LinkedIn 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

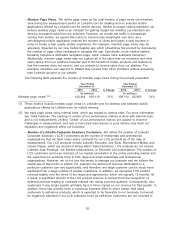

•Member Page Views. We define page views as the total number of page views our members

view during the measurement period on LinkedIn.com for desktop and on selected mobile

applications offered by LinkedIn.com for mobile devices. Similar to unique visiting members, we

believe member page views is an indicator for gaining insight into whether our members are

deriving increased value from our solutions. However, as overall site traffic is increasingly

coming from mobile, we expect this metric to become less meaningful over time, as a

well-designed mobile application reduces the number of clicks and pages a user touches in

order to create a high quality mobile experience. For example, member page views may be

adversely impacted by our new mobile flagship app which streamlines the product by decreasing

the number of page views necessary to navigate the app. Specifically, more intuitive tabbed

browsing replaces a dedicated navigation page, which creates more seamless interaction.

Additionally, member page views may not capture all of the value that our members and other

users derive from our solutions because part of the benefit of certain products and features is

that the member does not need to visit our website to receive value from our platform. For

example, members can respond to InMails they receive from other members without accessing

their LinkedIn account or our website.

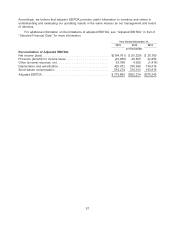

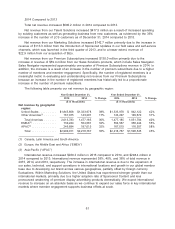

The following table presents the number of member page views during the periods presented:

Year Ended Year Ended

December 31, December 31,

2015 2014 % Change 2014 2013 % Change

(in millions) (in millions)

Member page views(1),(2) ........... 143,464 109,110 31% 109,110 82,990 31%

(1) These metrics include member page views on LinkedIn.com for desktop and selected mobile

applications offered by LinkedIn.com for mobile devices.

(2) We track page views using internal tools, which are subject to various risks. For more information,

see ‘‘Risk Factors—The tracking of certain of our performance metrics is done with internal tools

and is not independently verified. Certain of our performance metrics are subject to inherent

challenges in measurement, and real or perceived inaccuracies in such metrics may harm our

reputation and negatively affect our business.’’

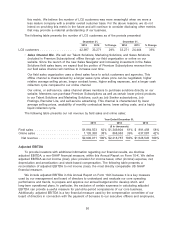

•Number of LinkedIn Corporate Solutions Customers. We define the number of LinkedIn

Corporate Solutions (‘‘LCS’’) customers as the number of enterprises and professional

organizations that we have under active contracts for our LCS products as of the date of

measurement. Our LCS products include LinkedIn Recruiter, Job Slots, Recruitment Media, and

Career Pages, which are all part of Hiring within Talent Solutions. LCS products do not include

LinkedIn Jobs Postings, Job Seeker subscriptions, or Recruiter Lite subscriptions. The number of

LCS customers can be an indicator of our market penetration in the online recruiting market and

the value that our products bring to both large and small enterprises and professional

organizations. However, we do not use this metric to manage our business and we believe the

usefulness of this metric is limited. For example, the amount of revenue attributable to a

particular customer can vary significantly, and therefore one large customer can be much more

significant than a large number of smaller customers. In addition, we recognize LCS product

revenue ratably over the terms of the respective agreements, which are typically 12 months. As

a result, a significant amount of the LCS product revenue is derived from the recognition of

deferred revenue relating to contracts entered into during previous quarters. Consequently, new

customers in any single quarter will likely have a minor impact on our revenue for that quarter. In

addition, there has recently been a conscious business effort to direct certain field sales

customers to self-serve products, which is expected to be favorable to our business, but would

be negatively reflected in our LCS customer count as self-serve customers are not included in

55