LinkedIn 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has determined it is the primary beneficiary of the JV due to the percentage

ownership as well as the power to direct the activities that most significantly impact the JV’s economic

performance. Furthermore, the Company has the right to receive benefits and obligation to absorb

losses from the entity. The liabilities of the JV are recourse solely to the JV’s assets.

The noncontrolling interest in the JV is classified outside of permanent equity in the Company’s

consolidated balance sheet as of December 31, 2015, as the preferred shares include a put right

against the Company available to the noncontrolling interest holders in the future. Net income

attributable to common stockholders on the Company’s consolidated statements of operations includes

the accretion of the RNCI to its redemption value.

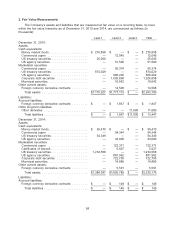

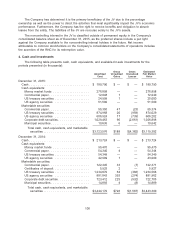

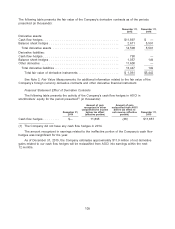

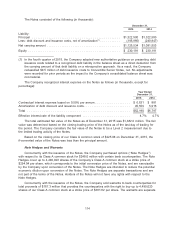

4. Cash and Investments

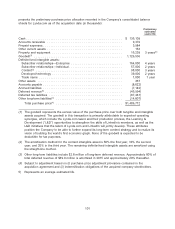

The following table presents cash, cash equivalents, and available-for-sale investments for the

periods presented (in thousands):

Gross Gross Estimated

Amortized Unrealized Unrealized Fair Market

Cost Gains Losses Value

December 31, 2015:

Cash ................................. $ 180,790 $ — $ — $ 180,790

Cash equivalents:

Money market funds .................... 276,898 — — 276,898

Commercial paper ...................... 12,048 1 — 12,049

US treasury securities ................... 24,999 1 — 25,000

US agency securities ................... 51,500 — — 51,500

Marketable securities:

Commercial paper ...................... 55,350 47 (23) 55,374

US treasury securities ................... 874,968 20 (959) 874,029

US agency securities ................... 606,924 17 (739) 606,202

Corporate debt securities ................. 1,029,463 96 (2,661) 1,026,898

Municipal securities ..................... 10,636 6 — 10,642

Total cash, cash equivalents, and marketable

securities ......................... $3,123,576 $188 $(4,382) $3,119,382

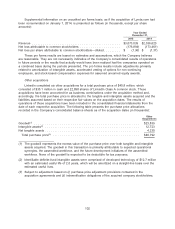

December 31, 2014:

Cash ................................. $ 213,724 $ — $ — $ 213,724

Cash equivalents:

Money market funds .................... 95,470 — — 95,470

Commercial paper ...................... 54,340 4 — 54,344

US treasury securities ................... 54,349 — — 54,349

US agency securities ................... 42,999 1 — 43,000

Marketable securities:

Commercial paper ...................... 122,345 33 (7) 122,371

Certificates of deposit ................... 5,925 2 — 5,927

US treasury securities ................... 1,234,870 64 (366) 1,234,568

US agency securities ................... 881,843 393 (274) 881,962

Corporate debt securities ................. 723,412 225 (932) 722,705

Municipal securities ..................... 14,893 4 (8) 14,889

Total cash, cash equivalents, and marketable

securities ......................... $3,444,170 $726 $(1,587) $3,443,309

106