Macy's 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

F-18

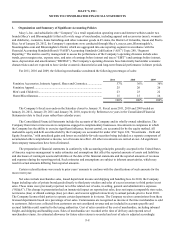

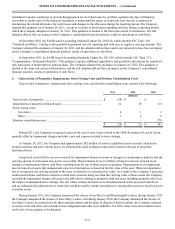

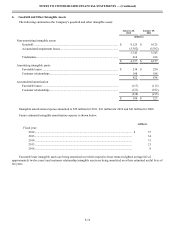

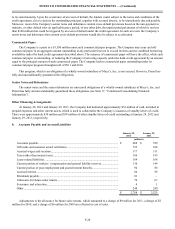

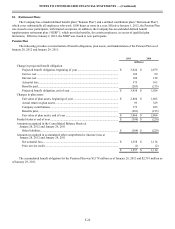

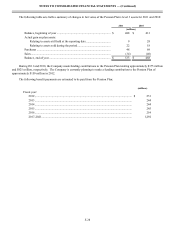

Interest expense is as follows:

2011 2010 2009

(millions)

Interest on debt................................................................................................ $ 467 $ 535 $ 587

Premium on early retirement of long-term debt.............................................. — 66 —

Amortization of debt premium........................................................................ (23)(31)(33)

Amortization of financing costs...................................................................... 8 11 10

Interest on capitalized leases........................................................................... 3 3 3

455 584 567

Less interest capitalized on construction ........................................................ 8 5 5

$ 447 $ 579 $ 562

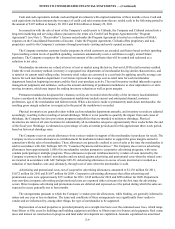

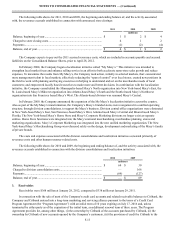

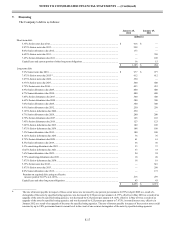

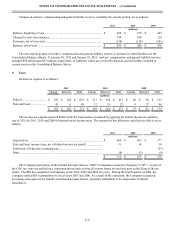

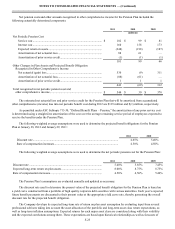

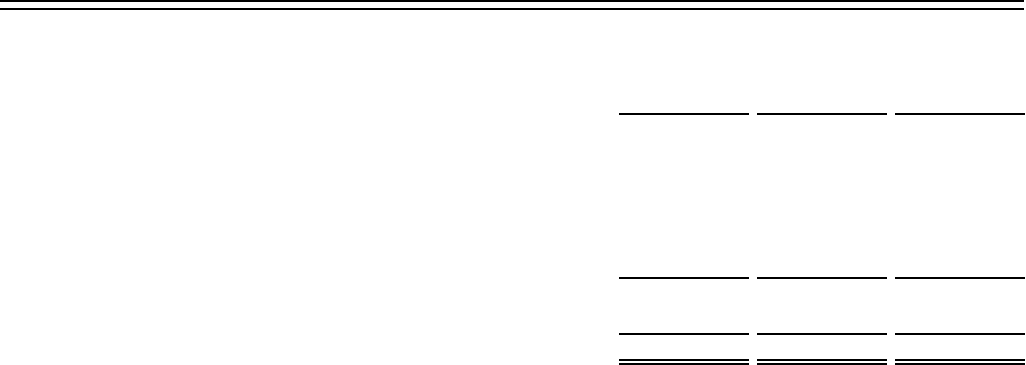

Future maturities of long-term debt, other than capitalized leases and premium on acquired debt, are shown below:

(millions)

Fiscal year:

2013.................................................................................................................................... $ 121

2014.................................................................................................................................... 461

2015.................................................................................................................................... 718

2016.................................................................................................................................... 1,105

2017.................................................................................................................................... 306

After 2017 .......................................................................................................................... 3,693

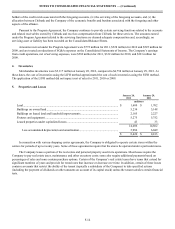

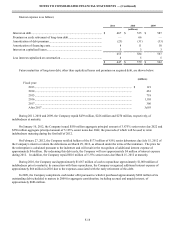

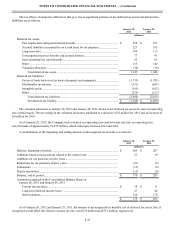

During 2011, 2010 and 2009, the Company repaid $439 million, $226 million and $270 million, respectively, of

indebtedness at maturity.

On January 10, 2012, the Company issued $550 million aggregate principal amount of 3.875% senior notes due 2022 and

$250 million aggregate principal amount of 5.125% senior notes due 2042, the proceeds of which will be used to retire

indebtedness maturing during the first half of 2012.

On February 27, 2012, the Company notified holders of the $173 million of 8.0% senior debentures due July 15, 2012 of

the Company's intent to redeem the debentures on March 29, 2012, as allowed under the terms of the indenture. The price for

the redemption is calculated pursuant to the indenture and will result in the recognition of additional interest expense of

approximately $4 million. By redeeming this debt early, the Company will save approximately $4 million of interest expense

during 2012. In addition, the Company repaid $616 million of 5.35% senior notes due March 15, 2012 at maturity.

During 2010, the Company used approximately $1,067 million of cash to repurchase approximately $1,000 million of

indebtedness prior to maturity. In connection with these repurchases, the Company recognized additional interest expense of

approximately $66 million in 2010 due to the expenses associated with the early retirement of this debt.

In 2009, the Company completed a cash tender offer pursuant to which it purchased approximately $680 million of its

outstanding debt scheduled to mature in 2009 for aggregate consideration, including accrued and unpaid interest, of

approximately $686 million.