Macy's 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-21

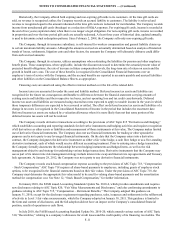

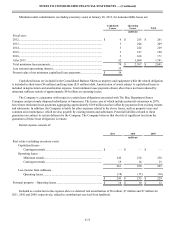

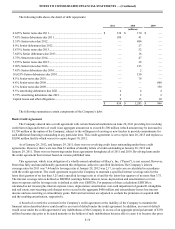

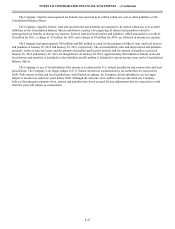

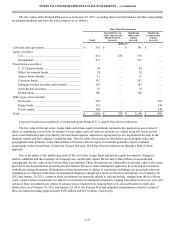

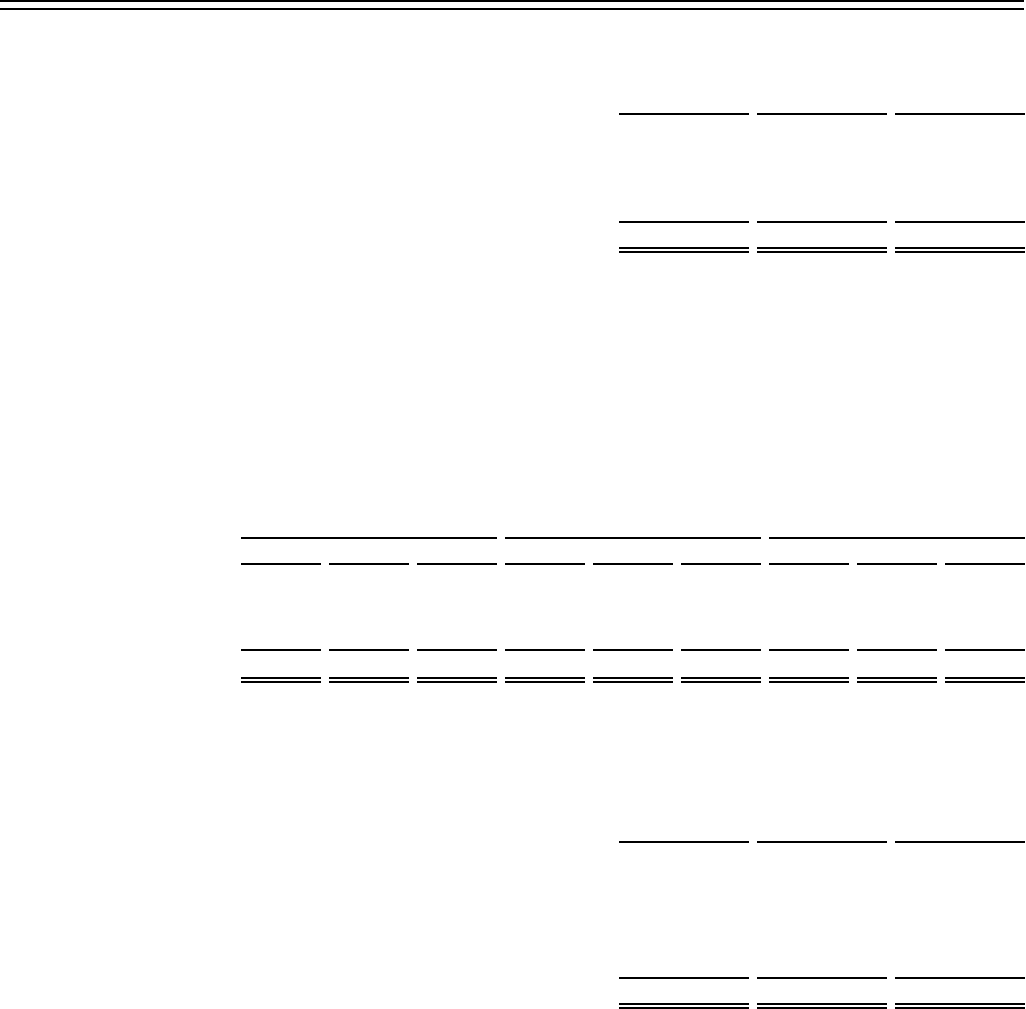

Changes in workers’ compensation and general liability reserves, including the current portion, are as follows:

2011 2010 2009

(millions)

Balance, beginning of year.............................................................................. $ 488 $ 478 $ 495

Charged to costs and expenses........................................................................ 144 148 124

Payments, net of recoveries ............................................................................ (139)(138)(141)

Balance, end of year........................................................................................ $ 493 $ 488 $ 478

The non-current portion of workers’ compensation and general liability reserves is included in other liabilities on the

Consolidated Balance Sheets. At January 28, 2012 and January 29, 2011, workers’ compensation and general liability reserves

included $98 million and $93 million, respectively, of liabilities which are covered by deposits and receivables included in

current assets on the Consolidated Balance Sheets.

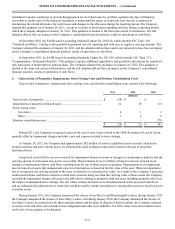

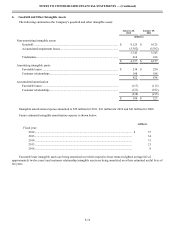

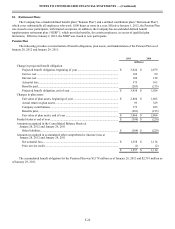

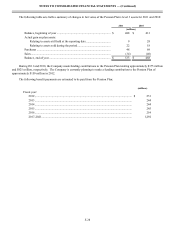

9. Taxes

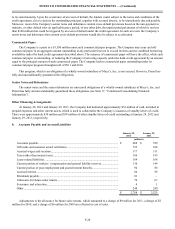

Income tax expense is as follows:

2011 2010 2009

Current Deferred Total Current Deferred Total Current Deferred Total

(millions)

Federal................................. $ 519 $ 144 $ 663 $ 217 $ 234 $ 451 $ 48 $ 84 $ 132

State and local...................... 43 6 49 12 10 22 9 37 46

$ 562 $ 150 $ 712 $ 229 $ 244 $ 473 $ 57 $ 121 $ 178

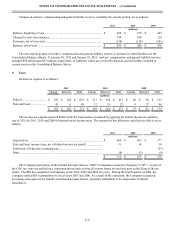

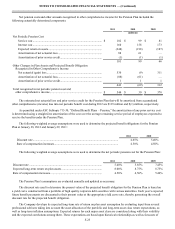

The income tax expense reported differs from the expected tax computed by applying the federal income tax statutory

rate of 35% for 2011, 2010 and 2009 to income before income taxes. The reasons for this difference and their tax effects are as

follows:

2011 2010 2009

(millions)

Expected tax.................................................................................................... $ 689 $ 462 $ 177

State and local income taxes, net of federal income tax benefit..................... 31 14 30

Settlement of federal tax examinations........................................................... — — (21)

Other................................................................................................................ (8)(3)(8)

$ 712 $ 473 $ 178

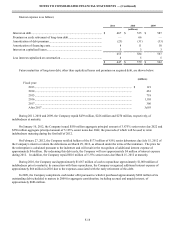

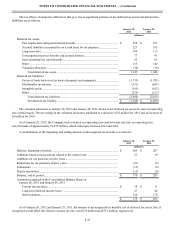

The Company participates in the Internal Revenue Service (“IRS”) Compliance Assurance Program ("CAP"). As part of

the CAP, tax years are audited on a contemporaneous basis so that all or most issues are resolved prior to the filing of the tax

return. The IRS has completed examinations of the 2010, 2009 and 2008 tax years. During the fourth quarter of 2009, the

Company settled IRS examinations for fiscal years 2007 and 2006. As a result of the settlement, the Company recognized

previously unrecognized tax benefits and related accrued interest, primarily attributable to the disposition of former

subsidiaries.