Lumber Liquidators 2007 Annual Report Download - page 43

Download and view the complete annual report

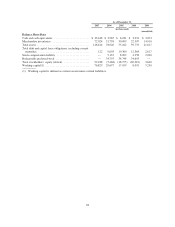

Please find page 43 of the 2007 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net Income. Net income decreased $1.6 million to $11.3 million in 2007 from $12.9 million in 2006 and as

a percentage of net sales decreased to 2.8% from 3.9%. Our effective income tax rate was approximately 38.8%

in both 2007 and 2006.

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

Net Sales. Net sales increased $87.1 million, or 36%, to $332.1 million in 2006 from $244.9 million in

2005. This increase was primarily driven by an increase of $42.0 million, or 17.3%, in comparable store net

sales, and by a $28.7 million increase in non-comparable net sales at the 19 stores opened during 2005, and $16.4

million at the 16 new stores opened during 2006. Comparable store net sales increases were driven principally by

maturation of new stores, optimization of our product mix to reflect customer demand and increased traffic

across our store base. The average retail price per unit sold also increased slightly. Overall net sales increased

due principally to the following factors:

• In early 2006, we introduced a number of new prefinished engineered hardwood products over a range

of retail price points not previously available, which increased sales in those product categories. We

also continued to increase the percentage of our net sales represented by moldings and accessories,

from 7% in 2005 to 8% in 2006.

• Increases in comparable store net sales and non-comparable net sales also resulted from the continuing

maturation of our store base, as net sales at stores open for less than 36 months (56% of our stores in

operation as of December 31, 2006) increased faster than our more mature stores.

• Net sales also increased due to improvements we made to our website that, among other things, made it

easier to place orders over the Internet.

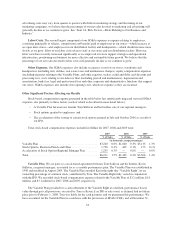

Gross Profit and Gross Margin. Gross profit increased $24.0 million, or 28%, to $110.1 million in 2006

from $86.1 million in 2005, principally as a result of increases in net sales that were partially offset by higher

average supplier costs and an increase in transportation costs. Gross margin decreased approximately 200 basis

points to 33.2% in 2006 from 35.2% in 2005, which was principally due to the following factors:

• The implementation of our 2006 initiative to broaden our product range increased net sales but caused

our gross margin to decline. In particular, we expanded our sales mix to include some products, such as

engineered hardwoods, that have a lower gross margin than our average product, which caused an

approximately 120 basis point decline in gross margin. The introduction of additional products in our

Dura-Wood line also caused an approximately 30 basis point decline in gross margin, as those products

have a lower gross margin than our average product and because we implemented a retail pricing

strategy designed to enable those products to gain market share.

• As part of our efforts to optimize inventory levels, we implemented a number of price discounts

(primarily during the fourth quarter of 2006) with respect to slower-moving inventory. We also were

required to increase reserves for product warranties due to a purchase of defective merchandise from

one supplier. These actions collectively resulted in an approximately 30 basis point decline in our gross

margin.

• Decreases in the prices of certain product categories, particularly laminates and bamboo, designed to

increase net sales and optimize our product mix, which were further impacted by supplier unit cost

increases that were not passed on proportionately to our customers, resulted in an approximately 25

basis point decline in gross margin.

• Higher domestic and international transportation costs, primarily due to higher fuel and ocean freight

costs, customs duties and per-mile ground charges, also caused a decline in gross margin.

These decreases were partially offset by increases in gross margin that resulted from increased efficiencies

at our Toano finishing line, slightly higher sales volumes of moldings and accessories (as those products

generally have a higher gross margin than our average product) and savings from new, longer-term international

transportation contracts.

37