Lumber Liquidators 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sales. Some of the operational metrics that we consider in evaluating net sales include our sales mix, future

demand as measured by open orders and the related customer deposits, the average number of days an order/

customer deposit is outstanding, requests for samples and catalogs, new store performance levels and our new

store pipeline. In assessing the overall performance of our business, we also consider gross profit and selling,

general and administrative expenses.

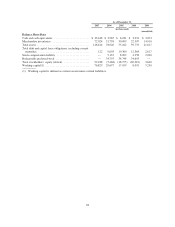

Net Sales. We derive net sales primarily from sales of solid and engineered hardwoods, laminate, bamboo

and cork flooring products, moldings and flooring accessories made through our stores, call center, website and

catalog. Net sales, which include freight costs billed to customers, are net of any returns by customers. Net sales

from customer orders placed through the call center, our website or our catalog are recorded by the store where

the customer picks up the merchandise or schedules delivery. Several factors affect our net sales in any period,

including the number of stores in operation and comparable store net sales for any given store or group of stores,

which can be influenced by our operational effectiveness, pricing, marketing and promotional efforts, brand

recognition levels, local competition and trade area demographics.

Growth In Our Store Base. We opened 25 stores in 2007, 16 stores in 2006 and 19 stores in 2005, which

contributed substantially to the growth of our net sales in those years. We plan to open between 30 and 40 new

stores during each of the next several years. The cost required to open a typical new store is approximately

$240,000, of which inventory, net of trade payables, represents approximately $190,000. Our new stores have

historically opened with an initial ramp-up period typically lasting from 36 to 48 months or more, during which

they generated net sales below the levels at which we expect them to normalize. Our average new store across

our markets has, however, historically become profitable within three months of beginning operations and

generally returned its initial cash investment within seven months. See “Item 1A. Risk Factors—Risks Related to

Our Business and Industry.”

Comparable Store Net Sales. The other important driver of growth in our net sales has been increased

comparable store net sales, which accounted for a substantial portion of our historical net sales growth. Stores

generally enter the comparable store base on the first day of the thirteenth full calendar month after they open.

Various factors affect comparable store net sales, including:

• consumer preferences, buying trends and overall economic trends and our ability to anticipate and

respond effectively to changes therein;

• changes in product assortment and the overall sales mix;

• the number of stores we open in existing markets;

• the maturity of a comparable store;

• competition;

• pricing;

• product availability and quality;

• the timing of our advertising promotional events and/or timing of three-day Holiday weekends; and

• weather and other climatological effects.

We believe that future comparable store net sales will likely increase at rates slower than those achieved

over the past several years, due to increases in baseline store volumes and an increase in the number of new

stores opened in existing markets, which tend to open at a higher base level of net sales. See “Item 1A. Risk

Factors—Risks Related to Our Business and Industry.”

31