Lumber Liquidators 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.margin benefited from the sales strength of new product lines introduced late in the second quarter, including

handscraped solid and engineered hardwoods, more durable laminates and strand bamboo. These products

typically carry a higher average retail price per unit and a higher gross margin than our average product and are a

part of the initiative we began in 2006 to broaden our assortment and the price points available to our customers.

In 2006, primarily in the fourth quarter, we took steps to optimize inventory levels, particularly in certain newly

introduced engineered hardwood lines, and fully clear residual liquidation purchases, adversely impacting gross

margin.

Increases in 2007 domestic and international transportation costs adversely impacted gross margin in

comparison to 2006, as per-mile ground charges increased primarily due to higher fuel costs. In addition, a

number of key tariffs assessed on imported products, most notably bamboo, were implemented or increased in

2007. These increases were partially offset by logistic initiatives, implemented in the third and fourth quarters of

2007, reducing the miles driven by trucks supplying our stores.

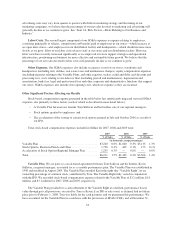

Operating Income. Operating income in 2007 decreased $2.6 million, or 12.2%, to $18.8 million, as a $27.6

million increase in SG&A expenses was partially offset by the $25.0 million increase in gross profit. The

increase in 2007 SG&A expenses compared to 2006 was principally due to the following factors:

• Salaries, commissions and benefits increased $10.5 million, or 35.5%, and as a percentage of net sales,

increased to 9.9% for 2007 from 8.9% for 2006. In-store and regional store management salaries,

commissions and benefits expense increased $6.3 million, primarily due to the 25 new store locations

opened in 2007 and an increase of the number of regional managers from eight to 15. The investment

we began in 2006 in our executive and operational store support infrastructure increased salaries,

commissions and benefits expense by $3.4 million in 2007. This investment, substantially complete at

December 31, 2007, included our new chief executive officer and six senior executive positions. In

addition, we added more finance, compliance and information technology personnel in 2007 as we

prepared to become, and operate as, a public company.

• Advertising expenses increased $5.4 million, or 14.9%, to $41.7 million, primarily due to the

expansion of our national branding campaigns through television, radio, and sports marketing, coupled

with internet search, local advertising and direct mail programs. As a percentage of net sales, however,

advertising expenses decreased to 10.3% for 2007 from 10.9% for 2006 as we were able to leverage

that expansion over increased net sales.

• Stock-based compensation expense increased $4.8 million, or 328.6%, to $6.2 million primarily due to

a $2.2 million increase in the stock-based compensation calculated under the Variable Plan and $1.2

million related to a one-time acceleration in the vesting of certain stock options and recognition of

certain stock units triggered by the IPO. In addition, the full year of expense recognition of stock

options granted in July and October 2006 and April 2007 increased 2007 expense by $1.4 million.

• Occupancy costs increased $2.5 million, but remained consistent as a percentage of net sales at 3.1%,

as costs related to the opening of 25 new store locations in 2007 and the full year impact of 16 new

store locations opened in 2006 were offset by increases in net sales.

• Depreciation and amortization increased $0.7 million but remained a consistent 0.9% as a percentage

of net sales.

• Certain other expenses, including legal and professional fees, increased $3.8 million, and as a

percentage of net sales, from 2.5% to 3.0%, as we enhanced our financial reporting, legal and

regulatory compliance, internal controls and corporate governance. Further, certain banking fees,

including bankcard discounts, increased commensurate with net sales.

As a percentage of net sales, operating income declined to 4.6% in 2007 from 6.4% in 2006. This decrease

was primarily due to the increase in SG&A expenses as a percentage of net sales to 28.7% in 2007 from 26.7% in

2006, partially offset by a slight increase in gross margin.

36