Lumber Liquidators 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

on the implied yield of U.S. Treasury zero-coupon issues with an equivalent remaining term. The expected life of

the options was determined using a lattice model to estimate the expected term as an input into the Black-

Scholes-Merton closed-form model.

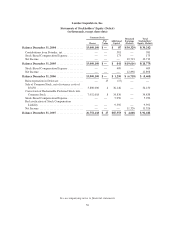

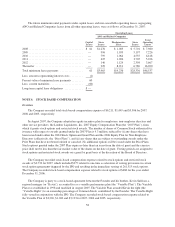

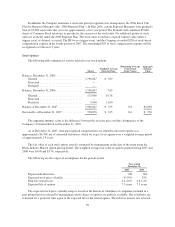

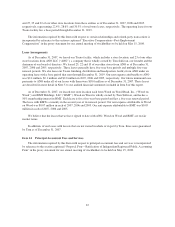

Stock options outstanding and exercisable as of December 31, 2007 are summarized below:

Outstanding Exercisable

Range of Exercise Prices

Number of

Option

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Number

of

Option

Shares

Weighted

Average

Exercise

Price

$ 7.58 – $7.83 ................................. 1,796,847 $ 7.69 8.7 708,876 $7.65

$10.26 – $11.00 ............................... 170,000 10.78 9.7 — —

Balance, December 31, 2007 ..................... 1,966,847 $ 7.95 8.8 708,876 $7.65

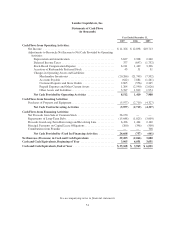

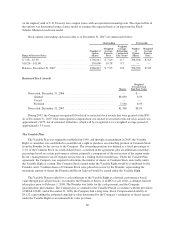

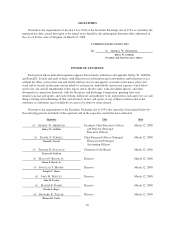

Restricted Stock Awards

Shares

Weighted

Average Grant

Date Fair Value

Nonvested, December 31, 2006 ................................... — $—

Granted ................................................. 88,830 8.95

Vested .................................................. — —

Forfeited ................................................. 7,530 8.95

Nonvested, December 31, 2007 ................................... 81,300 $8.95

During 2007, the Company recognized $16 related to restricted stock awards that were granted at the IPO.

As of December 31, 2007, total unrecognized compensation cost related to unvested restricted stock awards was

approximately $279, net of estimated forfeitures, which will be recognized over a weighted average period of

approximately 3.9 years.

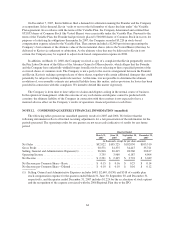

The Variable Plan

The Variable Plan was originally established in 1998, and through an amendment in 2005, the Variable

Right, as amended, was established to award Kevin a right to purchase an ownership position in Common Stock

from the Founder for his service to the Company. The ownership position was defined as a fixed percentage of

2.5% of the Common Stock on a fully diluted basis, as defined in the agreement, plus an additional ownership

percentage based on certain performance criteria, primarily a comparison of the net income of the region under

Kevin’s management to total Company net income on a trailing twelve-month basis. Under the Variable Plan

agreement, the Company was required to determine the number of shares of Common Stock exercisable under

the Variable Right at vesting. The Common Stock earned under the Variable Right would be contributed by the

Founder, and 1.5 million shares of Common Stock were placed in escrow by the Founder, representing the

maximum amount of shares the Founder and Kevin believed would be earned under the Variable Right.

The Variable Plan provided for a cash settlement of the Variable Right at a defined, performance based,

value through put-call provisions, executed by the Founder or Kevin, if an IPO or sale event, as defined, had not

taken place prior to February 1, 2008. The Founder was liable for the cash payment, and the Company

guaranteed his performance. The Company has accounted for the Variable Plan in accordance with the provisions

of SFAS 123(R), and at December 31, 2006, the Company had a long-term, Stock Compensation Liability of

$9,132, representing the estimated cumulative value determined by the Company’s estimation of shares earned

under the Variable Right at an estimated fair value per share.

60