Lumber Liquidators 2007 Annual Report Download - page 40

Download and view the complete annual report

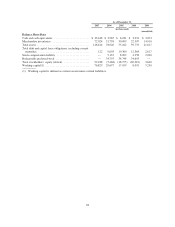

Please find page 40 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2006, we had a long-term, Stock Compensation Liability of $9.1 million, representing the estimated cumulative

value of shares earned under the Variable Right at an estimated fair value per share.

The Variable Right fully vested and became exercisable in connection with the IPO, and all cash settlement

provisions via put-call rights terminated. In accordance with the terms of the Variable Plan, we calculated that

853,853 shares of common stock had vested and were exercisable under the Variable Right (the “Vested

Shares”). Cumulative stock-based compensation expense related to the Variable Plan was calculated utilizing the

Vested Shares and the $11 per share IPO price to adjust the Stock Compensation Liability to $9.4 million,

representing $0.3 million of 2007 stock-based compensation expense. The Stock Compensation Liability was

reclassified to Additional Capital in accordance with the provisions of SFAS 123(R).

As described in Note 11 to the financial statements included in Item 8 of this report, Kevin filed for

arbitration on December 7, 2007 disputing our share count calculation. Total stock-based compensation expense

related to the Variable Plan was $3.2 million for the year ended December 31, 2007, which included our best

estimate of the ultimate value of incremental shares (above the Vested Shares) that may be delivered to Kevin via

settlement or arbitration. As the ultimate value that may be delivered to Kevin is not certain, we may be required

to adjust stock-based compensation expense in 2008.

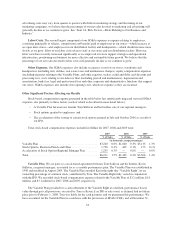

Stock Options, Restricted Stock and Other Equity Equivalents. As described in Note 6 to the financial

statements included in Item 8 of this report, we maintain an equity incentive plan for employees, non-employee

directors and other service providers, the Lumber Liquidators, Inc. 2007 Equity Compensation Plan (the “2007

Plan”), and a stock unit plan for regional store management (the “2006 Regional Plan”).

We adopted the 2007 Plan in August 2007 to consolidate the 2004 Stock Option and Grant Plan and the

2006 Equity Plan for Non-Employee Directors (collectively, the “Prior Plans”). Our initial grants under the Prior

Plans were 1,031,847 stock options in July 2006 and 765,000 stock options in October 2006. These initial grants

represent the majority of the 1,966,847 stock options outstanding at December 31, 2007, and after the

acceleration (as described below) will generally vest through July 2009 and October 2010, respectively.

Our May 2006 grant of stock units to certain regional managers was and will be the only grant under the

2006 Regional Plan. Tom placed in escrow the 85,000 shares of common stock necessary to provide for the

exercise of the stock units upon vesting. The stock units would have expired without value unless a trigger event,

as defined, occurred but the IPO was a defined trigger event. As of February 29, 2008, 34,000 shares had been

transferred from Tom to certain regional managers.

Acceleration of Stock Options and Initial Recognition of Stock Units. We recorded $1.0 million of stock-

based compensation expense in the fourth quarter of 2007 related to the one-time acceleration, triggered by the

IPO, of vesting provisions in certain stock option agreements resulting in the immediate vesting of 261,313 stock

options.

In addition, we recorded $0.3 million of stock-based compensation expense in the fourth quarter of 2007 to

cover the vesting period from May 2006 through December 31, 2007 related to 85,000 stock units granted under

the 2006 Regional Plan and scheduled to vest over approximately a five year period. The remaining $0.4 million

of stock compensation expense related to the Regional Plan will be recognized equally over the three years

ending December 31, 2010.

34