Lumber Liquidators 2007 Annual Report Download - page 51

Download and view the complete annual report

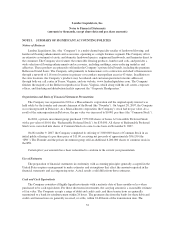

Please find page 51 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.penalties, accounting in interim periods, disclosure and transition. FIN 48 was effective as of January 1, 2007.

The adoption of FIN 48 did not have a material effect on our financial position or results of operations.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (or “SFAS 157”), which

defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles

and expands disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for

fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Early adoption is

permitted. We are currently evaluating the impact of SFAS 157 on our financial statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities (or “SFAS 159”). SFAS 159 permits entities to choose, at specified election dates, to

measure eligible items at fair value (“fair value option”) and to report in earnings unrealized gains and losses on

those items for which the fair value has been elected. SFAS 159 also requires entities to display the fair value of

those assets and liabilities on the face of the balance sheet. SFAS 159 establishes presentation and disclosure

requirements designed to facilitate comparisons between entities that choose different measurement attributes for

similar types of assets and liabilities. SFAS 159 will be effective for us as of the first quarter of 2008. Early

adoption is permitted. We are currently evaluating the impact of SFAS 159 on our financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Interest Rates.

We are exposed to interest rate risk through the investment of our cash and cash equivalents. Since the

completion of our IPO, we have invested our cash in short-term investments with maturities of three months or

less. Changes in interest rates affect the interest income we earn, and therefore impact our cash flows and results

of operation. In addition, any future borrowings under our revolving credit agreement would be exposed to

interest rate risk due to the variable rate of the facility.

We currently do not engage in any interest rate hedging activity and currently have no intention to do so in

the foreseeable future. However, in the future, in an effort to mitigate losses associated with these risks, we may

at times enter into derivative financial instruments, although we have not historically done so. We do not, and do

not intend to, engage in the practice of trading derivative securities for profit.

45