Lumber Liquidators 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and 25, 25 and 22 of our other store locations from these entities as of December 31, 2007, 2006 and 2005,

respectively, representing 22.4%, 28.6% and 30.3% of total store leases, respectively. The operating lease for our

Toano facility has a base period through December 31, 2019.

The information required by this Item with respect to certain relationships and related-party transactions is

incorporated by reference to the sections captioned “Executive Compensation—Post-Employment

Compensation” in the proxy statement for our annual meeting of stockholders to be held on May 15, 2008.

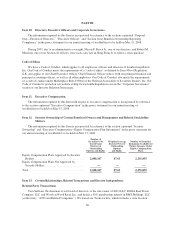

Lease Arrangements

As of December 31, 2007, we leased our Toano facility, which includes a store location, and 23 of our other

store locations from ANO LLC (“ANO”), a company that is wholly owned by Tom Sullivan, our founder and the

chairman of our board of directors. We leased 23, 22 and 19 of our other stores from ANO as of December 31,

2007, 2006 and 2005, respectively. These leases generally have five-year base periods and multiple five-year

renewal periods. We also lease our Toano finishing, distribution and headquarters facility from ANO under an

operating lease with a base period that runs through December 31, 2019. Our rent expense attributable to ANO

was $2.4 million, $2.1 million and $2.0 million in 2007, 2006 and 2005, respectively. Our future minimum lease

payments to ANO under all of our leases with them were $18.0 million as of December 31, 2007. These leases

are described in more detail in Note 5 to our audited financial statements included in Item 8 of this report.

As of December 31, 2007, we leased one store location each from Wood on Wood Road, Inc. (“Wood on

Wood”) and BMT Holdings, LLC (“BMT”). Wood on Wood is wholly owned by Tom Sullivan, and he has a

50% membership interest in BMT. Each lease is for a five-year base period and has a five-year renewal period.

The lease with BMT is currently in the second year of its renewal period. Our rent expense attributable to Wood

on Wood was $0.07 million in each of 2007, 2006 and 2005. Our rent expense attributable to BMT was $0.05

million in each of 2007, 2006 and 2005.

We believe that the leases that we have signed to date with ANO, Wood on Wood and BMT are on fair

market terms.

In addition, of our leases with lessors that are not owned in whole or in part by Tom, three were guaranteed

by Tom as of December 31, 2007.

Item 14. Principal Accountant Fees and Services.

The information required by this Item with respect to principal accountant fees and services is incorporated

by reference to the section captioned “Proposal Four—Ratification of Independent Registered Public Accounting

Firm” in the proxy statement for our annual meeting of stockholders to be held on May 15, 2008.

67