Lumber Liquidators 2007 Annual Report Download - page 47

Download and view the complete annual report

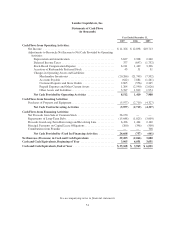

Please find page 47 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.merchandise inventories, offset by a reduction in accounts payable. The 2007 merchandise inventory build

occurred much earlier than in 2006, and together with a greater percentage of imported merchandise paid for

while on the water in December 2007 resulted in a decline in accounts payable.

Net cash provided by operating activities decreased in 2006 compared to 2005 primarily because of

increased merchandise inventory levels, partially offset by growth in net income and increases in accounts

payable. The increase in inventory levels and increases in accounts payable resulted from our need to support

additional net sales from newly opened stores and increasing comparable store net sales. In addition, we

increased inventory, primarily in our Toano facility, to be in a better position to drive sales and meet customer

demand.

Investing Activities. Net cash used in investing activities was $6.0 million for 2007, $2.7 million for 2006

and $4.3 million for 2005. Net cash used in investing activities during 2007 primarily related to capital purchases

of truck trailers that we use to move our merchandise from our warehouse to our stores, new store capital needs

(primarily store fixtures and leasehold improvements), and IT costs, including costs related to our new point of

sale system and routine purchases of computer hardware and software. Net cash used in investing activities in

2006 primarily related to IT systems, including new hardware and upgrades to our telephone system and website,

as well as new store capital needs. In 2006, we slowed the increase in new store locations as we expanded our

store support infrastructure to better facilitate sustainable growth of our operations. Net cash used in investing

activities in 2005 primarily related to purchases of truck trailers, IT system maintenance and new store capital

needs.

Financing Activities. Net cash provided by financing activities was $26.7 million for 2007. Net cash

provided by financing activities for 2007 was primarily from the $36.2 million net proceeds from our IPO in

November 2007, offset by scheduled monthly principal payments under the term portion of our senior secured

loan agreement prior to the IPO and the pay off of the $6.6 million balance remaining outstanding after the IPO.

Net cash used in financing activities for 2006 was primarily attributable to the use of $1.8 million to make

principal payments on our senior secured loan agreement, partially offset by an increase of $1.5 million in

borrowings. Net cash used in financing activities during 2005 was primarily attributable to principal payments on

our senior loan agreements, partially offset by an increase of $2.1 million in borrowings.

Revolving Credit Agreement

In August 2007, we entered into a new revolving credit agreement to replace the then-existing revolving

credit facility under the senior secured loan agreement. We can borrow up to $25.0 million under the new

agreement, which expires on August 10, 2012. We intend to use the revolving credit facility primarily to fund

inventory purchases, including (as provided in the agreement) the support of up to $5.0 million for letters of

credit and general operations. The revolving credit facility is secured by our inventory, has no mandated payment

provisions and we pay a fee of 0.125% per annum, which may be increased in the future based on financial

performance criteria, on any unused portion of the revolving facility. Amounts outstanding under the revolving

credit facility would be subject to an interest rate of LIBOR (reset on the 10th of the month) + 0.50%, which may

increase based on financial performance criteria. We had outstanding commitments under letters of credit of $0.3

million at December 31, 2007 and $24.7 million was available to borrow. The revolving credit agreement and

related security agreement contain a number of restrictions that require us to maintain certain financial ratios and

limit our ability, among other things, to borrow money, pledge our inventory or other assets as security in other

borrowings or transactions, undergo a merger or consolidation, guarantee certain obligations of third parties,

make or extend credit other than on ordinary terms in the course of our business or engage in any activity not

reasonably related to those we presently conduct. We were in compliance with these financial covenants at

December 31, 2007.

41