LinkedIn 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.foreign currency exchange rate fluctuations. The Company’s program is not designated for trading or

speculative purposes.

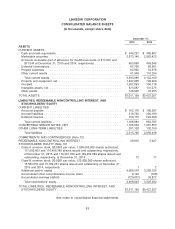

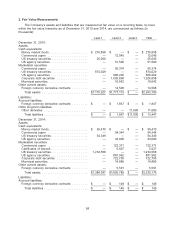

The foreign currency derivative contracts that were not settled as of December 31, 2015 and 2014

are recorded at fair value in the consolidated balance sheets. See Note 5, Derivative Instruments, for

additional information.

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation. Depreciation is

computed using the straight-line method over the estimated useful lives of the assets, which range from

two to five years. Buildings represent construction in progress related to the construction or

development of property that has not yet been placed in service for its intended use. Buildings will be

depreciated over a period of 40 years. Leasehold improvements are depreciated over the shorter of the

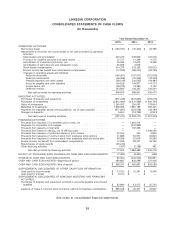

lease term or expected useful lives of the improvements. Depreciation expense totaled $285.8 million,

$202.3 million and $118.1 million for the years ended December 31, 2015, 2014 and 2013,

respectively. Land is not depreciated.

Website and Internal-Use Software Development Costs

The Company capitalizes certain costs to develop its website, mobile applications, and internal-use

software when planning stage efforts are successfully completed, management has committed project

resourcing, and it is probable that the project will be completed and the software will be used as

intended. Such costs are amortized on a straight-line basis over the estimated useful life of the related

asset, which is generally two years. Costs incurred prior to meeting these criteria, together with costs

incurred for training and maintenance, are expensed as incurred.

The Company capitalized website and internal-use software development costs of $97.4 million,

$55.7 million and $39.3 million for the years ended December 31, 2015, 2014 and 2013, respectively.

The Company’s capitalized website and internal-use software depreciation is included in depreciation

and amortization in the Company’s consolidated statements of operations, and totaled $51.8 million,

$40.7 million and $15.6 million for the years ended December 31, 2015, 2014 and 2013, respectively.

The Company had unamortized capitalized website and internal-use software of $105.0 million and

$59.4 million in the consolidated balance sheets as of December 31, 2015 and 2014, respectively.

Goodwill, Intangible Assets, Long-Lived Assets, and Impairment Assessments

Goodwill. Goodwill represents the excess of the purchase price of an acquired business over the

fair value of the underlying net tangible and intangible assets. Goodwill is evaluated for impairment

annually in the third quarter of the Company’s fiscal year, and whenever events or changes in

circumstances indicate the carrying value of goodwill may not be recoverable. Triggering events that

may indicate impairment include, but are not limited to, a significant adverse change in member

engagement or business climate that could affect the value of goodwill or a significant decrease in

expected cash flows. Since inception through December 31, 2015, the Company did not have any

goodwill impairment.

Intangible assets. Intangible assets consist of identifiable intangible assets, primarily customer

relationships and developed technology as a result from the Company’s acquisitions. Intangible assets

acquired in a business combination are initially measured at fair value; other intangible assets are

initially measured at cost. Thereafter, intangible assets are amortized on a straight-line basis over their

estimated useful lives.

Long-lived assets. The Company evaluates its long-lived assets, including property and

equipment and intangible assets, for impairment whenever events or changes in circumstances indicate

that the carrying amount of such assets may not be recoverable. Recoverability of assets to be held

92