LinkedIn 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On May 14, 2015, we acquired Lynda.com. We believe that the acquisition of Lynda.com positions

us to be able to further expand on our long-term content strategy, and to realize our vision of building

the world’s first economic graph. The total purchase price paid for all of the outstanding equity interests

of Lynda.com was approximately $1.5 billion, subject to adjustment, which was paid in combination of

approximately 52% in cash and approximately 48% in shares of our Class A common stock.

We believe that our existing cash and cash equivalents and marketable securities balances,

together with cash generated from operations, will be sufficient to meet our working capital expenditure

requirements for at least the next 12 months.

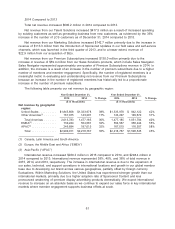

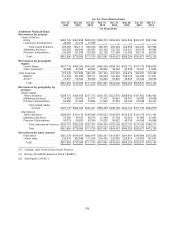

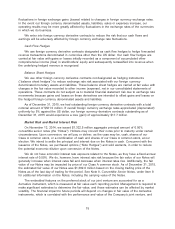

December 31, December 31,

2015 2014

(in thousands)

Consolidated Balance Sheet Data:

Cash and cash equivalents ................................. $ 546,237 $ 460,887

Marketable securities ..................................... $2,573,145 $2,982,422

Convertible senior notes, net ................................ $1,126,534 $1,081,553

Year Ended December 31,

2015 2014 2013

(in thousands)

Consolidated Statements of Cash Flows Data:

Cash flows provided by operating activities ............ $806,975 $ 568,951 $ 436,473

Cash flows used in investing activities ................ (792,077) (2,293,271) (1,357,545)

Cash flows provided by financing activities ............ 77,814 1,388,485 1,454,219

Effect of exchange rate changes on cash and cash

equivalents ................................. (7,362) (6,367) (466)

Change in cash and cash equivalents .............. $ 85,350 $ (342,202) $ 532,681

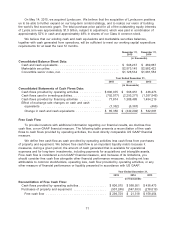

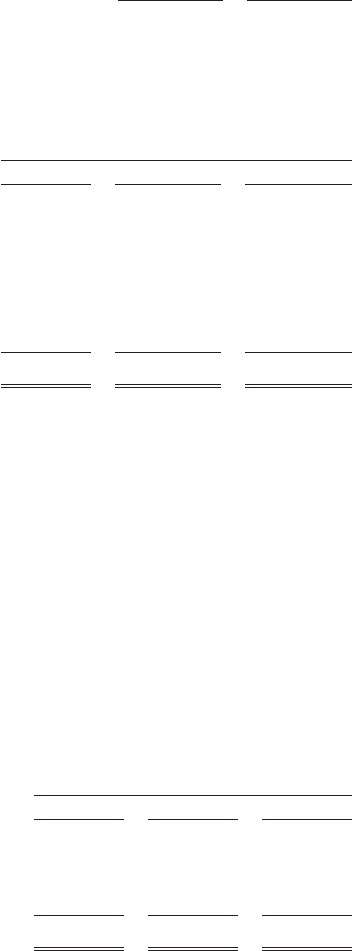

Free Cash Flow

To provide investors with additional information regarding our financial results, we disclose free

cash flow, a non-GAAP financial measure. The following table presents a reconciliation of free cash

flows to cash flows provided by operating activities, the most directly comparable US GAAP financial

measure.

We define free cash flow as cash provided by operating activities less cash flows from purchases

of property and equipment. We believe free cash flow is an important liquidity metric because it

measures, during a given period, the amount of cash generated that is available for operational

expenses and for long-term investments, including payments for acquisitions and intangible assets.

Free cash flow is considered a non-GAAP financial measure, and, because of its limitations, you

should consider free cash flow alongside other financial performance measures, including net loss

attributable to common stockholders, operating loss, cash flow provided by operating activities, or any

other measure of financial performance or liquidity presented in accordance with US GAAP.

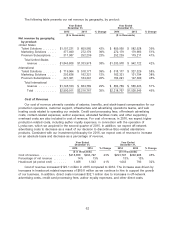

Year Ended December 31,

2015 2014 2013

(in thousands)

Reconciliation of Free Cash Flow:

Cash flows provided by operating activities ............... $806,975 $ 568,951 $ 436,473

Purchases of property and equipment .................. (507,246) (547,633) (278,019)

Free cash flow ................................. $299,729 $ 21,318 $ 158,454

71