Lumber Liquidators 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Expansion of Our Product Assortment. In both 2007 and 2006, we expanded our product offerings to

include a broader assortment of key product lines and narrow our price point differentials. In addition, we

increased our emphasis on moldings and accessories, which enable us to generate valuable add-on sales. In 2007,

we introduced a number of premium products within such key lines as handscraped solid and engineered

hardwood by our Virginia Mill Works Co. brand, stained and strand bamboos by our Morningstar brand, and

laminates with heavier-wear layer and foam backing by our Dream Home brand. In 2006, we significantly

expanded our solid and engineered hardwoods brands within our Dura-Wood product line. We believe that

presenting customers with a broader assortment of quality products with narrower price point differentials

encourages customers to “trade up” to our premium products, where we believe our prices present the greatest

value versus our competitors.

Enhanced Merchandising and Logistics Management. As a part of our infrastructure investment, our

merchandising team, with extensive product knowledge, was bolstered by a new Senior Vice President of

Merchandising and buyers with more traditional merchandising skills, enhancing both merchandise purchase

planning and inventory management disciplines. Greater coordination of our merchandise purchase planning with

our vendor mills including historic and projected sales on the product level drove gross margin improvement

through lower product costs and resulted in more consistent in-stock positions for key product lines. Our sales

volume increased, as more consistent in-stock positions allowed us to satisfy our customers’ varying delivery

needs. In the third quarter of 2007, our new Senior Vice President of Logistics implemented a program to

improve the efficiency of our warehouse-to-store deliveries, exchanging road miles with intermodal rail miles,

partially offsetting increases in fuel costs. As we seek to control all inbound shipping from our vendors and

explore alternatives to moving product through our warehouse in Toano, Virginia, we expect additional cost

reductions will be available to offset some increases in fuel and other transportation costs, including customs

duties.

External Factors Impacting Our Business

The wood flooring market which serves the homeowner is highly fragmented and dependent on a number of

complex economic and demographic factors that impact home-related discretionary spending, and these factors

may vary locally, regionally, and nationally. We are impacted by home remodeling activity, employment levels,

housing turnover, real estate prices, new housing starts, consumer confidence, credit availability, and the general

health of consumer discretionary spending. In the latter half of 2006 and continuing through 2007, a number of

economic indicators associated with the flooring market weakened, and many economic indicators generally

associated with consumer discretionary spending weakened in the fourth quarter of 2007. We will continue to

monitor demand indicators for our segment of the flooring market, but we do not anticipate significant

improvement in the general wood flooring market at least through the first half of 2008.

Although the hardwood flooring market is projected to experience long-term growth, industry sources report

an overall decline in the demand for flooring in 2006 and 2007. We believe the number of retailers serving the

homeowner-based segment of the wood floor market declined in 2007, and our results benefited from increased

market share. Though we are likely to be adversely impacted by decreased consumer demand for wood flooring,

we believe we will continue to benefit from the additional market share that we expect to gain through new store

openings. In addition, we should benefit from longer term favorable industry trends and characteristics, including

increased home improvement spending resulting from aging housing stock, increasing home ownership,

increasing average home size and favorable demographic trends—as well as the expansion and evolution of the

hardwood flooring market and the greater perceived attractiveness of hardwood flooring among consumers. See

“Item 1A. Risk Factors—Risks Related to Our Business and Industry.”

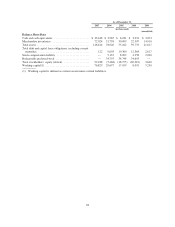

Assessing the Performance of Our Business

In assessing the performance of our business, we consider a variety of performance and financial measures.

The key measures we use to determine how our business is performing are net sales and comparable store net

30