LinkedIn 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financing Activities

In 2015, our financing activities consisted primarily of net proceeds from the issuance of common

stock from employee stock option exercises and stock purchase plan, as well as the excess tax benefit

from stock-based compensation. Additionally, we had repurchases of equity awards of $25.2 million,

partially offset by proceeds from our issuance of preferred shares in our joint venture of $20.0 million.

In 2014, we received net proceeds from our convertible senior notes issuance, after deducting

initial purchasers’ discount and debt issuance costs, of approximately $1,305.4 million. Concurrently

with the issuance of the Notes, we used approximately $248.0 million of the net proceeds of the

offering of the Notes to pay the cost of convertible note hedge transactions, which was partially offset

by $167.3 million in proceeds from warrants we sold. See Note 9, Convertible Senior Notes, of the

Notes to Consolidated Financial Statements under Item 8 for additional information.

In 2013, we received net proceeds from our follow-on offering, net of underwriting discounts and

commissions and other costs of $1,348.1 million in proceeds.

With the exception of the Notes issuance and the follow-on offering, our financing activities consist

primarily of the excess tax benefit from stock-based compensation and the proceeds from the issuance

of common stock from employee stock option exercises and our employee stock purchase plan.

Off Balance Sheet Arrangements

In the ordinary course of business, we provide standby letters of credit or other guarantee

instruments to third parties primarily for facility leases. As of December 31, 2015, we had financial

guarantees of $50.2 million that were not recorded on our consolidated balance sheet that consisted of

standby letters of credit and bank guarantees. We had no other off balance sheet arrangements as

defined in Item 303(a)(4) of Regulation S-K.

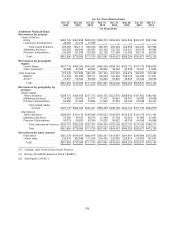

Contractual Obligations

Our principal obligations consist of our operating leases and 0.50% convertible senior notes. Our

headquarters is located in Mountain View, California, where we lease approximately 373,000 square

feet of office space under a lease that expires in 2023. We also lease office space of approximately

2,982,000 square feet in locations throughout the United States and approximately 893,000 square feet

internationally. In addition, we have data centers in the United States and Singapore pursuant to

various lease and co-location agreements. We have several significant long-term purchase obligations

outstanding with third parties. We do not have any significant capital lease obligations. As of

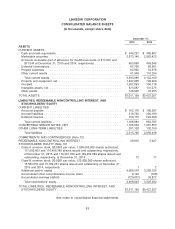

December 31, 2015, the following table summarizes our contractual obligations and the effect such

obligations are expected to have on our liquidity and cash flow in future periods:

Payments Due by Period

Less Than 1 - 3 3 - 5 More Than

Total 1 Year Years Years 5 Years

(in thousands)

Operating lease obligations(1) ....... $2,033,614 $159,693 $363,788 $ 395,218 $1,114,915

0.50% convertible senior notes(2) .... $1,348,951 $ 6,613 $ 13,225 $1,329,113 $ —

Purchase obligations ............. $ 54,335 $ 35,231 $ 19,104 $ — $ —

(1) Represents gross operating lease obligations, excluding sublease income of $213.6 million to be

recognized over the next 11 years, which primarily relates to sublease income for several buildings

we lease in Sunnyvale, California.

73