Macy's 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MACY’S, INC. ANNUAL REPORT 2011

on all

Growth

Fronts

Table of contents

-

Page 1

Growth on all Fronts MACY'S, INC. ANNUAL REPORT 2011 -

Page 2

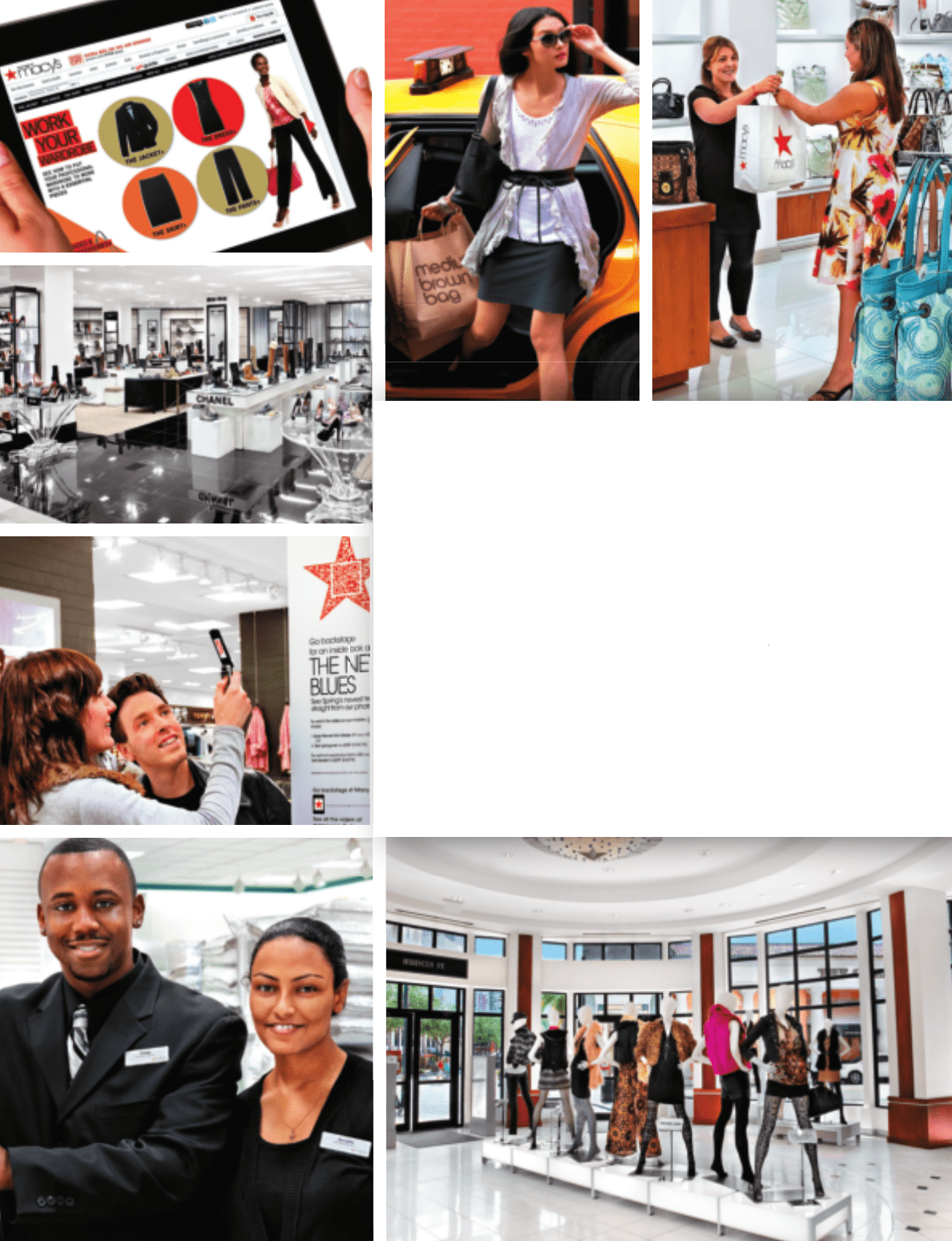

... exclusive brands that our customers won't ï¬nd elsewhere. We engage customers in stores, online and via mobile devices by offering advice and options that bring fashion ideas to life. Our looks set the tone in style magazines, videos, TV shows, movies, blogs and websites. Our associates take... -

Page 3

...in our company have driven enhanced returns to our shareholders. During fiscal 2011, the price of Macy's, Inc. common stock rose by nearly 50 percent, and the share price has nearly quadrupled since the beginning of ï¬scal 2009. We doubled our cash dividend on common stock to an annualized 40 cents... -

Page 4

... dazzling updated presentations of new and expanded merchandise space, and signiï¬cantly expanding the men's store. To the delight of shoppers, we are creating the world's largest women's shoe department (with 39,000 square feet of continuous selling space), which is expected to open in fall 2012... -

Page 5

... company The aggregate market value of the registrant's common stock held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second fiscal quarter (July 30, 2011) was approximately $12,339,100,000. Indicate the number of shares outstanding... -

Page 6

... ended January 28, 2012, January 29, 2011, January 30, 2010, January 31, 2009 and February 2, 2008, respectively. Forward-Looking Statements This report and other reports, statements and information previously or subsequently filed by the Company with the Securities and Exchange Commission (the "SEC... -

Page 7

... the Company piloted a new Bloomingdale's Outlet store concept. New Bloomingdale's Outlet stores continue to open and are each approximately 25,000 square feet and offer a range of apparel and accessories, including women's ready-towear, men's, children's, women's shoes, fashion accessories, jewelry... -

Page 8

... credit marketing services in respect of all proprietary and non-proprietary credit card accounts that are owned either by Department Stores National Bank ("DSNB"), a subsidiary of Citibank, N.A., or FDS Bank and that constitute a part of the credit programs of the Company's retail operations. Macy... -

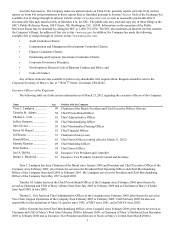

Page 9

...of the Board; President and Chief Executive Officer; Director Chief Private Brand Officer Chief Administrative Officer Chief Merchandising Officer Chief Merchandise Planning Officer Chief Financial Officer Chairman of macys.com Chief Stores Officer (retiring effective March 31, 2012) Chief Marketing... -

Page 10

... Reardon has been Chief Marketing Officer since February 2012; prior thereto she served as Executive Vice President for Marketing from February 2009 to February 2012 and Executive Vice President, national marketing strategy, events and public relations for Macy's Corporate Marketing from 2007 to... -

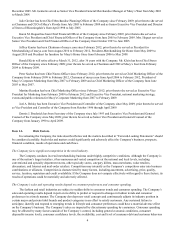

Page 11

... in the ratings that rating agencies assign to the Company's short and long-term debt may negatively impact the Company's access to the debt capital markets and increase the Company's cost of borrowing. In addition, the Company's bank credit agreements require the Company to maintain specified... -

Page 12

... in a highly competitive and challenging business environment, the Company is highly dependent upon management personnel to develop and effectively execute successful business strategies and tactics. Any circumstances that adversely impact the Company's ability to attract, train, develop and retain... -

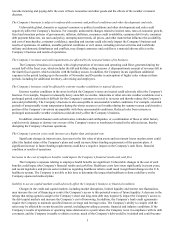

Page 13

... respect to store and distribution center locations, merchandise, advertising, software development and support, logistics, other agreements for goods and services in order to operate the Company's business in the ordinary course, extensions of credit, credit card accounts and related receivables... -

Page 14

... and financial performance, the Company's stock price could decline. Also, sales of a substantial number of shares of the Company's common stock in the public market or the appearance that these shares are available for sale could adversely affect the market price of the Company's common stock. Item... -

Page 15

... on the Company's Macy's branded operational structure.The Company's retail stores are located at urban or suburban sites, principally in densely populated areas across the United States. Store count activity was as follows: 2011 2010 2009 Store count at beginning of fiscal year...Stores opened and... -

Page 16

...financial condition and legal or contractual restrictions. The following table provides information regarding the Company's purchases of Common Stock during the fourth quarter of 2011. Total Number of Shares Purchased (thousands) Average Price per Share ($) Number of Shares Purchased under Program... -

Page 17

... return on the Common Stock with the Standard & Poor's 500 Composite Index and the Standard & Poor's Retail Department Store Index for the period from January 29, 2007 through January 27, 2012, assuming an initial investment of $100 and the reinvestment of all dividends, if any. The companies... -

Page 18

... Net income (loss) ...Average number of shares outstanding...Cash dividends paid per share...$ Depreciation and amortization...$ Capital expenditures...$ Balance Sheet Data (at year end): Cash and cash equivalents ...$ Total assets...Short-term debt ...Long-term debt...Shareholders' equity...2,827... -

Page 19

.... In 2010, the Company piloted a new Bloomingdale's Outlet store concept. Bloomingdale's Outlet stores are each approximately 25,000 square feet and offer a range of apparel and accessories, including women's ready-to-wear, men's, children's, women's shoes, fashion accessories, jewelry, handbags... -

Page 20

... 2010. Sales from the Company's Internet businesses in 2011 increased 39.6% compared to 2010 and positively affected the Company's 2011 comparable store sales by 1.5%. The Company continues to benefit from the successful execution of the My Macy's localization strategy. Geographically, sales in 2011... -

Page 21

... success in the My Macy's localization strategy. Geographically, sales in 2010 were strongest in Florida and the upper Midwest. By family of business, sales in 2010 were strongest in updated women's apparel, particularly the Company's I-N-C brand, jewelry and watches, men's apparel and accessories... -

Page 22

...'s common stock during 2012. The Company may continue or, from time to time, suspend repurchases of shares under its share repurchase program, depending on prevailing market conditions, alternate uses of capital and other factors. The Company entered into a credit agreement with certain financial... -

Page 23

... on prevailing market conditions, alternate uses of capital and other factors. On January 5, 2012, the Company's board of directors declared a quarterly dividend of 20 cents per share on its common stock, payable April 2, 2012 to Macy's shareholders of record at the close of business on March... -

Page 24

...sources: cash on hand, cash from operations, borrowings under existing or new credit facilities and the issuance of long-term debt or other securities, including common stock. Critical Accounting Policies Merchandise Inventories Merchandise inventories are valued at the lower of cost or market using... -

Page 25

...Company could experience higher costs of sales and higher advertising expense, or reduce the amount of advertising that it uses, depending on the specific vendors involved and market conditions existing at the time. Physical inventories are generally taken within each merchandise department annually... -

Page 26

... discount rate. Projected sales, gross margin and SG&A expense rate assumptions and capital expenditures are based on the Company's annual business plan or other forecasted results. Discount rates reflect market-based estimates of the risks associated with the projected cash flows of the reporting... -

Page 27

... of the Pension Plan), the discount rate used to determine the present value of projected benefit obligations and the weighted average rate of increase of future compensation levels. As of January 29, 2011, the Company lowered the assumed annual long-term rate of return for the Pension Plan's assets... -

Page 28

... on the Company's consolidated financial position, results of operations or cash flows. In June 2011, the FASB issued Accounting Standard Update No. 2011-05, which amends ASC Topic 220, "Comprehensive Income," to increase the prominence of items reported in other comprehensive income by eliminating... -

Page 29

..., January 29, 2011 and January 30, 2010...Consolidated Balance Sheets at January 28, 2012 and January 29, 2011 ...Consolidated Statements of Changes in Shareholders' Equity for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010...Consolidated Statements of Cash Flows for... -

Page 30

... with our 2012 Annual Meeting of Shareholders (the "Proxy Statement"), and "Item 1. Business - Executive Officers of the Registrant" in this report and incorporated herein by reference. Item 11. Executive Compensation. Information called for by this item is set forth under "Compensation Discussion... -

Page 31

... - Stock Ownership of Directors and Executive Officers" in the Proxy Statement and incorporated herein by reference. Item 13. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Information called for by this item is set forth under "Further Information... -

Page 32

...successor to The May Department Stores Company ("May Delaware")), Macy's Retail Holdings, Inc. ("Macy's Retail") (f/k/a The May Department Stores Company (NY) or "May New York") and The Bank of New York Mellon Trust Company, N.A. ("BNY Mellon", successor to J.P. Morgan Trust Company and as successor... -

Page 33

... as Trustee Guarantee of Securities, dated as of August 30, 2005, by the Company relating to the 1997 Indenture Indenture, dated as of June 17, 1996, among the Company (as successor to May Delaware), Macy's Retail (f/k/a May New York) and The Bank of New York Mellon Trust Company, N.A. ("BNY Mellon... -

Page 34

... as of August 30, 2005, among the Company, Macy's Retail and J.P. Morgan Securities Inc. Commercial Paper Dealer Agreement, dated as of October 4, 2006, among the Company and Loop Capital Markets, LLC Tax Sharing Agreement Exhibit 10.02 to the June 20, 2011 Form 8-K 10.2 10.3 Exhibit 10.6 to the... -

Page 35

... Agreement, dated May 22, 2006, between the Company and Citibank Credit Card Program Agreement, effective as of June 1, 2005, among the Company, FDS Bank, Macy's Credit and Customer Services, Inc. ("MCCS") (f/k/a FACS Group, Inc.) and Citibank First Amendment to Credit Card Program Agreement, dated... -

Page 36

... 2009 Form 10-Q effective as of June 1, 2009, among the Company, FDS Bank, MCCS, MWSI, Bloomingdale's and DSNB Seventh Amendment to Credit Card Program Agreement, effective as of February 26, 2010, among the Company, FDS Bank, MCCS, MWSI, Bloomingdale's and DSNB 1995 Executive Equity Incentive Plan... -

Page 37

... Retirement Plan effective January 1, 2012 * Executive Deferred Compensation Plan * Macy's, Inc. Profit Sharing 401(k) Investment Plan (the "Plan") (amending and restating the Macy's, Inc. Profit Sharing 401(k) Investment Plan and The May Department Stores Company Profit Sharing Plan), effective... -

Page 38

...The following financial statements from Macy's, Inc.'s Annual Report on Form 10-K for the year ended January 28, 2012, filed on March 28, 2012, formatted in XBRL: (i) Consolidated Statements of Income, (ii) Consolidated Balance Sheets, (iii) Consolidated Statements of Changes in Shareholders' Equity... -

Page 39

... report has been signed below by the following persons on behalf of the Registrant and in the capacities indicated on March 28, 2012. Signature Title * Terry J. Lundgren Chairman of the Board, President and Chief Executive Officer (principal executive officer) and Director Chief Financial Officer... -

Page 40

[This Page Intentionally Left Blank] -

Page 41

... TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Management...Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Income for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 ...Consolidated Balance Sheets at January 28, 2012 and... -

Page 42

... public accounting firm, which is subject to shareholder approval, and the general oversight review of management's discharge of its responsibilities with respect to the matters referred to above. Terry J. Lundgren Chairman, President and Chief Executive Officer Karen M. Hoguet Chief Financial... -

Page 43

... PUBLIC ACCOUNTING FIRM The Board of Directors and Shareholders Macy's, Inc.: We have audited the accompanying consolidated balance sheets of Macy's, Inc. and subsidiaries as of January 28, 2012 and January 29, 2011, and the related consolidated statements of income, shareholders' equity and cash... -

Page 44

MACY'S, INC. CONSOLIDATED STATEMENTS OF INCOME (millions, except per share data) 2011 2010 2009 Net sales ...Cost of sales ...Gross margin ...Selling, general and administrative expenses ...Gain on sale of properties, impairments, store closing costs and division consolidation costs...Operating ... -

Page 45

...: Short-term debt...Merchandise accounts payable ...Accounts payable and accrued liabilities ...Income taxes...Deferred income taxes...Total Current Liabilities ...Long-Term Debt ...Deferred Income Taxes...Other Liabilities ...Shareholders' Equity: Common stock (414.2 and 423.3 shares outstanding... -

Page 46

... ...Prior service credit on post employment benefit plans, net of income tax effect of $1 million...Total comprehensive income ...Common stock dividends ($.55 per share) ...Stock repurchases...Stock-based compensation expense...Stock issued under stock plans ...Retirement of common stock ...Deferred... -

Page 47

MACY'S, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (millions) 2011 2010 2009 Cash flows from operating activities: Net income...$ Adjustments to reconcile net income to net cash provided by operating activities: Gain on sale of properties, impairments, store closing costs and division ... -

Page 48

... Accounting Policies Macy's, Inc. and subsidiaries (the "Company") is a retail organization operating stores and Internet websites under two brands (Macy's and Bloomingdale's) that sell a wide range of merchandise, including apparel and accessories (men's, women's and children's), cosmetics... -

Page 49

... 28, 2012 and $104 million at January 29, 2011. In connection with the sale of most of the Company's credit assets to Citibank, the Company and Citibank entered into a long-term marketing and servicing alliance pursuant to the terms of a Credit Card Program Agreement (the "Program Agreement") (see... -

Page 50

... discount rate. The projected sales, gross margin and SG&A expense rate assumptions and capital expenditures are based on the Company's annual business plan or other forecasted results. Discount rates reflect market-based estimates of the risks associated with the projected cash flows directly... -

Page 51

... in future compensation levels, the long-term rate of return on assets and the growth in health care costs. The cost of these benefits is recognized in the Consolidated Financial Statements over an employee's term of service with the Company, and the accrued benefits are reported in accounts payable... -

Page 52

... cash flows and an estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or based on prices of similar assets. During January 2012, the Company announced the closure of ten Macy's and Bloomingdale's stores; during January 2011, the Company announced... -

Page 53

... 29, 2011. In connection with the sale of most of the Company's credit card accounts and related receivable balances to Citibank, the Company and Citibank entered into a long-term marketing and servicing alliance pursuant to the terms of a Credit Card Program Agreement (the "Program Agreement") with... -

Page 54

... Balance Sheets. Amounts received under the Program Agreement were $772 million for 2011, $528 million for 2010 and $525 million for 2009, and are treated as reductions of SG&A expenses on the Consolidated Statements of Income. The Company's earnings from credit operations, net of servicing... -

Page 55

... $ 261 249 229 190 171 1,741 2,841 Capitalized leases are included in the Consolidated Balance Sheets as property and equipment while the related obligation is included in short-term ($4 million) and long-term ($35 million) debt. Amortization of assets subject to capitalized leases is included in... -

Page 56

... million for 2010 and $41 million for 2009. Future estimated intangible amortization expense is shown below: (millions) Fiscal year: 2012...$ 2013...2014...2015...2016... 37 34 31 21 8 Favorable lease intangible assets are being amortized over their respective lease terms (weighted average life of... -

Page 57

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 7. Financing The Company's debt is as follows: January 28, January 29, 2012 2011 (millions) Short-term debt: 5.35% Senior notes due 2012...$ 5.875% Senior notes due 2013...8.0% Senior debentures due 2012...6.625% Senior notes due 2011...7.45... -

Page 58

...(33) 10 3 567 5 562 Future maturities of long-term debt, other than capitalized leases and premium on acquired debt, are shown below: (millions) Fiscal year: 2013...$ 2014...2015...2016...2017...After 2017 ... 121 461 718 1,105 306 3,693 During 2011, 2010 and 2009, the Company repaid $439 million... -

Page 59

... various published rates. This agreement, which is an obligation of a wholly-owned subsidiary of Macy's, Inc. ("Parent"), is not secured. However, Parent has fully and unconditionally guaranteed this obligation, subject to specified limitations.The Company's interest coverage ratio for 2011 was 7.44... -

Page 60

... paper program. The Company may issue and sell commercial paper in an aggregate amount outstanding at any particular time not to exceed its then-current combined borrowing availability under the bank credit agreement described above. The issuance of commercial paper will have the effect, while... -

Page 61

...' compensation and general liability reserves included $98 million and $93 million, respectively, of liabilities which are covered by deposits and receivables included in current assets on the Consolidated Balance Sheets. 9. Taxes Income tax expense is as follows: 2011 Current Deferred Total Current... -

Page 62

... for tax positions of prior years...Reductions for tax positions of prior years...Settlements ...Statute expirations ...Balance, end of period...$ Amounts recognized in the Consolidated Balance Sheets at January 28, 2012 and January 29, 2011 Current income taxes...$ Long-term deferred income taxes... -

Page 63

... January 28, 2012, approximately $60 million of federal, state and local interest and penalties is included in other liabilities and $9 million is included in current income taxes on the Consolidated Balance Sheets. The Company or one of its subsidiaries files income tax returns in the U.S. federal... -

Page 64

...TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 10. Retirement Plans The Company has a funded defined benefit plan ("Pension Plan") and a defined contribution plan ("Retirement Plan") which cover substantially all employees who work 1,000 hours or more in a year. Effective January 1, 2012, the... -

Page 65

..., 2012 and January 29, 2011: 2011 2010 Discount rate...Rate of compensation increases... 4.65% 4.50% 5.40% 4.50% The following weighted average assumptions were used to determine the net periodic pension cost for the Pension Plan: 2011 2010 2009 Discount rate ...Expected long-term return on plan... -

Page 66

...inflation. The Company employs a total return investment approach whereby a mix of domestic and foreign equity securities, fixed income securities and other investments is used to maximize the long-term return on the assets of the Pension Plan for a prudent level of risk. Risks are mitigated through... -

Page 67

...TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The fair values of the Pension Plan assets as of January 29, 2011, excluding interest and dividend receivables and pending investment purchases and sales, by asset category are as follows: Fair Value Measurements Quoted Prices in Active Markets for... -

Page 68

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table sets forth a summary of changes in fair value of the Pension Plan's level 3 assets for 2011 and 2010: 2011 (millions) 2010 Balance, beginning of year ...$ Actual gain on plan assets: Relating to assets still held at the reporting... -

Page 69

...Change in plan assets Fair value of plan assets, beginning of year ...Company contributions ...Benefits paid...Fair value of plan assets, end of year ...Funded status at end of year ...Amounts recognized in the Consolidated Balance Sheets at January 28, 2012 and January 29, 2011 Accounts payable and... -

Page 70

... retirement plan: 2011 2010 2009 Discount rate ...Rate of compensation increases ... 5.40% 4.90% 5.65% 4.90% 7.45% 7.20% The supplementary retirement plan's assumptions are evaluated annually and updated as necessary. The discount rate used to determine the present value of the projected benefit... -

Page 71

... executives may elect to defer a portion of their compensation each year as either stock credits or cash credits. The Company transfers shares to a trust to cover the number management estimates will be needed for distribution on account of stock credits currently outstanding. At January 28, 2012... -

Page 72

... specified health care and life insurance benefits. Eligibility requirements for such benefits vary by division and subsidiary, but generally state that benefits are available to eligible employees who were hired prior to a certain date and retire after a certain age with specified years of service... -

Page 73

... obligations: 2011 2010 2009 Discount rate ... 5.40% 5.65% 7.45% The postretirement benefit obligation assumptions are evaluated annually and updated as necessary. The discount rate used to determine the present value of the Company's accumulated postretirement benefit obligations is... -

Page 74

... 2009, the Company obtained shareholder approval for the Macy's 2009 Omnibus Incentive Compensation Plan under which up to fifty-one million shares of Common Stock may be issued. This plan is intended to help the Company attract and retain directors, officers, other key executives and employees... -

Page 75

... shares of common stock were available for additional grants pursuant to the Company's equity plan. Shares awarded are generally issued from the Company's treasury stock. Stock-based compensation expense included the following components: 2011 2010 (millions) 2009 Stock options...$ Stock credits... -

Page 76

... Additional information relating to stock options is as follows: 2011 2010 (millions) 2009 Intrinsic value of options exercised ...$ Grant date fair value of stock options that vested during the year...Cash received from stock options exercised ...Tax benefits realized from exercised stock options... -

Page 77

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) period ending January 30, 2010. There were a total of 1,649,870 stock credit awards outstanding as of January 28, 2012, relating to the 2008 grant. In general, with respect to the stock credits awarded to participants in 2008, the value of ... -

Page 78

... employee tax liabilities related to stock plan activity and shares maintained in a trust related to deferred compensation plans. Under the deferred compensation plans, shares are maintained in a trust to cover the number estimated to be needed for distribution on account of stock credits currently... -

Page 79

...Stock Common Stock Issued Deferred Compensation Plans Common Stock Outstanding Other (thousands) Total Balance at January 31, 2009 ...Stock issued under stock plans ...Stock repurchases: Repurchase program ...Other ...Deferred compensation plan distributions...Balance at January 30, 2010 ...Stock... -

Page 80

... these locations were calculated based on the projected cash flows and an estimated risk-adjusted rate of return that would be used by market participants in valuing these assets or prices of similar assets. Financial instruments that potentially subject the Company to concentrations of credit risk... -

Page 81

...: 2011 Net Income Shares Net Income 2010 Shares Net Income 2009 Shares (millions, except per share data) Net income and average number of shares outstanding ...$ 1,256 Shares to be issued under deferred compensation plans ...$ 1,256 Basic earnings per share...Effect of dilutive securities - Stock... -

Page 82

..., Macy's Retail Holdings, Inc. ("Subsidiary Issuer") are fully and unconditionally guaranteed by Parent. In the following condensed consolidating financial statements, "Other Subsidiaries" includes all other direct subsidiaries of Parent, including FDS Bank, West 34th Street Insurance Company... -

Page 83

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) MACY'S, INC. Condensed Consolidating Balance Sheet As of January 28, 2012 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated ASSETS: Current Assets: Cash and cash equivalents ...Receivables...Merchandise... -

Page 84

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) MACY'S, INC. Condensed Consolidating Statement of Operations For 2011 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated Net sales ...$ Cost of sales ...Gross margin...Selling, general and ... -

Page 85

...- (Continued) MACY'S, INC. Condensed Consolidating Statement of Cash Flows For 2011 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated Cash flows from operating activities: Net income ...$ Gain on sale of properties, impairments, store closing costs and... -

Page 86

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) MACY'S, INC. Condensed Consolidating Balance Sheet As of January 29, 2011 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated ASSETS: Current Assets: Cash and cash equivalents ...Receivables...Merchandise... -

Page 87

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) MACY'S, INC. Condensed Consolidating Statement of Operations For 2010 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated Net sales ...$ Cost of sales ...Gross margin...Selling, general and ... -

Page 88

...STATEMENTS - (Continued) MACY'S, INC. Condensed Consolidating Statement of Cash Flows For 2010 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated Cash flows from operating activities: Net income...$ Gain on sale of properties, impairments, store closing... -

Page 89

... Consolidating Statement of Operations For 2009 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated Net sales ...$ Cost of sales ...Gross margin...Selling, general and administrative expenses ...Gain on sale of properties, impairments, store closing... -

Page 90

...(Continued) MACY'S, INC. Condensed Consolidating Statement of Cash Flows For 2009 (millions) Subsidiary Issuer Other Subsidiaries Consolidating Adjustments Parent Consolidated Cash flows from operating activities: Net income (loss)...$ Gain on sale of properties, impairments, store closing costs... -

Page 91

[This Page Intentionally Left Blank] -

Page 92

... sales Net income $26,405 $1,256 4.8% Non-GAAP measure: Net sales Net income Add back interest expense - net Add back federal, state and local income tax expense Deduct the impact of the gain on the sale of store leases Add back impairments, store closing costs and division consolidation costs Add... -

Page 93

... can shop online, review your credit account and get detailed information on offers, events and activities associated with each brand. STORES Go to macysinc.com/StoreInformation for a complete listing of Macy's and Bloomingdale's store locations, summaries of store counts and square footage, charts... -

Page 94

... Chief Merchandise Planning Ofï¬cer Karen M. Hoguet Chief Financial Ofï¬cer Jeffrey Kantor Chairman of macys.com Martine Reardon Chief Marketing Ofï¬cer Peter Sachse Chief Stores Ofï¬cer Michael Gould Chairman and Chief Executive Ofï¬cer, Bloomingdale's OTHER MACY'S, INC. CORPORATE OFFICERS... -

Page 95

Shareholder Information TO REACH US macysinc.com/ir Sign up to have Macy's, Inc.'s news releases sent to you via e-mail by subscribing to News Direct. Get the latest stock price and chart, or take advantage of the historical price look-up feature. TRANSFER AGENT FOR MACY'S, INC. SHARES Macy's, Inc.... -

Page 96

MACY'S • BLOOMINGDALE'S macysinc.com macys.com bloomingdales.com