LinkedIn 2015 Annual Report Download - page 54

Download and view the complete annual report

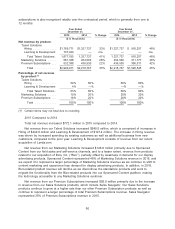

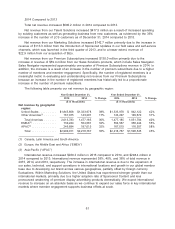

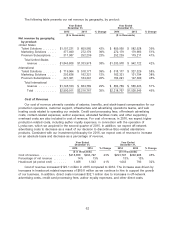

Please find page 54 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.While we experienced significant revenue growth in 2015 compared to 2014, we had

significant operating losses as a result of our long-term investment strategy. In 2015, our net

revenue was $2,990.9 million, which represents an increase of 35% from 2014. Our net revenue

benefited from increased sales of our core products, specifically Recruiter, Jobs, Sponsored Content,

and Sales Solutions as well as revenue from our recent acquisition of Lynda.com. In 2015, we had an

operating loss of $214.7 million driven by increases in headcount-related expenses of $636.2 million as

we hired additional employees to support the growth in our business. We also had an increase of

$183.5 million in depreciation and amortization related to intangible assets from our acquisition of

Lynda.com, build out of our data centers, leasehold improvements as we lease additional facilities to

accommodate our headcount growth, and capitalized website and internal-use software.

We expect our growth rate to continue to decrease over time. As our net revenue increases,

we expect that our growth rate related to net revenue will continue to decrease over time. Also, given

the large scale and critical mass of our network, we believe member and engagement growth, as

measured by our key metrics, will decelerate over time and that this may impact the growth of certain

portions of our business. Our future growth will depend, in part, on our ability to continue to increase

member growth and engagement by creating value for members as well as strengthening our core

offerings on mobile and desktop devices and expanding our global presence, which we believe will

result in increased sales of our Talent Solutions, Marketing Solutions, and Premium Subscriptions.

Our long-term financial focus is on sustainable, long-term growth; however, in the near term

we expect US GAAP operating losses as we continue to make investments in our business.

Our investments in 2016 will focus on the following themes: our core products within Talent Solutions,

Marketing Solutions, and Premium Subscriptions, the marketplace dynamics between members and

customers to create reciprocal value in our products, and intelligent growth by supporting our

long-term financial objectives of sustainable revenue and earnings growth.

•Our Products. With respect to product development, we will continue to focus investment on

our member and customer value proposition: connect to opportunity.

•Members. We plan to continue to invest in our global member experience focusing on our

value propositions: helping members stay connected and informed, advance their careers,

and work smarter.

•Customers. We plan to invest in our core product development efforts to transform the way

customers hire, market, sell, and learn.

In addition, we expect to continue to invest in mobile across our product lines. Mobile is the

fastest growing channel for member engagement, growing at twice the rate of overall site traffic

with mobile unique visiting members representing 54% of unique visiting members in 2015.

•Our Talent. We expect to expand our workforce in 2016, however, such expansion, specifically

related to our sales and product development teams, will be at a slower rate than in 2015. We

expect that the increased headcount will result in an increase in related expenses, including

stock-based compensation expense and capital expenditures related to facilities. As of

December 31, 2015, we had 9,372 employees, which represented an increase of 36% compared

to the prior year end. Excluding the employees from our acquisition of Lynda.com, we would

have had 8,797 employees, which represents an increase of 28% compared to 2014.

•Our Technology. We expect to continue to make significant capital expenditures to upgrade our

technology and network infrastructure to improve the ability of our website to handle expected

increases in usage, to enable the release of new features and solutions, and to scale for future

growth. These investments are particularly focused on expanding our footprint of data centers.

52