LinkedIn 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

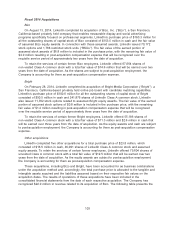

fair value of $1.2 million resulting in post-acquisition compensation expense that will be recognized

over the requisite service period of approximately three years from the date of acquisition.

The acquisition has been accounted for as a business combination under the acquisition method

and, accordingly, the total purchase price is allocated to the tangible and intangible assets acquired

and the liabilities assumed based on their respective fair values on the acquisition date. Pulse’s results

of operations have been included in the consolidated financial statements from the date of acquisition.

To retain the services of certain former Pulse employees, LinkedIn offered nonvested Class A common

stock that will be earned over three years from the date of acquisition. As these equity awards are

subject to post-acquisition employment, the Company is accounting for them as post-acquisition

compensation expense. In connection with these post-acquisition arrangements, the Company issued

244,601 shares of nonvested Class A common stock with a total fair value of $44.0 million.

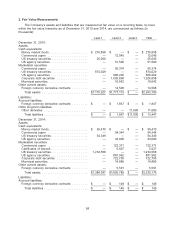

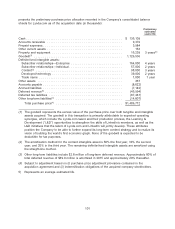

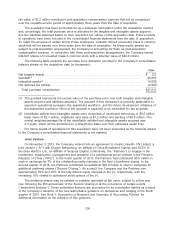

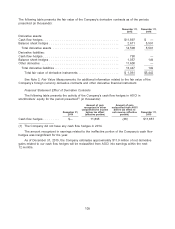

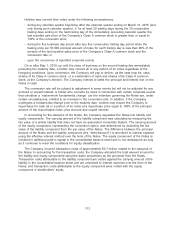

The following table presents the purchase price allocation recorded in the Company’s consolidated

balance sheets on the acquisition date (in thousands):

Total

Net tangible assets ..................................................... $ 221

Goodwill(1) ........................................................... 35,657

Intangible assets(2) ..................................................... 14,000

Net deferred tax liability .................................................. (2,267)

Total purchase consideration ............................................ $47,611

(1) The goodwill represents the excess value of the purchase price over both tangible and intangible

assets acquired and liabilities assumed. The goodwill in this transaction is primarily attributable to

expected operational synergies, the assembled workforce, and the future development initiatives of

the assembled workforce. None of the goodwill is expected to be deductible for tax purposes.

(2) Identifiable definite-lived intangible assets were comprised of developed technology of $9.5 million,

trade name of $2.7 million, registered user base of $1.2 million and backlog of $0.6 million. The

overall weighted-average life of the identifiable definite-lived intangible assets acquired was

2.9 years, which will be amortized on a straight-line basis over their estimated useful lives.

Pro forma results of operations for this acquisition have not been presented as the financial impact

to the Company’s consolidated financial statements is not material.

Joint Venture

On November 3, 2013, the Company entered into an agreement to create LinkedIn CN Limited, a

joint venture (‘‘JV’’) with Dragon Networking, an affiliate of China Broadband Capital, and SCCV IV

Success HoldCo, Ltd., an affiliate of Sequoia Capital, (collectively, the ‘‘Partners’’) to engage in the

investment, organization, management and operation of a professional social network in the People’s

Republic of China (‘‘PRC’’). In the fourth quarter of 2013, the Partners had contributed $5.0 million in

cash in exchange for 7% of the outstanding equity interests in the form of preferred shares. In the

second quarter of 2015, the Partners contributed an additional $20.0 million in cash in exchange for

additional preferred shares (‘‘Second Closing’’). As a result, the Company and the Partners own

approximately 65% and 25% of the fully diluted equity interests in the JV, respectively, with the

remaining 10% related to authorized stock options of the JV.

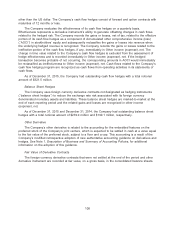

The preferred shares may be callable or puttable, generally at fair value, subject to a floor and

cap, following the fifth anniversary of the Second Closing or at the occurrence of certain events

(‘‘embedded features’’). These embedded features are accounted for as a derivative liability as a result

of the Company’s adoption of the new authoritative guidance on derivatives and hedging in the fourth

quarter of 2015. See Note 1, Description of Business and Summary of Accounting Policies, for

additional information on the adoption of this guidance.

105