LinkedIn 2015 Annual Report Download - page 79

Download and view the complete annual report

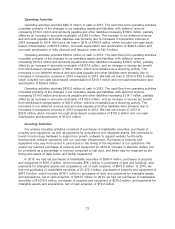

Please find page 79 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.If our assumptions change and we amend an existing lease or enter into a new lease, we may

have leases that are accounted for as capital leases, as well as operating leases. Accounting for a

lease as a capital lease would accelerate the timing of expense recognition due to the recognition of

larger amounts of interest expense near the beginning of the lease term. It would also change the

characterization of expense from rent expense to a combination of depreciation and interest expense,

both of which are excluded from our adjusted EBITDA metric and would likely impact other financial

metrics. However, lease classification would not be expected to impact our cash flow.

Income Taxes

We record income taxes using the asset and liability method, which requires the recognition of

deferred tax assets and liabilities for the expected future tax consequences of events that have been

recognized in our financial statements or tax returns. In estimating future tax consequences, generally

all expected future events other than enactments or changes in the tax law or rates are considered.

Valuation allowances are provided when necessary to reduce deferred tax assets to the amount

expected to be realized.

We recognize a tax benefit from an uncertain tax position only if it is more likely than not the tax

position will be sustained on examination by the taxing authorities, based on the technical merits of the

position. The tax benefits recognized in the financial statements from such positions are then measured

based on the largest benefit that has a greater than 50% likelihood of being realized upon settlement.

In the event that any unrecognized tax benefits are recognized, the effective tax rate will be affected. If

recognized, approximately $43.2 million of unrecognized tax benefit would impact the effective tax rate

at December 31, 2015. Although we believe our estimates are reasonable, no assurance can be given

that the final tax outcome of these matters will be the same as these estimates. These estimates are

updated quarterly based on factors such as change in facts or circumstances, changes in tax law, new

audit activity, and effectively settled issues.

We regularly assess the realizability of our deferred tax assets and establish a valuation allowance

if it is more-likely-than-not that some portion of the deferred tax assets will not be realized. We weigh

all available positive and negative evidence, including earnings history and results of recent operations,

scheduled reversals of deferred tax liabilities, projected future taxable income, and tax planning

strategies. Assumptions used to forecast future taxable income often require significant judgment. More

weight is given to objectively verifiable evidence. In the event we determine that it would not be able to

realize all or part of our net deferred tax assets in the future, a valuation allowance will be established

against deferred tax assets in the period in which we make such determination. The need to establish

a valuation allowance against deferred tax assets may cause greater volatility in our effective tax rate.

It is reasonably possible that any such adjustment would materially change in the next 12 months. See

Note 15, Income Taxes, of the Notes to the Consolidated Financial Statements under Item 8 for

additional information on our income taxes.

Legal Contingencies

We are subject to legal proceedings and litigation arising in the ordinary course of business.

Periodically, we evaluate the status of each legal matter and assess our potential financial exposure. If

the potential loss from any legal proceeding or litigation is considered probable and the amount can be

reasonably estimated, we accrue a liability for the estimated loss. Significant judgment is required to

determine the probability of a loss and whether the amount of the loss is reasonably estimable. The

outcome of any proceeding is not determinable in advance. As a result, the assessment of a potential

liability and the amount of accruals recorded are based only on the information available at the time. As

additional information becomes available, we reassess the potential liability related to the legal

proceeding or litigation, and may revise our estimates. Any revisions could have a material effect on

our results of operations. See Note 12, Commitments and Contingencies, of the Notes to the

77