LinkedIn 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

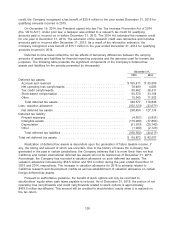

The Company regularly assesses the realizability of its deferred tax assets and establishes a

valuation allowance if it is more-likely-than-not that some portion of the deferred tax assets will not be

realized. The Company weighs all available positive and negative evidence, including earnings history

and results of recent operations, scheduled reversals of deferred tax liabilities, projected future taxable

income, and tax planning strategies. Assumptions used to forecast future taxable income often require

significant judgment. More weight is given to objectively verifiable evidence. In the event the Company

determines that it would not be able to realize all or part of its net deferred tax assets in the future, a

valuation allowance will be established against deferred tax assets in the period in which the Company

makes such determination. The need to establish a valuation allowance against deferred tax assets

may cause greater volatility in the effective tax rate. It is reasonably possible that any such adjustment

would materially change in the next 12 months.

As of December 31, 2015, the Company had net operating loss carryforwards for federal income

tax return purposes of approximately $1,217.5 million, which expire at various dates beginning in the

year 2023, if not utilized. The Company had net operating loss carryforwards of approximately

$572.5 million for California income tax return purposes and approximately $1,234.0 million for other

state income tax return purposes which expire at various dates beginning in the year 2023, if not

utilized.

As of December 31, 2015, the Company had research and development credit carryforwards for

federal income tax return purposes of approximately $113.8 million, which expire at various dates

beginning in the year 2023, if not utilized. The Company had research and development credit

carryforwards for state income tax return purposes of approximately $107.8 million, which can be

carried forward indefinitely.

Utilization of the net operating loss carryforwards and credits may be subject to a substantial

annual limitation due to the ownership change limitations provided by the Internal Revenue Code of

1986, as amended and similar state provisions. The annual limitation may result in the expiration of net

operating losses and credits before utilization. The Company believes an ownership change, as defined

under Section 382 of the Internal Revenue Code, existed in prior years, and has reduced its net

operating loss carryforwards to reflect the limitation.

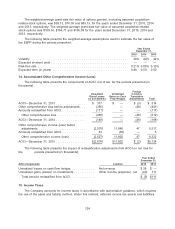

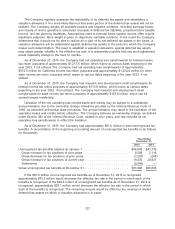

As of December 31, 2015, the Company had approximately $81.0 million in total unrecognized tax

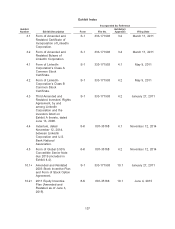

benefits. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows

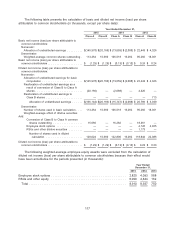

(in thousands):

Year Ended

December 31,

2015 2014

Unrecognized tax benefits balance at January 1 ......................... $66,508 $43,735

Gross increase for tax positions of prior years ......................... 2,268 2,116

Gross decrease for tax positions of prior years ........................ (1,297) (264)

Gross increase for tax positions of current year ........................ 19,470 20,921

Settlements ................................................. (5,949) —

Gross unrecognized tax benefits at December 31 ........................ $81,000 $66,508

If the $81.0 million of unrecognized tax benefits as of December 31, 2015 is recognized,

approximately $43.2 million would decrease the effective tax rate in the period in which each of the

benefits is recognized. If the $66.5 million of unrecognized tax benefits as of December 31, 2014 is

recognized, approximately $38.1 million would decrease the effective tax rate in the period in which

each of the benefits is recognized. The remaining amount would be offset by the reversal of related

deferred tax assets on which a valuation allowance is in place.

127