Lumber Liquidators 2007 Annual Report Download - page 61

Download and view the complete annual report

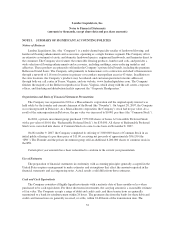

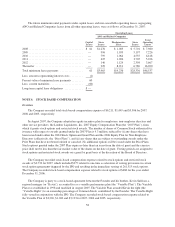

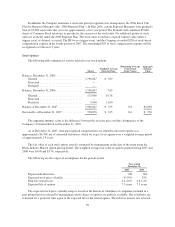

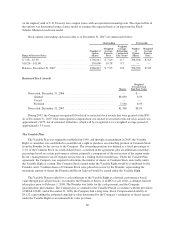

Please find page 61 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-Based Compensation

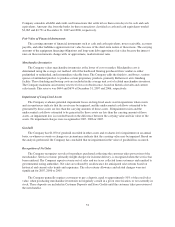

The Company adopted the provisions of Statement of Financial Accounting Standards (or “SFAS”) No. 123

(revised in 2004), “Share-Based Payment” (or “SFAS 123(R)”), using the prospective-transition method effective

January 1, 2006. Prior to the adoption of SFAS 123(R), the Company used the intrinsic value method under the

provisions of Accounting Principles Board Opinion No. 25 (or “APB 25”). There were no material differences in

the calculations of the Company’s stock-based compensation expense under APB 25 and SFAS 123,

“Accounting for Stock-Based Compensation” in 2005.

The Company issues incentive awards in the form of stock options and restricted stock awards to employees

and non-employee directors. The Company recognizes expense for its stock-based compensation based on the

fair value of the awards that are granted. Measured compensation cost is recognized ratably over the requisite

service period of the related stock-based compensation award.

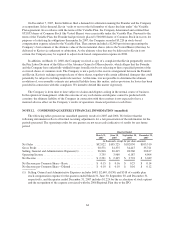

Income Taxes

Income taxes are accounted for in accordance with SFAS No. 109, “Accounting for Income Taxes” (or

“SFAS 109”). Income taxes are provided for under the asset and liability method and consider differences

between the tax and financial accounting bases. The tax effects of these differences are reflected on the balance

sheet as deferred income taxes and valued using the effective tax rate expected to be in effect when the

differences reverse. SFAS 109 also requires that deferred tax assets be reduced by a valuation allowance if it is

more likely than not that some portion of the deferred tax asset will not be realized. In evaluating the need for a

valuation allowance, the Company took into account various factors, including the expected level of future

taxable income. If actual results differ from the assumptions made in the evaluation of the valuation allowance, a

change in the valuation allowance will be recorded through income tax expense in the period such determination

is made.

Effective January 1, 2007, the Company adopted Financial Accounting Standards Board (or “FASB”)

Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (or “FIN 48”). FIN 48 clarifies the

accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with

SFAS 109. FIN 48 describes a recognition threshold and measurement attribute for the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return and also provides

guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and

transition. The adoption of FIN 48 did not have a material effect on the Company’s financial position or results

of operations.

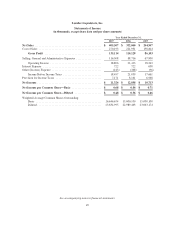

Net Income per Common Share

Basic net income per common share is determined by dividing net income by the weighted average number

of common shares outstanding during the year. Diluted net income per common share is determined by dividing

net income by the weighted average number of common shares outstanding during the year, plus the dilutive

effect of common share equivalents, such as stock options, warrants and preferred stock. Common shares and

common share equivalents included in the computation represent shares issuable upon assumed exercise of

outstanding stock options and warrants and the conversion of redeemable convertible preferred stock, except

when the effect of their inclusion would be antidilutive.

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (or “SFAS 157”), which

defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles

and expands disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for

fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Early adoption is

permitted. The Company is currently evaluating the impact of this pronouncement on its financial statements.

55