LinkedIn 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

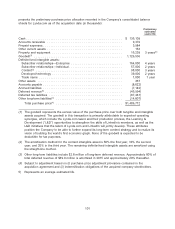

outstanding shares of capital stock of Lynda.com consists of approximately $777.7 million in cash and

3,573,589 shares of LinkedIn Class A common stock. LinkedIn also issued 178,763 stock options

related to assumed Lynda.com equity awards. The fair value of the earned portion of assumed stock

options of $11.2 million is included in the purchase price, with the remaining fair value of $18.9 million

representing post-acquisition compensation expense that will be recognized over the requisite service

period of approximately three years from the date of acquisition. LinkedIn accelerated the vesting of

and settled in cash the stock options for non-continuing employees and recognized $22.4 million in

stock-based compensation expense immediately. A portion of the consideration was placed in escrow

to satisfy certain indemnification obligations of the former Lynda.com stockholders as described in the

Merger Agreement.

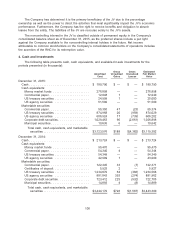

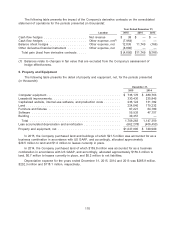

The following table presents the components of the preliminary purchase consideration transferred

based on the closing price of $194.49 per share of LinkedIn’s Class A common stock (in thousands):

Cash ............................................................. $ 777,745

Class A common stock ................................................ 695,028

Earned portion of the assumed stock options ................................ 11,181

Other consideration .................................................. 2,758

Purchase consideration .............................................. $1,486,712

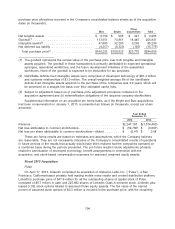

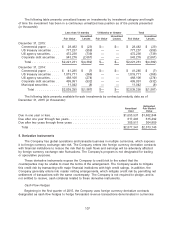

The acquisition has been accounted for as a business combination under the acquisition method

and, accordingly, the total purchase price is allocated to the tangible and intangible assets acquired

and the liabilities assumed based on the fair value on the acquisition date. The fair value of assets

acquired and liabilities assumed from the acquisition of Lynda.com is based on a preliminary valuation

and, as such, the Company’s estimates and assumptions are subject to change within the

measurement period. The primary areas of the purchase price that are not yet finalized are related to

indirect taxes. The changes to the purchase price allocation primarily related to income taxes with the

largest change related to the early adoption of authoritative accounting guidance on deferred taxes.

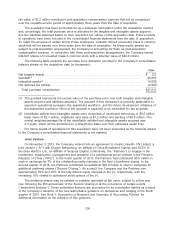

The results of operations of Lynda.com are included in the consolidated financial statements from

the date of acquisition. The Company has recognized $107.4 million in revenue and net loss of

$82.9 million related to its acquisition of Lynda.com in 2015. The net loss related to Lynda.com

includes tax-effected one-time charges, such as severance, of approximately $19.4 million. The

Company also recognized transaction costs of approximately $2.0 million, which are included in general

and administrative expense in the consolidated statement of operations in 2015. The following table

100