LinkedIn 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

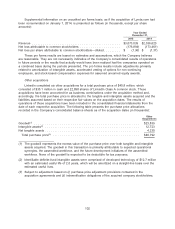

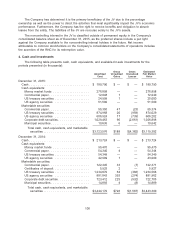

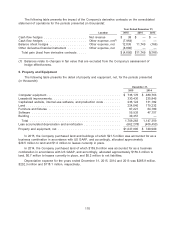

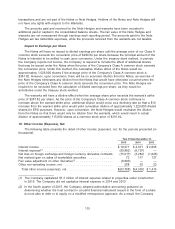

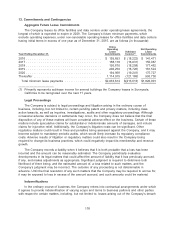

Amortization expense for the years ended December 31, 2015, 2014 and 2013 was $134.7 million,

$34.6 million and $16.4 million, respectively. Estimated amortization of purchased intangible assets for

future periods is as follows (in thousands):

Amortization

Year Ending December 31, expense

2016 ............................................................. $169,435

2017 ............................................................. 102,682

2018 ............................................................. 53,731

2019 ............................................................. 20,507

2020 ............................................................. 5,052

Thereafter ......................................................... 20,904

Total ........................................................... $372,311

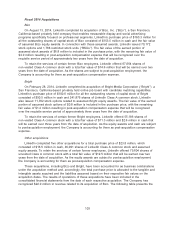

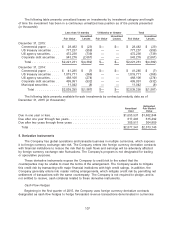

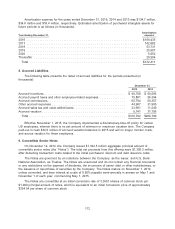

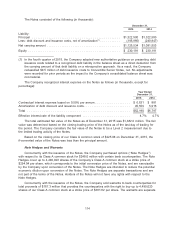

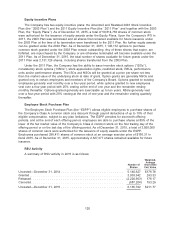

8. Accrued Liabilities

The following table presents the detail of accrued liabilities for the periods presented (in

thousands):

December 31,

2015 2014

Accrued incentives ............................................ $ 96,708 $ 69,583

Accrued payroll taxes and other employee-related expenses .............. 75,881 56,394

Accrued commissions .......................................... 65,794 59,357

Other accrued expenses ........................................ 44,987 31,900

Accrued sales tax and value-added taxes ............................ 23,681 11,249

Accrued vacation ............................................. 9,741 31,706

Total .................................................... $316,792 $260,189

Effective November 1, 2015, the Company implemented a discretionary-time-off policy for certain

US employees, wherein there is no set amount of minimum or maximum vacation time. The Company

paid-out in cash $34.5 million of accrued vacation balances in 2015 and will no longer monitor, track,

and accrue vacation for these employees.

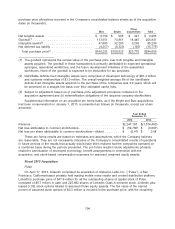

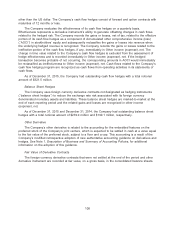

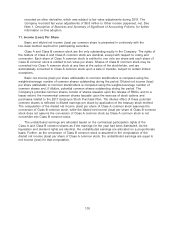

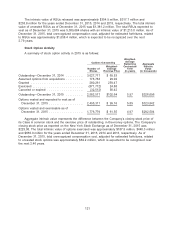

9. Convertible Senior Notes

On November 12, 2014, the Company issued $1,322.5 million aggregate principal amount of

convertible senior notes (the ‘‘Notes’’). The total net proceeds from this offering were $1,305.3 million,

after deducting transaction costs related to the initial purchasers’ discount and debt issuance costs.

The Notes are governed by an indenture between the Company, as the issuer, and U.S. Bank

National Association, as Trustee. The Notes are unsecured and do not contain any financial covenants

or any restrictions on the payment of dividends, the incurrence of senior debt or other indebtedness, or

the issuance or repurchase of securities by the Company. The Notes mature on November 1, 2019,

unless converted, and bear interest at a rate of 0.50% payable semi-annually in arrears on May 1 and

November 1 of each year, commencing May 1, 2015.

The Notes are convertible at an initial conversion rate of 3.3951 shares of common stock per

$1,000 principal amount of notes, which is equivalent to an initial conversion price of approximately

$294.54 per share of common stock.

112