LinkedIn 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

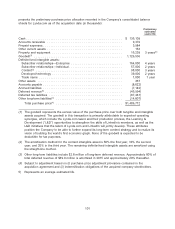

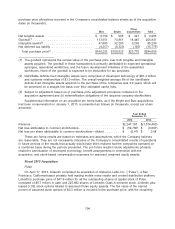

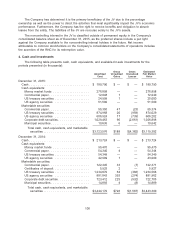

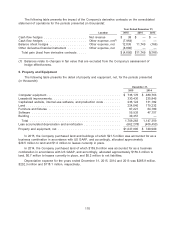

presents the preliminary purchase price allocation recorded in the Company’s consolidated balance

sheets for Lynda.com as of the acquisition date (in thousands):

Preliminary

estimated

useful life

Cash .................................................... $ 136,109

Accounts receivable ......................................... 9,370

Prepaid expenses ........................................... 3,984

Other current assets ......................................... 153

Property and equipment ...................................... 16,239 3 years(5)

Goodwill(1) ................................................ 1,126,536

Definite-lived intangible assets:

Subscriber relationships—Enterprise ............................ 164,000 4 years

Subscriber relationships—Individual ............................. 57,000 2 years

Content(2) ............................................... 98,000 3 years

Developed technology ...................................... 39,000 2 years

Trade name ............................................. 1,000 1 year

Other assets .............................................. 367

Accounts payable ........................................... (8,622)

Accrued liabilities ........................................... (7,142)

Deferred revenue(3) .......................................... (46,994)

Deferred tax liabilities ........................................ (87,481)

Other long-term liabilities(3) .................................... (14,807)

Total purchase price(4) .................................... $1,486,712

(1) The goodwill represents the excess value of the purchase price over both tangible and intangible

assets acquired. The goodwill in this transaction is primarily attributable to expected operating

synergies, which include the Lynda.com talent and their production process, the Learning &

Development (‘‘L&D’’) opportunities to strengthen the skills of LinkedIn’s members, as well as the

L&D initiatives that the talent of Lynda.com and LinkedIn will jointly develop. These attributes

position the Company to be able to further expand its long-term content strategy and to realize its

vision of building the world’s first economic graph. None of the goodwill is expected to be

deductible for tax purposes.

(2) The amortization method for the content intangible asset is 50% the first year, 30% the second

year, and 20% in the third year. The remaining definite-lived intangible assets are amortized using

the straight-line method.

(3) Other long-term liabilities include $2.8 million of long-term deferred revenue. Approximately 80% of

total deferred revenue of $49.9 million is amortized in 2015 and approximately 20% thereafter.

(4) Subject to adjustment based on (i) purchase price adjustment provisions contained in the

acquisition agreement and (ii) indemnification obligations of the acquired company stockholders.

5) Represents an average estimated life.

101