Lumber Liquidators 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 2. Properties.

As of February 29, 2008, we operated 124 stores located in 43 states, including 8 opened since

December 31, 2007. We lease all of our stores, which average approximately 6,400 square feet and generally

include an 800 square foot showroom. We also lease our corporate headquarters located in Toano, Virginia,

which includes our call center, corporate offices, and distribution and finishing facility. Our corporate

headquarters has 307,784 square feet, of which approximately 32,000 square feet are office space, and is located

on a 74-acre plot.

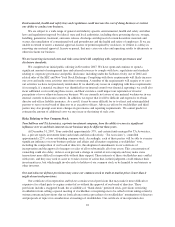

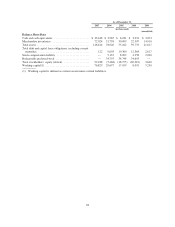

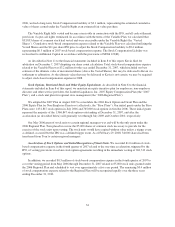

The table below sets forth the locations (alphabetically by state) of our stores in operation as of February 29,

2008.

State Stores State Stores State Stores State Stores

Alabama 1 Indiana 2 Missouri 2 Pennsylvania 5

Arizona 2 Iowa 1 Nebraska 1 Rhode Island 1

Arkansas 1 Kansas 1 Nevada 2 South Carolina 3

California 10 Kentucky 1 New Hampshire 3 Tennessee 3

Colorado 3 Louisiana 2 New Jersey 3 Texas 11

Connecticut 2 Maine 1 New Mexico 1 Utah 1

Delaware 1 Maryland 2 New York 6 Virginia 6

Florida 11 Massachusetts 4 North Carolina 2 Washington 3

Georgia 2 Michigan 3 Ohio 5 West Virginia 1

Idaho 1 Minnesota 2 Oklahoma 2 Wisconsin 3

Illinois 4 Mississippi 1 Oregon 2

Currently, 26 of our store locations are leased from related parties. See discussion of properties leased from

related parties in Note 5 to the financial statements included in Item 8 of this report and within Related Party

Transactions and Lease Arrangements in Item 13 of this report.

Item 3. Legal Proceedings.

On January 4, 2007, Clifford Wayne Bassett and Clifford Wayne Bassett, MD, PC (together “Dr. Bassett”)

filed a lawsuit entitled Clifford Wayne Bassett et al. v. Lumber Liquidators, Inc. et al., in the U.S. District Court

for the Southern District of New York, against us, E.W. Scripps Company (“Scripps”) and others. We purchased

an article from Scripps describing the benefits of hardwood flooring in relation to other types of flooring. The

article contained a quote by Dr. Bassett, an allergist, who claims that the use of the quote was unauthorized.

Dr. Bassett asserted damages in excess of $10 million. The parties reached a settlement and the case was

dismissed with prejudice on January 18, 2008. We did not receive nor were we required to pay any material

amount in connection with the settlement.

On July 12, 2007, we received a copy of a demand for arbitration, dated July 11, 2007, in which a senior

executive who separated from us in May 2006 (the “Former Executive”) claimed that we breached our obligations

to him upon his resignation of employment. The Former Executive alleged that he terminated his employment for

“good reason,” as defined in his employment agreement and our warrant plan, based on, among other things, an

allegedly substantial reduction in his responsibilities. He sought damages of approximately $0.7 million (plus the

value of certain other specified benefits), as well as a declaration that he has owned 1% of our company since he

terminated his employment. As part of the arbitration process, we concluded that, among other things, the Former

Employee breached certain provisions of the Employee Confidentiality and Non-Compete Agreement that he signed

with us and violated certain statutory and common law duties. Accordingly, we asserted a counter-demand for

arbitration against the Former Executive. On February 29, 2008, the arbitrator issued a ruling in which he found that

the Former Executive was not entitled to any of the relief that he sought and ruled for us on some of our claims but

did not award any monetary damages. Each party was ordered to bear its own attorneys’ fees and costs and the fees

and expenses of the arbitrator will be split equally between the parties.

24