Macy's 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

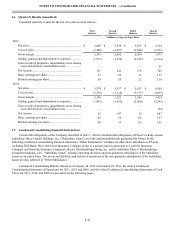

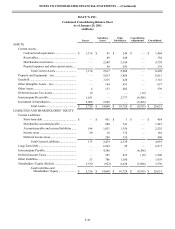

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-39

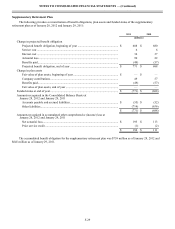

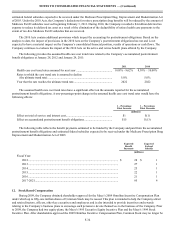

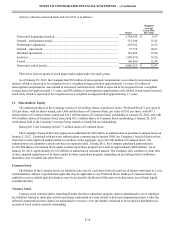

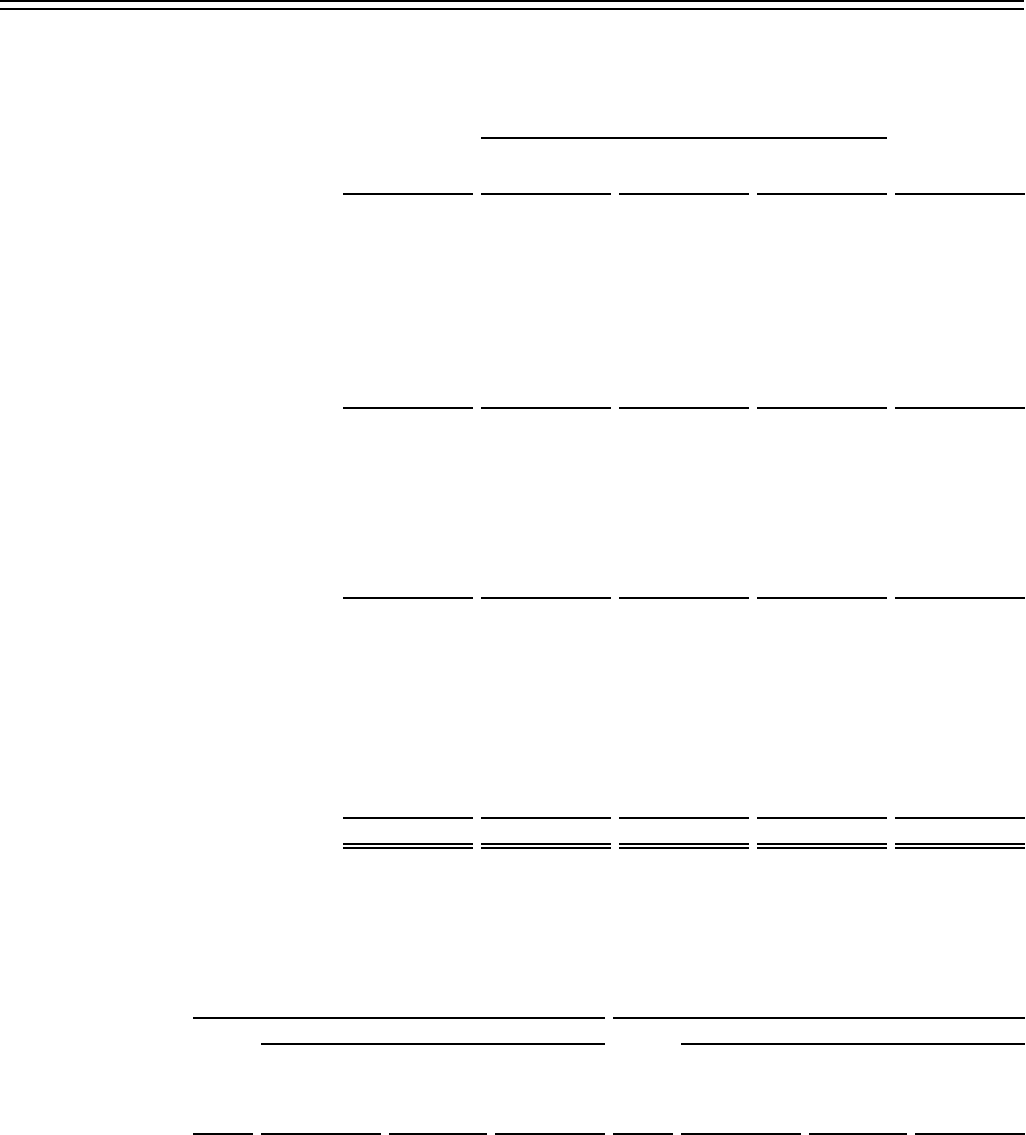

Changes in the Company’s Common Stock issued and outstanding, including shares held by the Company’s treasury, are

as follows:

Treasury Stock

Common

Stock

Issued

Deferred

Compensation

Plans Other Total

Common

Stock

Outstanding

(thousands)

Balance at January 31, 2009 .................... 495,038.5 (1,317.7)(73,637.0)(74,954.7) 420,083.8

Stock issued under stock plans ................ (105.0) 937.9 832.9 832.9

Stock repurchases:

Repurchase program......................... — —

Other ................................................. (130.1)(130.1)(130.1)

Deferred compensation plan

distributions.......................................... 56.6 56.6 56.6

Balance at January 30, 2010 .................... 495,038.5 (1,366.1)(72,829.2)(74,195.3) 420,843.2

Stock issued under stock plans ................ (48.8) 2,439.5 2,390.7 2,390.7

Stock repurchases:

Repurchase program......................... — —

Other ................................................. (58.5)(58.5)(58.5)

Deferred compensation plan

distributions.......................................... 165.9 165.9 165.9

Balance at January 29, 2011 .................... 495,038.5 (1,249.0)(70,448.2)(71,697.2) 423,341.3

Stock issued under stock plans ................ (87.2) 7,274.1 7,186.9 7,186.9

Stock repurchases:

Repurchase program......................... (16,356.5)(16,356.5)(16,356.5)

Other ................................................. (80.1)(80.1)(80.1)

Deferred compensation plan

distributions.......................................... 89.4 89.4 89.4

Retirement of common stock................... (7,700.0) 7,700.0 7,700.0 —

Balance at January 28, 2012 .................... 487,338.5 (1,246.8)(71,910.7)(73,157.5) 414,181.0

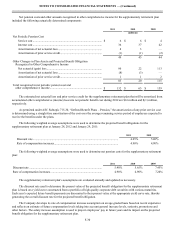

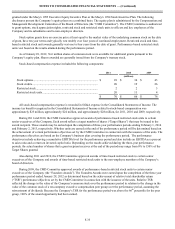

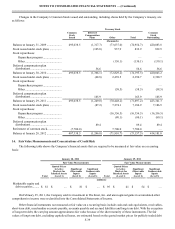

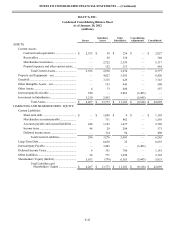

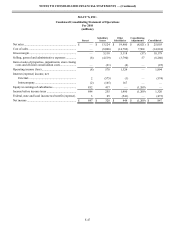

14. Fair Value Measurements and Concentrations of Credit Risk

The following table shows the Company’s financial assets that are required to be measured at fair value on a recurring

basis:

January 28, 2012 January 29, 2011

Fair Value Measurements Fair Value Measurements

Total

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(millions)

Marketable equity and

debt securities......... $ 81 $ — $ 81 $ — $ 95 $ 41 $ 54 $ —

On February 25, 2011, the Company sold its investment in The Knot, Inc. and unrecognized gains in accumulated other

comprehensive income were reclassified into the Consolidated Statements of Income.

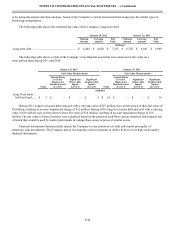

Other financial instruments not measured at fair value on a recurring basis include cash and cash equivalents, receivables,

short-term debt, merchandise accounts payable, accounts payable and accrued liabilities and long-term debt. With the exception

of long-term debt, the carrying amount approximates fair value because of the short maturity of these instruments. The fair

values of long-term debt, excluding capitalized leases, are estimated based on the quoted market prices for publicly traded debt