused. The Company may continue or, from time

to time, suspend repurchases of its shares under its share repurchase program, depending on prevailing market conditions,

alternative uses of capital and other factors.

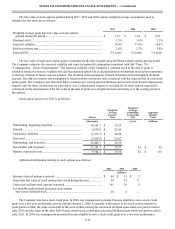

Common Stock

The holders of the Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote

of shareholders. Subject to preferential rights that may be applicable to any Preferred Stock, holders of Common Stock are

entitled to receive ratably such dividends as may be declared by the Board of Directors in its discretion, out of funds legally

available therefor.

Treasury Stock

Treasury stock contains shares repurchased under the share repurchase program, shares repurchased to cover employee

tax liabilities related to stock plan activity and shares maintained in a trust related to deferred compensation plans. Under the

deferred compensation plans, shares are maintained in a trust to cover the number estimated to be needed for distribution on

account of stock credits currently outstanding.