LinkedIn 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The weighted-average grant date fair value of options granted, excluding assumed acquisition-

related stock options, was $99.13, $76.39 and $89.13, for the years ended December 31, 2015, 2014

and 2013, respectively. The weighted-average grant date fair value of assumed acquisition-related

stock options was $168.34, $164.71 and $166.08 for the years ended December 31, 2015, 2014 and

2013, respectively.

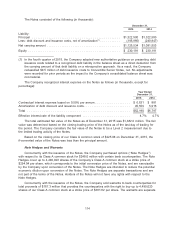

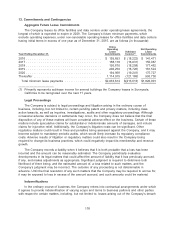

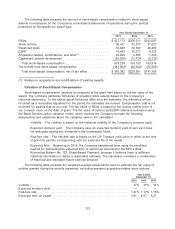

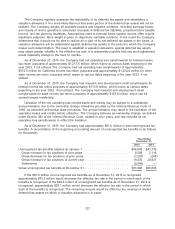

The following table presents the weighted-average assumptions used to estimate the fair value of

the ESPP during the periods presented:

Year Ended

December 31,

2015 2014 2013

Volatility ..................................................... 39% 44% 42%

Expected dividend yield .......................................... — — —

Risk-free rate ................................................. 0.21% 0.06% 0.10%

Expected term (in years) ......................................... 0.49 0.50 0.50

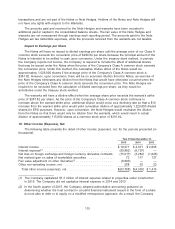

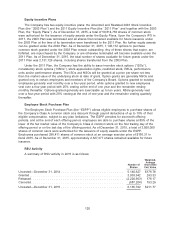

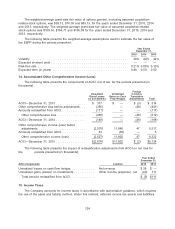

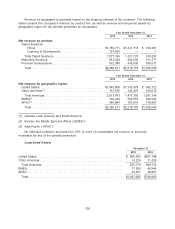

14. Accumulated Other Comprehensive Income (Loss)

The following table presents the components of AOCI, net of tax, for the periods presented (in

thousands):

Foreign

Unrealized Unrealized Currency

Gains/Losses Gains on Cash Translation

on Investments Flow Hedges Adjustments Total

AOCI—December 31, 2013 ................ $ 317 $ — $ (3) $ 314

Other comprehensive loss before adjustments . . . (355) — (46) (401)

Amounts reclassified from AOCI ............. (111) — — (111)

Other comprehensive loss ............... (466) — (46) (512)

AOCI—December 31, 2014 ................ (149) — (49) (198)

Other comprehensive income (loss) before

adjustments ......................... (2,570) 11,840 47 9,317

Amounts reclassified from AOCI ............. 43 (38) — 5

Other comprehensive income (loss) ........ (2,527) 11,802 47 9,322

AOCI—December 31, 2015 ................ $(2,676) $11,802 $ (2) $9,124

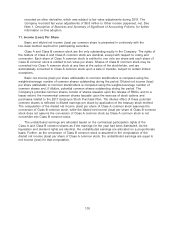

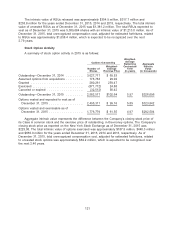

The following table presents the impact of reclassification adjustments from AOCI on net loss for

the periods presented (in thousands):

Year Ended

December 31,

AOCI Components Location 2015 2014

Unrealized losses on cash flow hedges ............. Net revenue $ 38 $ —

Unrealized gains (losses) on investments ............ Other income (expense), net (43) 111

Total amount reclassified from AOCI .............. $ (5) $111

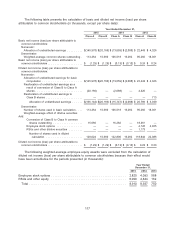

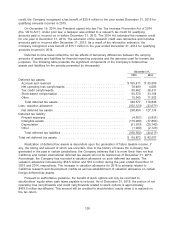

15. Income Taxes

The Company accounts for income taxes in accordance with authoritative guidance, which requires

the use of the asset and liability method. Under this method, deferred income tax assets and liabilities

124