Lumber Liquidators 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

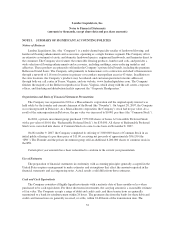

Senior Secured Loan Agreement

In March 2006, we entered into an amended and restated senior secured loan agreement with Bank of

America, N.A., and we amended it in July 2006. The agreement included a term loan with an original principal

amount of $9.9 million. On November 15, 2007, we used $6.6 million of the net IPO proceeds to retire the

principal balance of the term loan and interest accrued to date. The term loan had required principal payments in

60 equal monthly installments through scheduled expiration in March 2011, and bore interest, payable monthly

in arrears, at the 30-Day LIBOR plus 0.90%. This senior secured loan agreement also included a revolving credit

facility that initially permitted borrowings of up to $5.0 million, amended in July 2006 to increase the maximum

borrowings to $10.0 million. That facility was replaced by a new revolving credit agreement in August 2007.

Conversion of Preferred Stock

In connection with our IPO, funds managed by TA Associates converted 7,952,018 shares of series A

convertible preferred stock, par value $0.01, to shares of common stock, par value $0.001, on a one-to-one basis

on November 8, 2007. These shares had been purchased in December 2004 for $35.0 million.

Related Party Transactions

See the discussion of related party transactions in Note 5 and Note 10 to the financial statements included in

Item 8 of this report and within Related Party Transactions and Lease Arrangements in Item 13 of this report.

Contractual Commitments and Contingencies

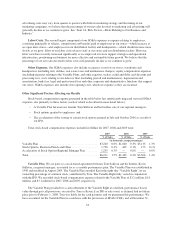

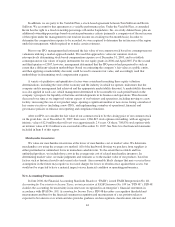

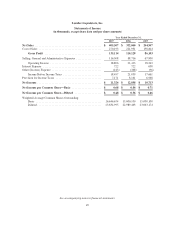

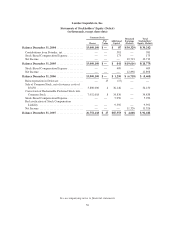

Our significant contractual obligations and commitments as of December 31, 2007 are summarized in the

following table:

Payments Due by Period

Total

Less Than

1 Year

1to3

Years

3to5

Years 5+ Years

(in thousands)

Contractual obligations

Operating lease obligations(1) ........................ $46,537 $7,980 $13,644 $8,893 $16,020

Other notes payable ................................. 62 62 — — —

Capital lease obligations, including interest .............. 61 61 — — —

Supplier purchase commitments(2) .................... — — — — —

Total contractual obligations .......................... $46,660 $8,103 $13,644 $8,893 $16,020

(1) Included in this table is the base period or current renewal period for our operating leases. The operating

leases generally contain varying renewal provisions.

(2) We have one long-term purchase agreement with a merchant vendor that we entered into in July 2006 that

requires us to purchase approximately 27 million square feet of the vendor’s assorted products over a four-

year period, with the unit prices set at the time a purchase order is created/accepted. Issues have arisen with

regard to the quality of the products provided by the vendor, the vendor’s requests for changes in prices for

the products and the vendor’s failure to honor purchase orders that it had accepted. We are not currently

receiving product under the agreement, and we intend to seek payment for our cover costs relating to

purchase orders that were not delivered. The products ordered from the vendor that are not being delivered

have been purchased from other suppliers and we expect the cover costs to be immaterial.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements or other financing activities with special-purpose

entities.

42