Lumber Liquidators 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Income. Operating income increased $3.2 million, or 18%, to $21.4 million in 2006, principally

as a result of the $24.0 million increase in gross profit that was partially offset by a $20.8 million increase in

SG&A expenses principally due to the following factors:

• Advertising expenses increased $8.7 million, or 32%, in 2006 primarily due to the expansion of our

national advertising campaign through television, radio and sports, as well as increased costs relating to

online advertising and direct mail programs. As a percentage of net sales, advertising expenses

declined to 10.9% in 2006 from 11.3% in 2005, principally due to our ability to leverage our national

advertising over increased net sales across all our sales channels.

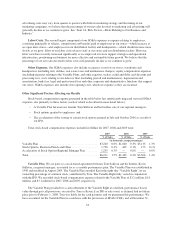

• Salaries, commissions and benefits increased $6.1 million, or 26%, in 2006 primarily due to an

increase in the store support infrastructure principally in the second half of 2006, including the hiring

of our new chief executive officer and other executives and operational managers. As a percentage of

net sales, salaries, commissions and benefits paid to our employees declined to 8.9% in 2006 from

9.6% in 2005, principally due to our ability to leverage our store support infrastructure over increased

net sales, although several of the additional costs were not recognized over the full year.

• Occupancy costs increased $2.3 million, or 28%, in 2006 principally due to 16 new stores opened in

2006 and the full-year impact of 19 stores opened in 2005. As a percentage of net sales, occupancy

costs decreased to 3.1% in 2006 from 3.3% in 2005.

• Professional expenses increased $0.8 million to support enhanced financial reporting, legal and

regulatory compliance, internal controls and corporate governance functions.

• Stock-based compensation expense decreased due to lower current-year expense associated with the

Variable Plan, which was partially offset by expense related to stock options granted in 2006.

As a percentage of net sales, operating income declined to 6.4% in 2006 from 7.4% in 2005. This decrease

was primarily due to the decline in gross margin, partially offset by a decline in SG&A expenses as a percentage

of net sales to 26.7% in 2006 from 27.7% in 2005.

Net Income. Net income increased $2.2 million to $12.9 million in 2006 from $10.7 million in 2005, but

declined as a percentage of net sales to 3.9% in 2006 from 4.4% in 2005. Our effective income tax rate was

approximately 38.8% for 2006 compared to 39.3% for 2005, reflecting slight variances in state income tax rates.

38