Lumber Liquidators 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities” (or “SFAS 159”). SFAS 159 permits entities to choose, at specified election dates, to

measure eligible items at fair value (or “fair value option”) and to report in earnings unrealized gains and losses

on those items for which the fair value option has been elected. SFAS 159 also requires entities to display the fair

value of those assets and liabilities on the face of the balance sheet. SFAS 159 establishes presentation and

disclosure requirements designed to facilitate comparisons between entities that choose different measurement

attributes for similar types of assets and liabilities. SFAS 159 is effective for the Company as of the first quarter

of 2008. Early adoption is permitted. The Company is currently evaluating the impact of this pronouncement on

its financial statements.

NOTE 2. NOTES RECEIVABLE

The Company holds two notes receivable from a merchandise supplier with an outstanding balance due to

the Company of $1,375 at December 31, 2007, of which $519 had been included in other current assets. In June

2007, the Company consolidated two outstanding notes receivable into one note with an aggregate value of $912

maturing in June 2010. A separate note, which matures in August 2009, was not modified. As of December 31,

2006, notes receivable from merchandise vendors had an outstanding balance due to the Company of $1,780, of

which $1,009 had been included in other current assets.

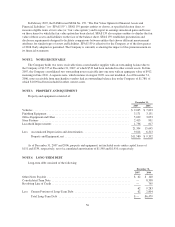

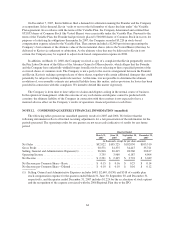

NOTE 3. PROPERTY AND EQUIPMENT

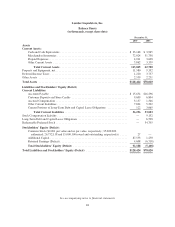

Property and equipment consisted of:

December 31,

2007 2006

Vehicles ................................................................... $ 9,045 $ 7,633

Finishing Equipment ......................................................... 3,171 3,151

Office Equipment and Other ................................................... 5,029 3,053

Store Fixtures .............................................................. 2,413 991

Leasehold Improvements ..................................................... 1,736 817

21,394 15,645

Less: Accumulated Depreciation and Amortization ................................ 9,814 6,313

Property and Equipment, net ............................................. $11,580 $ 9,332

As of December 31, 2007 and 2006, property and equipment, net included assets under capital leases of

$151 and $339, respectively, net of accumulated amortization of $1,598 and $1,410, respectively.

NOTE 4. LONG-TERM DEBT

Long-term debt consisted of the following:

December 31,

2007 2006

Other Notes Payable .......................................................... $ 62 $ 140

Consolidated Term Note ....................................................... — 8,398

Revolving Line of Credit ....................................................... — 745

62 9,283

Less: Current Portions of Long-Term Debt ....................................... 62 2,804

Total Long-Term Debt .................................................. $— $6,479

56