Macy's 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-13

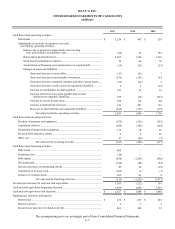

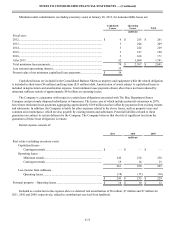

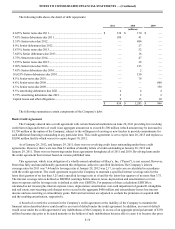

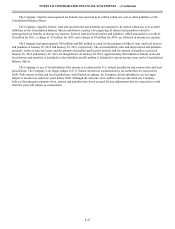

The following table shows for 2011, 2010 and 2009, the beginning and ending balance of, and the activity associated

with, the severance accruals established in connection with announced store closings:

2011 2010 2009

(millions)

Balance, beginning of year.............................................................................. $ 1 $ 2 $ 4

Charged to store closing costs......................................................................... 4 1 2

Payments......................................................................................................... (1)(2)(4)

Balance, end of year........................................................................................ $ 4 $ 1 $ 2

The Company expects to pay out the 2011 accrued severance costs, which are included in accounts payable and accrued

liabilities on the Consolidated Balance Sheets, prior to April 28, 2012.

In February 2008, the Company began a localization initiative called “My Macy’s.” This initiative was intended to

strengthen local market focus and enhance selling service in an effort to both accelerate same-store sales growth and reduce

expenses. To maximize the results from My Macy’s, the Company took action, initially in selected markets, that: concentrated

more management talent in local markets, effectively reducing the “span of control” over local stores; created new positions in

the field to work with planning and buying executives in helping to understand and act on the merchandise needs of local

customers; and empowered locally based executives to make more and better decisions. In combination with the localization

initiative, the Company consolidated the Minneapolis-based Macy’s North organization into New York-based Macy’s East, the

St. Louis-based Macy’s Midwest organization into Atlanta-based Macy’s South and the Seattle-based Macy’s Northwest

organization into San Francisco based Macy’s West. The Atlanta-based division was renamed Macy’s Central.

In February 2009, the Company announced the expansion of the My Macy’s localization initiative across the country.

Also as part of the My Macy’s transformation, the Company’s Macy’s branded stores were reorganized in a unified operating

structure, through division consolidations, to support the Macy’s business. Division central office organizations were eliminated

in New York-based Macy’s East, San Francisco-based Macy’s West, Atlanta-based Macy’s Central and Miami-based Macy’s

Florida. The New York-based Macy’s Home Store and Macy’s Corporate Marketing divisions no longer exist as separate

entities. Home Store functions were integrated into the Macy’s national merchandising, merchandise planning, stores and

marketing organizations. Macy’s Corporate Marketing was integrated into the new unified marketing organization. The New

York-based Macy’s Merchandising Group was refocused solely on the design, development and marketing of the Macy’s family

of private brands.

The costs and expenses associated with the division consolidations and localization initiatives consisted primarily of

severance costs and other human resource-related costs.

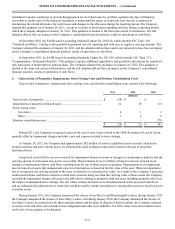

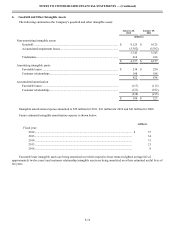

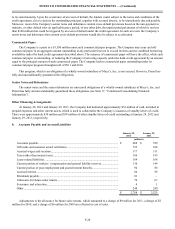

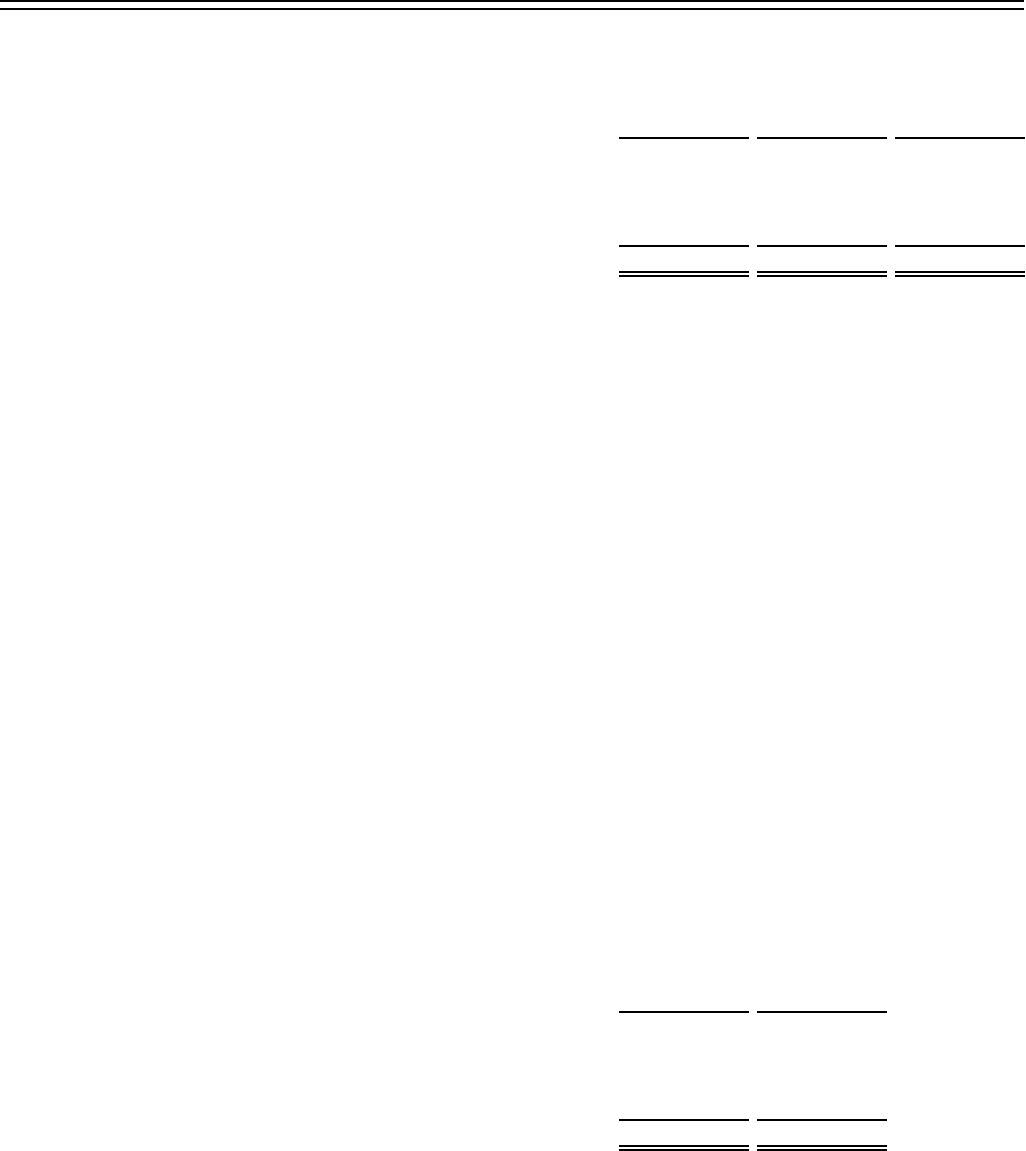

The following table shows for 2010 and 2009, the beginning and ending balance of, and the activity associated with, the

severance accruals established in connection with the division consolidations and localization initiatives:

2010 2009

(millions)

Balance, beginning of year.............................................................................. $ 69 $ 30

Charged to division consolidation costs.......................................................... — 166

Payments......................................................................................................... (69)(127)

Balance, end of year........................................................................................ $ — $ 69

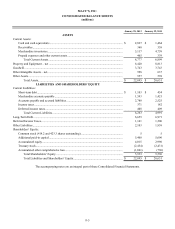

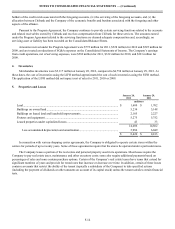

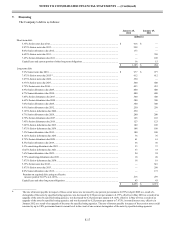

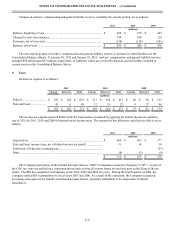

3. Receivables

Receivables were $368 million at January 28, 2012, compared to $338 million at January 29, 2011.

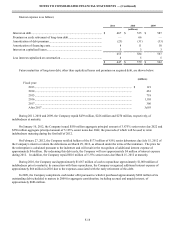

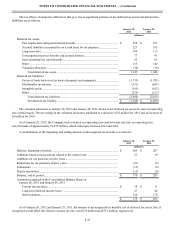

In connection with the sale of most of the Company's credit card accounts and related receivable balances to Citibank, the

Company and Citibank entered into a long-term marketing and servicing alliance pursuant to the terms of a Credit Card

Program Agreement (the “Program Agreement”) with an initial term of 10 years expiring on July 17, 2016 and, unless

terminated by either party as of the expiration of the initial term, an additional renewal term of three years. The Program

Agreement provides for, among other things, (i) the ownership by Citibank of the accounts purchased by Citibank, (ii) the

ownership by Citibank of new accounts opened by the Company’s customers, (iii) the provision of credit by Citibank to the