Lumber Liquidators 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Variable Right fully vested and became exercisable in connection with the IPO, and all cash settlement

provisions via put-call rights terminated. In accordance with the terms of the Variable Plan, the Company

calculated that 853,853 shares of Common Stock had vested and were exercisable under the Variable Right (the

“Vested Shares”). Cumulative stock-based compensation expense related to the Variable Plan was determined

utilizing the Vested Shares and the $11 per share IPO price to adjust the Stock Compensation Liability to $9,392,

representing $260 of 2007 stock-based compensation expense. The Stock Compensation Liability was

reclassified to Additional Capital in accordance with the provisions of SFAS 123(R).

As described in Note 11, Kevin filed for arbitration on December 7, 2007 disputing the Company’s share

count calculation. The Company increased stock-based compensation expense related to the Variable Plan by

$2,960 to $3,220 for the year ended December 31, 2007, representing the Company’s best estimate of the

ultimate value of incremental shares (above the Vested Shares) that may be delivered to Kevin via settlement or

arbitration. As the ultimate value that may be delivered to Kevin is not certain, the Company may be required to

adjust stock-based compensation expense in 2008.

Stock Warrants

The Company had a stock warrant plan (the “Warrant Plan”), established in 2004, with a senior executive

who separated from the Company in May 2006. As a result of the separation during the second quarter of 2006,

the Company reversed the $259 of compensation expense that had been previously recognized.

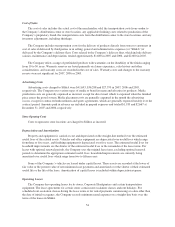

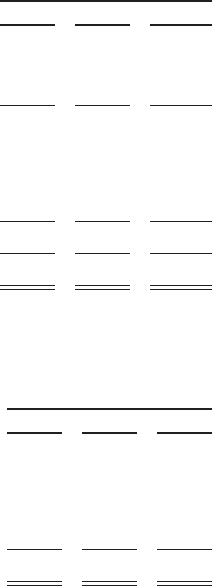

NOTE 7. INCOME TAXES

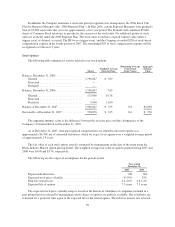

The provision for income taxes consists of the following:

Year Ended December 31,

2007 2006 2005

Current

Federal .......................................................... $5,577 $7,433 $ 7,242

State ............................................................ 1,217 1,425 1,438

Total Current ......................................................... 6,794 8,858 8,680

Deferred

Federal .......................................................... 310 (627) (1,444)

State ............................................................ 67 (70) (288)

Total Deferred ........................................................ 377 (697) (1,732)

Total Provision for Income Taxes ........................................ $7,171 $8,161 $ 6,948

The reconciliation of significant differences between income tax expense (benefit) applying the federal

statutory rate of 35% and the actual income tax expense (benefit) at the effective rate are as follows:

Year Ended December 31,

2007 2006 2005

Income Tax Expense at Federal Statutory Rate ............................... $6,474 $7,299 $6,203

Increases (Decreases):

State Income Taxes, Net of Federal Income Tax Benefit ................... 838 855 745

Other ............................................................ (141) 7 —

Total ................................................................ $7,171 $8,161 $6,948

61