Lumber Liquidators 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

advertising costs may vary from quarter to quarter with shifts in marketing strategy and the timing of our

marketing campaigns, we believe that the percentage of our net sales devoted to marketing and advertising will

generally decline as we continue to grow. See “Item 1A. Risk Factors—Risks Relating to Our Business and

Industry.”

Labor Costs. The second-largest component of our SG&A expenses is expense relating to employees,

consisting principally of salaries, commissions and benefits paid to employees in our stores—which increase as

we open more stores—and employees in our distribution facility and headquarters—which should increase more

slowly as we grow. Most of our labor costs relate to staff at our stores and our distribution facility. However,

labor costs have recently increased significantly as we improved our store support strategies and operational

infrastructure, positioning our business for more effective and sustainable future growth. We believe that the

percentage of our net sales devoted to labor costs will generally decline as we continue to grow.

Other Expenses. Our SG&A expenses also include occupancy costs for our stores, warehouse and

headquarters (including rent, utilities, real estate taxes and maintenance charges); equity compensation expenses

(including expenses relating to the Variable Plan); and other expenses such as credit and debit card discount and

processing fees, costs relating to our delivery fleet (including payroll and maintenance), depreciation and

amortization, bank fees, legal and professional fees and other corporate and administrative functions that support

our stores. SG&A expenses also include store opening costs, which we expense as they are incurred.

Other Significant Factors Affecting our Results

Stock-based compensation expense presented in the table below has significantly impacted our total SG&A

expenses, due primarily to three factors (each of which is described in more detail below):

• A Variable Plan between our founder Tom Sullivan and his brother, one of our regional managers;

• Stock options granted to employees; and

• The acceleration of the vesting of certain stock options granted in July and October 2006 as a result of

our IPO.

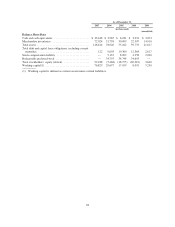

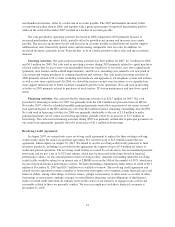

Total stock-based compensation expenses included in SG&A for 2007, 2006 and 2005 were:

2007 2006 2005

% of Sales % of Sales % of Sales

(in thousands, except percentages)

Variable Plan ......................................... $3,220 0.8% $1,040 0.3% $3,133 1.3%

Stock Options, Restricted Stock and Other .................. 1,756 0.4% 409 0.1% 173 0.1%

Acceleration of Stock Options/Regional Manager Plan ........ 1,235 0.3% — 0.0% — 0.0%

Total ............................................... $6,211 1.5% $1,449 0.4% $3,306 1.4%

Variable Plan. We are party to a stock-based agreement between Tom Sullivan and his brother, Kevin

Sullivan, a regional manager, accounted for as a variable performance plan. The Variable Plan was established in

1998 and modified in August 2005. The Variable Plan awarded Kevin the right (the “Variable Right”) to an

ownership percentage of common stock, contributed by Tom. The Variable Right fully vested in conjunction

with the IPO. We recorded stock-based compensation expense related to the Variable Plan of $3.2 million, $1.0

million, and $3.1 million for 2007, 2006 and 2005, respectively.

The Variable Plan provided for a cash settlement of the Variable Right at a defined, performance based,

value through put-call provisions, executed by Tom or Kevin, if an IPO or sale event, as defined, had not taken

place prior to February 1, 2008. Tom was liable for the cash payment, and we guaranteed his performance. We

have accounted for the Variable Plan in accordance with the provisions of SFAS 123(R), and at December 31,

33